EMEA Cloud IT Infrastructure Revenue Up 37% to $1.4 Billion in 2Q16 – IDC

Cloud represented 24% of total storage capacity, 5% decline over 2Q15.

This is a Press Release edited by StorageNewsletter.com on October 14, 2016 at 2:19 pmAccording to the International Data Corporation‘s Worldwide Quarterly Cloud Infrastructure Tracker, IT infrastructure spending (server, disk storage, and Ethernet switch) for public and private cloud in Europe, the Middle East, and Africa (EMEA) grew by 37.4 % year-on-year to reach $1.4 billion in revenue in the second quarter of 2016.

The cloud-related share of total EMEA infrastructure revenue from servers, disk storage, and Ethernet switches grew 7% points compared to last year to exceed 22.5% in 2Q16.

In terms of storage capacity, cloud represented around 23.8 % of total EMEA capacity in 2Q16, with a 4.6 % decline over the same period a year before.

Looking at the market in euros, EMEA reported strong Y/Y user value growth (34.2%) in 2Q16 in public and private cloud across servers, storage, and switches.

“IDC expects this market to reach a value of $10.5 billion by 2020 (from a five year forecast), or 36.5 % of the total market expenditure,” said Kamil Gregor, research analyst, European infrastructure group, IDC. “Fueled by increasing maturity and adoption rates of many new cloud-dependent technologies, such as the Internet of Things, cloud continues to represent an area of tremendous growth for the European infrastructure sector.”

For the scope of this tracker, IDC has tracked the following vendors: Cisco, Dell, EMC, Fujitsu, Hitachi, HP, IBM, Lenovo, NetApp, Oracle, the major ODM vendors, and others.

Regional Highlights

“In the first proper post-Brexit quarter, we still see no justification for significant adjustments of our cloud forecast in the region,” said Gregor. “Cloud infrastructure vendors reported a brief disruption of their operations immediately after the referendum, but since then, business seems to have continued as usual. Enterprises may reevaluate where their cloud data is located if Brexit causes a mismatch of regulatory rules in the U.K. and the rest of the region in the long-term future.

“Multicloud continues to be a very successful deployment model throughout the region. IDC expects over 70% of Western European enterprises to adopt some form of multicloud by the end of next year. Regulatory differences between EU countries have been a major driver of multicloud adoption. They will be at least partially removed by the EU General Data Protection Regulation, which enters into effect in May 2018, although we do not expect this to slow multicloud adoption in Western Europe.”

Central and Eastern Europe, the Middle East, and Africa (CEMA) cloud infrastructure revenue grew by 18.8% year-over-year to $198.04 million in 2Q16, benefitting from increased investments in both public and private cloud. The resumption of investments in IT infrastructure on the back of stabilization of the geopolitical situation surrounding Russia contributed to strong cloud infrastructure revenue growth the in Central and Eastern Europe (CEE) subregion, breaking a year long losing streak.

“Private cloud deployments drove growth as organizations that are consolidating their IT infrastructure appreciate the ease of integration with existing systems as well as ease of procurement over traditional IT infrastructure,” said Jiri Helebrand, research manager, systems and infrastructure solutions, IDC CEMA.

Cloud infrastructure spending in the CEMA region is estimated to be 17% of the total addressable server, storage, and networking hardware market, with public cloud accounting for about 46% of this share.

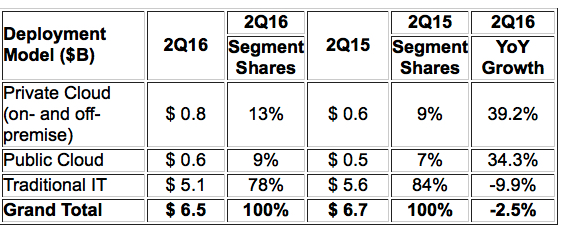

EMEA Cloud IT Infrastructure Value

(in $ billion)

Taxonomy notes

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the ‘service users’.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter