Central and Eastern Europe, Middle East, and Africa External Storage Market Declined by 10% in 2015

For first time in six years in 2015, now below $2 billion

This is a Press Release edited by StorageNewsletter.com on May 16, 2016 at 2:52 pmAlthough one of the fastest developing regional markets until 2015, the Central and Eastern Europe, Middle East and Africa (CEMA) external storage market declined by 10% year on year in 2015.

Total shipment value dropped below $2 billion, while total market capacity grew by 27%, according to results published by International Data Corporation in its Enterprise Storage Systems Quarterly Tracker for Q4 2015. It should be noted, however, that in local currency (€), the market grew 7% in value over 2014.

With a year-on-year drop in market value of 18%, Russia was the main contributor to the CEMA region’s negative performance. The rest of Central and Eastern Europe (CEE) markets recorded low single-digit growth compared to the previous year. The dynamic Middle East and Africa (MEA) market likewise failed to match previous years’ growth levels and declined 4% in value in 2015.

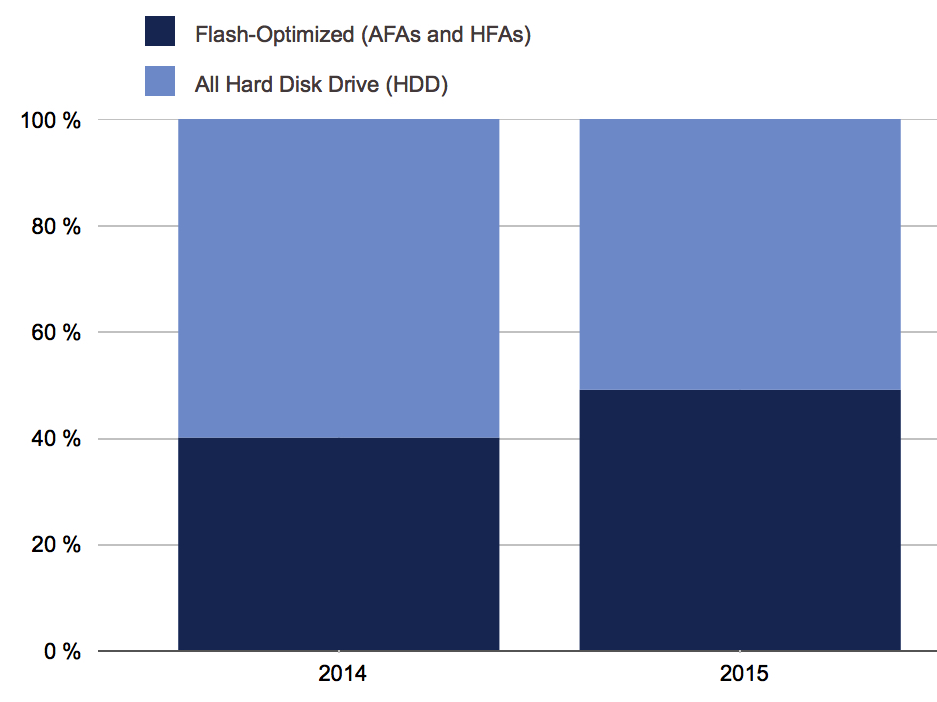

While the overall market performed poorly, the biggest contraction was recorded in the all-HDD array segment, which fell 24% in value terms. At the same time, the market value of hybrid flash array (HFA) shipments remained almost flat, while the all-flash array (AFA) segment flourished, posting 103% growth over 2014. AFA shipments in MEA stood out with 208% growth, as both incumbents and new players pushed their offerings and targeted different end user segments with lower prices.

By country market, growth in spending across CEE stemmed from some of the larger markets – Poland, the Czech Republic, and Romania – as datacenter consolidation projects in the finance sector boosted shipments of high-end systems. Smaller countries, on the other hand, were more vulnerable to macroeconomic and political influences, which negatively affected both the number and size of deals. In Russia, a similar situation was exacerbated by the worsening GDP indicators and currency plunge, along with the drop of crude oil prices, which led to a 33% drop in countrywide storage spending.

Out of the five largest MEA countries, Turkey was the only one to record growth, with 2015 storage spending up 11% year on year. Accelerated government, telecom, and finance sectors investments in both high-end and midrange storage arrays, help boost the country market to the second largest in the region. Low oil prices and political turbulence in the rest of the region continued to impact business confidence, limiting government investments and placing cost optimization at the forefront of storage spending.

The top 3 storage vendors in CEMA remained unchanged between 2014 and 2015, as EMC, HPE, and IBM held combined value share of 67%, in spite of the fact that their combined market value declined year on year at a higher rate than the market average.

“As most of the factors responsible for the market’s contraction are not related to a dramatic change of storage consumption, IDC expects the CEMA storage market to rebound in the short-to-medium term as a result of rising datacenter needs,” says Marina Kostova, a senior storage solutions analyst, IDC CEMA. “However, if the recovery fails to happen within a year, new vendors and technologies such as cloud, SDS, convergence, hardware commoditization, and container-based virtualization will gain traction and substantially limit the growth potential of traditional storage solutions and incumbent vendors.“

CEMA External Storage Systems Market Shares by Storage Array Type, 2014-2015

Flash-Optimized (AFAs and HFAs)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter