EMEA Integrated Systems Revenue Jumps to $1.8 Billion in 2013 – IDC

58% Y/Y growth in 4Q13

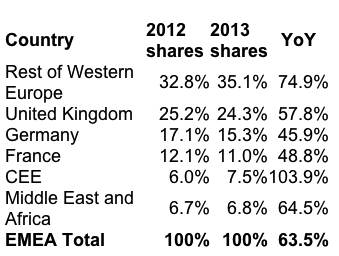

This is a Press Release edited by StorageNewsletter.com on June 4, 2014 at 2:54 pmThe value of the integrated systems market in EMEA recorded another peak, growing by 58% year over year in 4Q13 and 63.5% for the full 2013 at $1.76 billion, according to the latest Quarterly Integrated Infrastructure & Platform Tracker from IDC Corp., representing around a quarter of global sales in this segment.

Major vendor offerings tracked in IDC’s report include Oracle Engineered Systems, VCE Vblock, Cisco/NetApp Flexpod, IBM PureSystems, HP Converged Systems, EMC Vspex, Hitachi Unified Compute Platform, and Dell Active Systems.

Integrated infrastructure systems, single SKU systems optimized for virtualization (see definitions below), have proven the more popular investment option, accounting for over 57% of total sales in EMEA in 2013, more than doubling from 2012, mainly driven by price point and vendor choice/momentum.

Western Europe

In the EMEA region, Western Europe’s revenues still account for about 86% of sales. UK companies adopted early and represent around one third of the market, with Germany now growing more whereas in France, adoption is beginning to ramp up more slowly. In the Nordics, customers are also more speedily moving to integrated systems.

“The increasing need for easy manageability as well as data consistency preservation is pushing the market towards the adoption of integrated solutions, which are quick to set up and have optimized performance based on a certified stack,” said Silvia Cosso, research analyst, IDC european storage group. “However, the still comparatively high price point of systems has so far limited the adoption of the technology in some areas. The discussion, however, needs to turn from CAPEX to OPEX.”

According to a survey carried out by IDC in major European markets, end users that invested in integrated systems saw key benefits in improved DR (32% of the respondents) and lower TCO (30%).

“While hurdles to mainstream adoption remain – particularly in harmonizing the new stacks with existing environments – accelerated penetration of integrated solutions appears evident when comparing adoption among users and non-users. Integrated system users we interviewed reported that 14% of their hardware spending was absorbed by such solutions in 2013, and they expected that to grow to 18% by 2018. This compared to a 2018 expectation of less than 10% for non-users. This is mainly due to the ability of integrated systems to better support business processing applications and data analytics, as well as the tendency of adopters or midsized service providers to standardize on them,” said Giorgio Nebuloni, research manager, enterprise server group, IDC EMEA (Source: IDC European Integrated System Survey, December 2013 – 400 respondents from five European geographies.)

CEMA

Central and Eastern Europe, the Middle East, and Africa (CEMA) accounted for 14% of EMEA market revenue in 2013, with sales of integrated solutions split evenly between CEE and MEA.

Integrated Infrastructure was the preferred solution, recording year-on-year revenue growth over 100%, while Integrated Platforms’ revenue increased by less than 30% year-on-year in 2013.

“The majority of integrated infrastructure sales were driven by organizations from developing countries, where the deployment of integrated solution also addresses a lack of skilled IT resources as the easy manageability and simplified provisioning of the solutions reduces the time IT staff spend on routine tasks,” said Jiri Helebrand, research manager, IDC CEMA.

New Way of Purchasing Infrastructure and Applications

IDC defines integrated infrastructure and platforms as pre-integrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment and basic element/systems management software at the point of sale. Systems not sold with all four of these components are not counted within this tracker.

IDC segments this market into two categories:

- Integrated platforms are systems sold with additional pre-integrated packaged software and customized system engineering optimized to enable such functions as application development software, databases, testing, and integration tools.

- Integrated infrastructure systems are designed for general-purpose, distributed workloads that are likely to have differing performance profiles. While integrated infrastructure is similar to integrated platforms in that it will leverage the same infrastructure building blocks, it is not optimized for a specific workload.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter