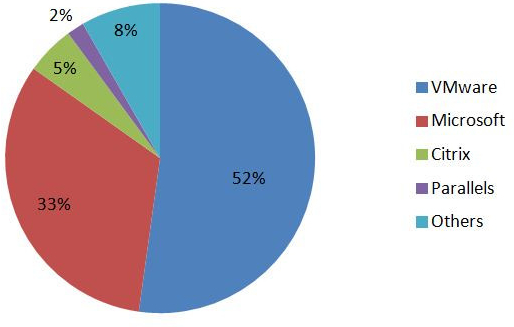

33% of EMEA New Servers With Virtualization in 4Q13

52% with VMware

This is a Press Release edited by StorageNewsletter.com on April 7, 2014 at 2:58 pmAccording to IDC Corp.‘s EMEA Quarterly Server Virtualization Tracker, 33.0% of all new servers shipped in EMEA in 4Q13 were virtualized, a moderate increase from 30.0% in 4Q12.

Physical server shipments were flat this quarter, showing only a 0.3% decline year-over-year, totaling 606,400 units. At the same time 200,300 server units were virtualized at the point of initial shipment in 4Q13, which is an annual increase of 9.6%. Virtualization licenses distributed this quarter grew year-over-year by 12.0% to 282,300, while EMEA virtualization software revenue increased even more by 14.2% to $456.3 million.

EMEA Virtualized Units Share 2013

(Source: IDC EMEA Quarterly Server Virtualization Tracker, 2014)

The EMEA server virtualization market continues its gradual but slow shift towards the use of paid hypervisors, with paid virtualization software now running on 83.0% of all new server hardware shipments virtualized in 4Q13 compared to 82.4% recorded in 4Q12.

For the full 2013, 2.2 million physical servers were shipped in EMEA, representing an annual decline of 2.7%. 717,000 virtualized servers and 1.0 million virtualization software licenses were shipped, showing moderate to strong annual growth of 9.6% and 13.5%, respectively. Virtualization software revenue reached $1.6 billion, which means an increase of 14.6% on the previous year.

“Although the server hardware market is stagnating, virtualization efforts are continuing across our region,” said Andreas Olah, research analyst, enterprise server group, IDC EMEA. “Many smaller businesses have already embraced these technologies, and the virtualization topic is maturing. This is evident from the fact that discussions in European organizations have moved on from initial approaches that focused mainly on hypervisor choice towards management and automation tools that let VMs move seamlessly between servers, and even between clouds in a hybrid model.

“The leading virtualization vendors are aggressively pushing holistic stack approaches that include various tools and links to their own cloud offerings, such as VMware with its software-defined datacenter model with vCloud Hybrid Service, and Microsoft’s extensive cloud OS framework. Although clients were initially overwhelmed by the complexity of these approaches, their value proposition is becoming better understood, which drives wider adoption of these types of holistic solutions.“

Western Europe continues to lead the way in terms of wider adoption of server virtualization technology, with 33.8% of new servers shipped in 4Q13 virtualized compared to 31.1% a year ago, though emerging regions are catching up rapidly. Despite the overall uptrend, a slowdown in virtualization growth is becoming apparent in Western Europe which is down to technology maturity and the disruptive nature of replacing or virtualizing outdated legacy machines. Moreover, growth on the server hardware side is increasingly shifting toward datacenter expansion by the largest tier 1 cloud service providers that tend to run on non-virtualized gear. This is most apparent in the Nordics, Benelux, and Ireland, where virtualization rates are below other mature markets in the region as a result.

Despite the 3.3% contraction in server shipments in 4Q13 compared with 4Q12, the emerging markets of Central and Eastern Europe, Middle East and Africa witnessed double-digit growth of 10.3% in virtual server unit shipments, year over year. This reflects growing maturity in virtualization adoption, with the aim to consolidate the infrastructure by using fewer servers to deploy more VMs, and exploit existing hardware capacities to a greater extent.

“Server virtualization in Central and Eastern Europe is still developing at lower rates than in Western Europe, due to widespread usage of entry-level dedicated single-socket tower servers for only one or two applications without using virtualization technology“, said Mohamed Hefny, senior research analyst, systems and infrastructure solutions, IDC CEMA. “At the same time, virtualization rates for the Middle East and Africa are comparable to levels seen in Western Europe, as the region is known to take leaps to the latest technologies and is catching up with the latest trends, while skipping several steps in between.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter