40% of Senior IT Pros to Increase Spending on Converged Infrastructure in 4Q15 – 451 Research

17% very likely to switch vendors

This is a Press Release edited by StorageNewsletter.com on November 5, 2015 at 3:22 pmJust 17% of enterprise IT users will increase spending on traditional servers, while 40% of end users plan to increase spending over the next 90 days on converged infrastructure, according to the results of a new survey launched by 451 Research, a division of The 451 Group.

The inaugural Voice of the Enterprise: Converged Infrastructure survey also shows that nearly 17% of survey respondents are ‘very likely’ to switch vendors over the next 90 days.

“Commoditization of x86 systems is catalyzing competition as decision-makers increasingly consider alternatives, including white-box (unbranded) servers. A growing opportunity exists for those vendors that can position their offerings to address key customer needs,” said Nikolay Yamakawa, senior analyst, 451 Research.

HP Proliant, Dell PowerEdge lead in Standard Servers;

HP ConvergedSystem, Dell Converged Solutions,

NetApp and VCE lead in Converged Infrastructure

The study reveals that HP Proliant and Dell PowerEdge stand out with customers as the leaders in the standard server market. 52% of standard server customers are using HP Proliant, while Dell PowerEdge is used by 50% and captured the highest customer ratings. Dell PowerEdge stood out for its product competitiveness and roadmap, ease of management, TCO, and sales force quality. HP Proliant gained favorable ratings in performance optimization, ease of deployment/integration, company brand and reputation.

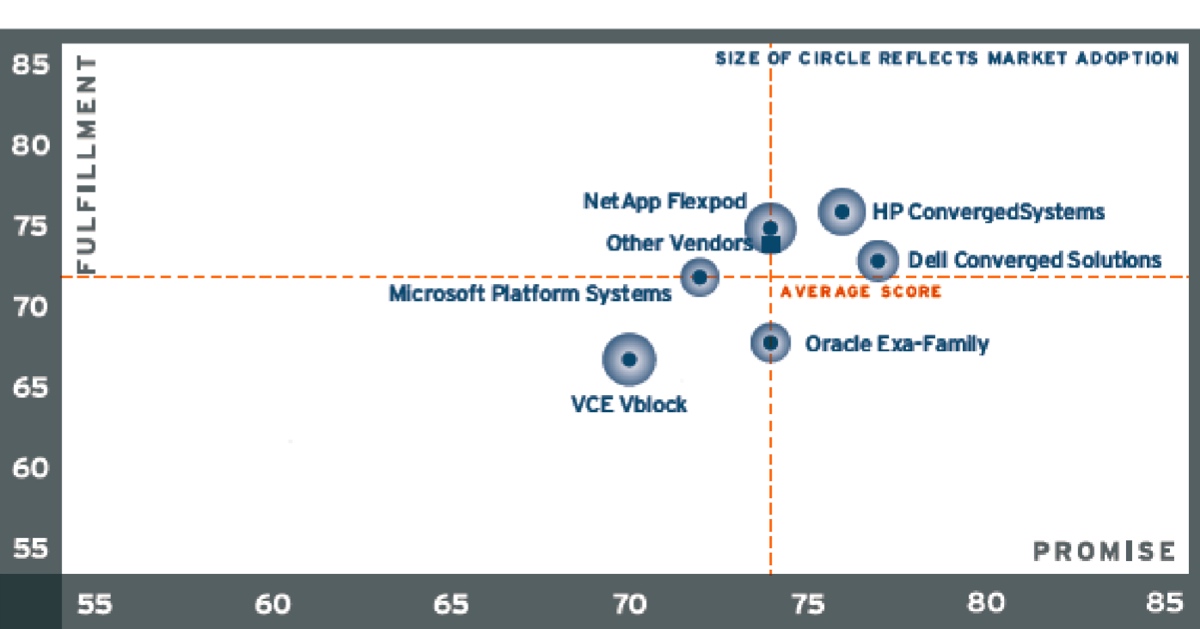

Vendors that rate most favorably among customers in the Converged Infrastructure space include HP ConvergedSystem, Dell Converged Solutions and NetApp FlexPod. VCE Vblock (owned by EMC) leads in adoption among converged infrastructure vendors.

The 3Q15 survey also shows that, among standard server vendors, Cisco UCS is currently the third most-cited vendor in use, with 33.9% of respondents reporting Cisco implementations and another 19.3% considering Cisco as an alternate vendor. Furthermore, Cisco remains prevalent in converged infrastructure, with 25.2% of respondents citing Cisco as a vendor.

Meanwhile, VCE Vblock and NetApp FlexPod, which captured the highest adoption rates among respondents, both run Cisco UCS server components as part of their converged infrastructure platforms. Additionally, a whole array of newer and incumbent vendors are starting to gain traction with hyper-converged offerings, adding more fuel to the competitive fire.

Adoption of white-box servers is also growing. Approximately 4% of enterprises have installed white-box (unbranded) servers; another 6% are considering a switch to white-box servers from their current standard server vendor.

Yamakawa noted: “Speed and ease of deployment rank as top drivers in the shift to converged infrastructure; lack of in house expertise is the biggest single inhibitor, according to end users in our Q3 survey.”

43% of customers identify ease/speed of deployment and integration as the top benefits of converged infrastructure; lack of staff expertise is cited most often as a deterrent to adoption (41% of respondents).

“The study indicates that one way to ease the transition into the converged space is to identify the gaps in internal skillsets and work with potential vendors to organize the training and proof-of-concept exercises prior to implementation. Some enterprises can make the transition smoother by evaluating those applications and workloads that will be shifted to ensure compatibility,” added Yamakawa.

(Source: 451 Research, Q3 2015 Voice of the Enterprise: Converged Infrastructure study)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter