EMEA Integrated Infrastructure and Platform Revenue Grows 51% Y/Y in 2Q14 – IDC

Generated 225PB of new capacity during quarter, up 84% Y/Y

This is a Press Release edited by StorageNewsletter.com on October 6, 2014 at 2:52 pmThe integrated infrastructure and platforms market in EMEA recorded vendor revenue of $649 million in 2Q14, up 51% over the same period a year ago, according to EMEA Quarterly Integrated Infrastructure and Platforms Tracker, September 29, 2014 market report from International Data Corp.www.idc.com*

The market generated nearly 225PB of new storage capacity shipments during the quarter, which was up 84% year over year.

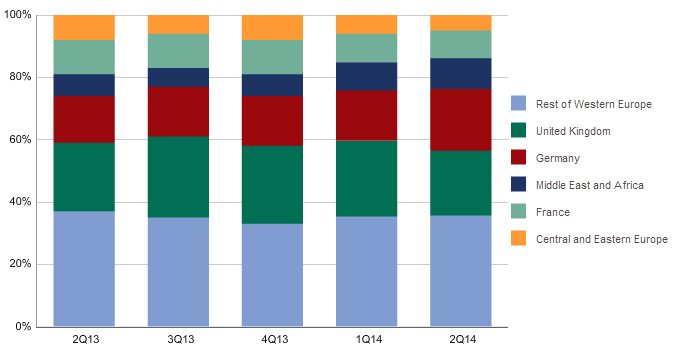

The share of Western European sales in EMEA has remained stable at about 85%, with Central and Eastern Europe, the Middle East, and Africa (CEMA) taking the remaining 15% of EMEA market value. Western Europe’s year-over-year growth, albeit still high (53%), showed signs of tapering down compared with previous quarters, as the market slowly reaches critical mass.

“With strong sales of integrated platforms for databases and datawarehouses in large companies, Germany exhibited the highest Y/Y increase, showing that its typically risk-adverse IT organizations are starting to recognize the advantages of deploying integrated systems,” said Giorgio Nebuloni, research manager, IDC EMEA. “Other Western European markets are expected to follow suit in the coming quarters, driven by MSP deployments of infrastructure systems.”

“Now that virtually every major vendor has put integrated solutions at the core of their strategy and marketing communication, consumers are realizing that the integrated approach is the answer to increasingly siloed environments and complex manageability pain points,” said Silvia Cosso, senior research analyst, IDC EMEA.

“While the overall share of CEMA sales in EMEA continued to grow, adoption differs greatly across the geographies,” said Jiri Helebrand, research manager, IDC CEMA. “Indeed, sales of integrated solutions in the MEA region are much larger in comparison with the CEE region, as organizations from developing countries are more keen to deploy integrated systems to reduce infrastructure inefficiencies and IT maintenance costs.”

IDC defines integrated infrastructure and platforms as preintegrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment, and basic element/systems management software at the point of sale.

IDC segments this market into two categories:

- Integrated platforms, systems sold with additional preintegrated packaged software and customized system engineering optimized to enable functions such as application development software, databases, testing, and integration tools

- Integrated infrastructure systems, which leverage the same infrastructure building blocks as integrated platforms but are not optimized for a specific workload and are designed for general-purpose, distributed workloads instead

Integrated infrastructure systems account for 57% of total sales in EMEA, down from 66% registered last quarter, but still up 68% year over year.

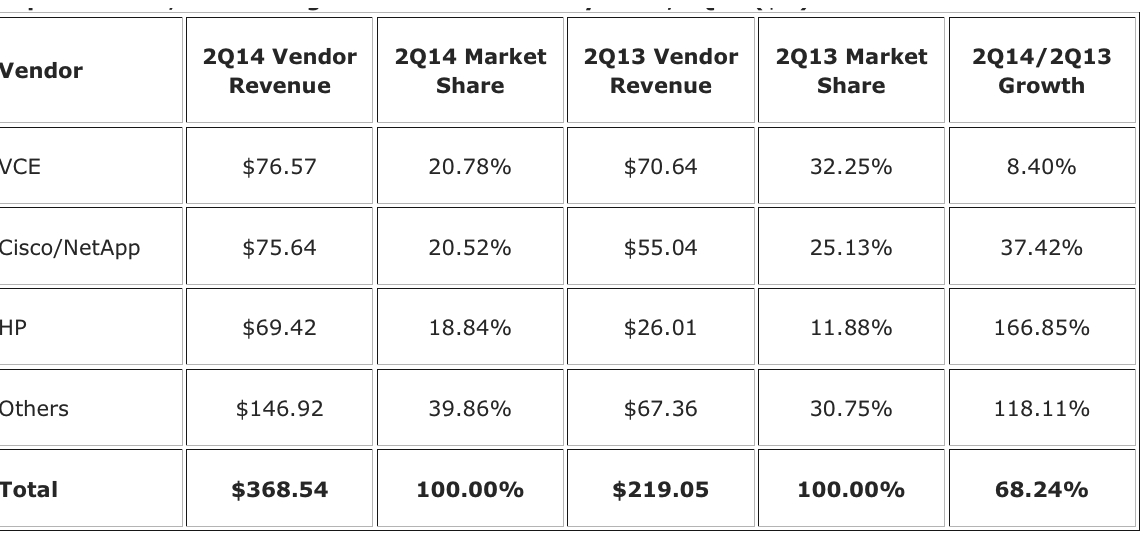

Top 3 Vendors, EMEA Integrated Infrastructure Systems, 2Q14

(in $million)

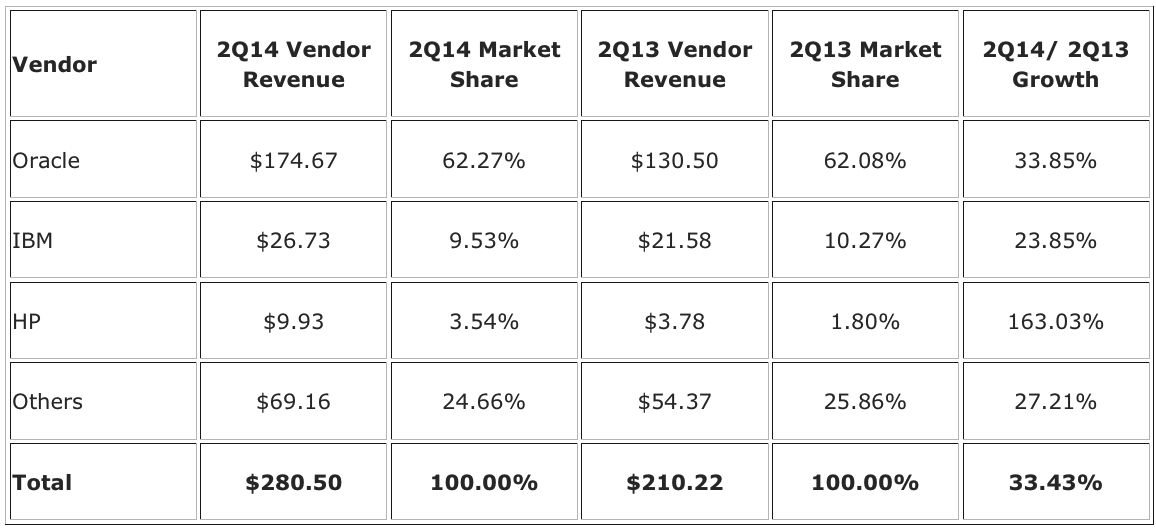

Top 3 Vendors, EMEA Integrated Platforms, 2Q14

(in $million)

Major County and Region Revenue Share of Integrated System Market in EMEA, 2Q14

(Source: IDC, EMEA Quarterly Integrated Infrastructure and Platforms Tracker, September 29, 2014)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter