EMEA External Disk System Market Up 2.6% Y/Y in 2Q14 – IDC

HP and IBM winners, EMC loser

This is a Press Release edited by StorageNewsletter.com on September 12, 2014 at 3:12 pmThe external disk storage systems market in Europe, the Middle East, and Africa (EMEA) increased 2.6% year on year in terms of user value in 2Q14, according to the EMEA Quarterly Disk Storage Systems Tracker from International Data Corporation.

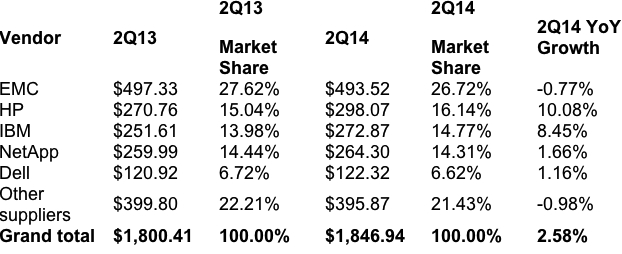

Top 5 Vendors, EMEA External Disk Storage Systems Value, 2Q13/2Q14

(in $million)

(Source: IDC EMEA Quarterly Disk Storage Systems Tracker, 2014)

IDC noted increasing adoption of the more expensive flash media in storage systems, resulting in a slower decline in the dollar per gigabyte value, at about 23% year on year, with shipped storage capacity up almost 34% to more than 2.7EB.

Flash start-up players and a few established vendors are making use of flash-based systems, both all flash arrays (AFAs) and hybrid flash arrays (HFAs), to disrupt and in some cases take out competitors’ high-end systems, replacing them with flash-equipped midrange environments. To better gauge the growth in this area, IDC EMEA is currently working on a geographical sizing and vendor share analysis of the AFA and HFA segments in the region, with results expected in the next month.

Western Europe

Western Europe’s return to growth over the quarter (+2.3%) more than compensates for the sluggish beginning of the year and brings the overall DSS market to a 0.9% increase for 1H14 compared with the same period a year ago.

However, growth remains mixed across vendors and countries, with IBM’s strong performance (mainly due to a revival in its DS8000 series) accounting for most of the growth in the subregion. In terms of the five largest vendors, EMC and HP had a positive quarter in Western Europe, while NetApp remained flat and Dell declined. Hitachi had a particularly gloomy quarter, dropping to levels last seen in 2009, with only some of this due to its financial year ending in March. Oracle narrowed the gap with Hitachi after increasing sales of its Exadata family.

By country, Germany had another positive quarter, with Y/Y growth just shy of 10%. The U.K. declined 2.3% Y/Y, after positive growth in the past four quarters. France, the third-largest Western European market, declined 2.4%; this was its fourth decline in a row and evidence that it may not recover any time soon.

From a storage class perspective, the high-end continued the negative run that goes back to 1Q12.

“With differences between midrange and high-end enterprise systems thinning if not overlapping, a greater share of the high end has been reclaimed by the midrange space, with midrange arrays showing they can compete in efficiency and data management tools with the traditional high-end systems,” said Silvia Cosso, storage systems analyst, IDC.

CEMA

CEMA storage sales improved in 2Q14, with customer revenue increasing 16.0% quarter by quarter and 3.4% annually. Despite the proliferation of the entry-level storage class across CEMA, customer readiness to invest in storage hardware solutions varies in the two subregions. Central and Eastern Europe (CEE) registered stable overall growth due to large high-end system shipments, while the Middle East and Africa (MEA) remained flat following the customer shift from high-end to midrange storage.

Russia was not only the largest market in CEE but was also by far the best performer in terms of growth.

“In contrast to the general trend of declining high-end sales in EMEA, storage sales in the upper price spectrum of the market were given a significant boost by the completion of deals delayed from the end of 2013 and by EOL storage infrastructure replacement in the telecommunication and banking sectors,” said Marina Kostova, storage systems analyst, IDC CEMA. “Despite a challenging economic and political environment, the unpredictable Russian market was able to drive growth in the entire region – negating the poor performance of most other countries in the region.“

There were mixed storage results in the MEA region. Gulf countries and Israel recorded double-digit growth on the back of both entry and midrange solution sales. Major verticals in Africa, on the other hand, closed fewer large deals in the quarter, while issues with channel coverage affected the distribution of lower-priced storage products – with both factors leading to an overall decline.

Vendor Highlights

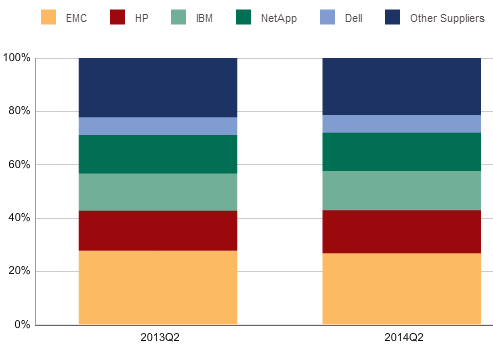

There were no major changes in the quarter in terms of vendor market shares, but there was still a mixed performance among the top vendors and across the subregions.

EMC, though still the clear leader, lost almost a percentage point in share compared with 2Q13 following a drop in sales across CEMA. Its backup and unified businesses saw very healthy growth, but its Symmetrix line, with refreshment sales yet to kick in, pulled the vendor down.

HP regained second place. Its market share increased by more than a percentage point, driven by a strong quarter in CEE due to a pickup in orders for the legacy XP brand and with 3PAR StoreServ 7000 becoming the leading midrange platform in the Middle East.

IBM, in third place, also recorded a very decent quarter across EMEA with almost 20% Y/Y growth in Western Europe, despite the poor performance in CEMA.

Both vendors successfully refreshed their existing customer installed base of legacy infrastructure, which gave an additional boost to their performance.

NetApp had a strong quarter in CEMA, which made up for the sluggish performance in Western Europe, but the vendor fell short of IBM in terms of market share.

Dell regained fifth place in EMEA, with sales in both CEMA subregions compensating for the moderate decline in Western Europe; overall, it had a positive 2Q14.

Taxonomy Notes:

- IDC defines a disk storage system as a set of storage elements, including controllers, cables, and (in some instances) HBAs, associated with three or more disks. A system may be located outside or within a server cabinet and the average cost of the disk storage systems does not include infrastructure storage hardware (i.e., switches) and non-bundled storage software.

- The information in this quantitative study is based on a branded view of disk storage systems sales. Revenue associated with the products to the end user is attributed to the seller (brand) of the product, not the manufacturer. OEM sales are not included.

- EMEA Quarterly Disk Storage Systems Tracker is a quantitative tool for analyzing the EMEA disk storage market on a quarterly basis. The tracker includes quarterly shipments and revenues (both customer and factory), terabytes, $/GB, GB/unit, and average selling value – each can be segmented by product category, installation base, OS, vendor, product brand, model name, and region.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter