External Disk Storage Market in Central and Eastern Europe Dropping – IDC

-2.6% Y/Y in 4Q13 to $300 million

This is a Press Release edited by StorageNewsletter.com on April 9, 2014 at 2:30 pmEnd of 2013 in Central and Eastern Europe (CEE) external storage market, even though recovering slightly, continued the trend form previous quarter and fell by 2.6% year on year to round $300 million.

The results from IDC Corp.‘s Disk Storage Systems Quarterly Tracker showed capacity was still growing by double-digit rates due to ASP/GB returning to logical decline path. For the entire year, CEE external storage revenue was almost flat, declining only by 1% due to weak second half of the year.

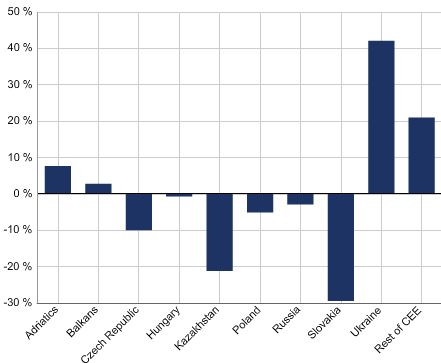

CEE External Disk Storage Systems Market, Y/Y Growth Rates, 4Q13

4Q13

(Source: IDC Disk Storage Systems Quarterly Tracker)

The top three vendors, EMC, HP and IBM, although capturing close to 75% of all market revenue, did not face a very decent quarter.

EMC continued to lead the market and was very successful with its Isilon and backup solutions but lost in all other product lines resulting in an overall drop of 7.4% on annual terms.

HP was the most successful of the three vendors with 2.9% annual increase as it tripled its 3PAR StoreServ revenue from the same period last year all over Europe and also benefited from its enhanced backup products.

IBM prospered in the entry-level segment but ranked third unable to achieve the largest CEE countries’ good results from Q412 in midrange and high-end segments.

The tier 2 vendors exhibited positive performance capturing share in the entry level segment and in verticals like government and finance even though they suffered from sales to telco companies.

Besides macroeconomic stagnation, political unrest in various CEE countries throughout 2013 also did not help much for storage market development – market players planned their storage supply and demand more cautiously. Government was the segment losing the most in 2013, shrinking its share by more than 5 percentage points, followed by small businesses. On the other hand, medium and large businesses invested more aggressively.

“Towards the year end, we already saw some revival of spending by public administration as large projects were finally brought to completion in markets like Russia, Poland, Ukraine and Kazakhstan“, storage systems research manager for IDC CEMA, Pavel Roland, comments. “We expect spending to intensify in 2014, especially in the second half of the year.“

In 2013, midrange storage systems achieved a larger share than the other two storage classes combined as it was the only one to post a positive growth year on year.

However, in Q4 2013 the more affordable entry level systems outperformed the midrange class.

“The midmarket lost part of its momentum from 2012 as many medium-sized and large businesses were already mature enough to take advantage of more advance technologies like unified, converged or even flash-optimized storage but lacked the financial resources,” says Marina Kostova, research analyst storage systems, IDC CEMA. “Instead, they were spending on entry level solutions, upgrades of high-end systems, cloud storage and storage management software.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter