Seven Million Personal and Entry-Level Storage Devices Shipped in EMEA in 3Q14 – IDC

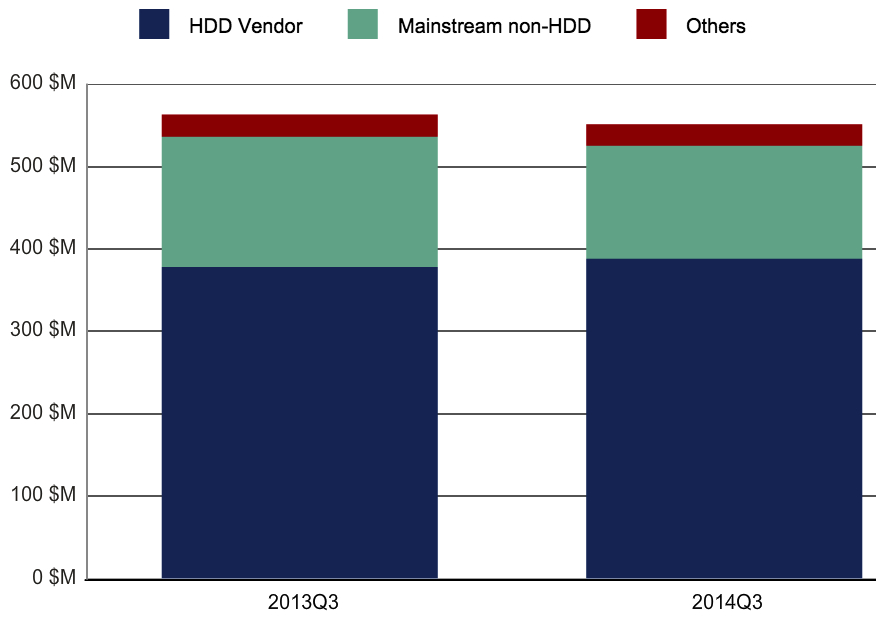

Shipment value down 2.3% Y/Y to $551 million

This is a Press Release edited by StorageNewsletter.com on December 1, 2014 at 3:06 pmResearch from International Data Corporationwww.idc.com shows that the personal and entry-level storage (PELS) market in EMEA was up 0.4% year over year with around 7 million units shipped in 3Q14, according to the IDC Worldwide Personal and Entry-Level Storage Tracker.

Shipment values were down 2.3% from a year ago, to $551 million.

The increase in shipments mainly came from the personal storage segment, where unit shipments were up 0.5% Y/Y in 3Q14 in EMEA. Within this segment, single-bay devices accounted for 98.1% of market share, increasing unit shipments 0.4% Y/Y and remaining the most popular storage product choice. Dual-bay devices, accounting for the rest of the market, saw units shipped increase 6.1% from a year ago.

Entry-level unit shipments decreased 7.7% Y/Y. This decline was primarily from the 4-bay devices that represented 64.6% of the total market segment and whose units shipped were down 13.8% Y/Y during the quarter. Higher-bay devices [8-12 bays] that contributed to 29.1% of entry-level segment shipments saw a combined increase of 16.7% Y/Y in their unit shipments.

In terms of capacity, 4TB devices accounted for the majority of the entry-level market with 32% of total units shipped, followed by 8TB storage devices with 21.4%.

The personal storage market is shifting from lower capacity points to higher capacities. Personal storage products with higher capacities (2/4/6/8TB) contributed to 23.5% of units and experienced a combined growth of 25.3% Y/Y. Products with lower capacity points (500GB/1TB), however, contributed to 71.9% of the units share, down 5.6% compared to a year ago, according to Jimena Sisa, senior research analyst, IDC.

“Lower ASPs are clearly triggering higher consumer and small and medium business spending, as customers here are opting for higher-capacity products such as 2TB, 4TB, 6TB, and 8TB,” she added.

The PELS market includes storage hardware products embedding from 1 to 12 disk bays, manufactured and marketed for consumers, SOHO, and small businesses.

Major vendors covered in this tracker include Western Digital, Seagate, Toshiba, Buffalo Technology, D-Link, Netgear, and Lenovo/EMC (Iomega).

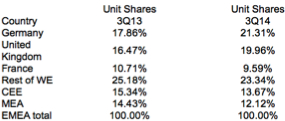

EMEA Personal and Entry-Level Storage Country Share, 3Q14

EMEA Personal and Entry-Level Storage by Vendor Type, 3Q14

Note: IDC defines personal storage as having 1-2 bays and entry-level storage as having 3-12 bays. HDD vendors are suppliers that manufacture their own HDD drives, in addition to branded external storage. IDC defines a mainstream non-HDD vendor as a major PELS vendor that does not manufacture its own HDD drives.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter