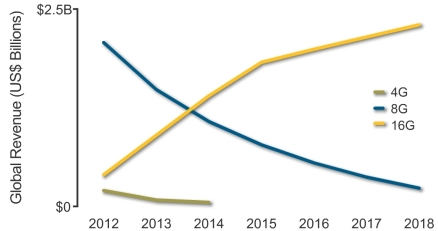

16Gb FC Ramping Fast, 42% of Market in 1Q14 – Infonetics

But FC switch and HBA revenue down 9% from 4Q13

This is a Press Release edited by StorageNewsletter.com on June 23, 2014 at 2:51 pmMarket research firm Infonetics Research released excerpts from its 1Q14 SAN and Converged Data Center Network Equipment report, which tracks SAN FC switches and HBAs, converged data center network adapters, and switch ports-in-use for storage.

16Gb FC now makes up 42% of SAN market

and is accelerating fast at expense of 4Gb and 8Gb

(Source: Infonetics Research)

“With 16Gb FC ramping fast, 8Gb is making a quick exit,” says Cliff Grossner, Ph.D., directing analyst for data center and cloud, Infonetics. “16Gb FC solutions now make up 42% of SAN revenue, and we expect to see the continued acceleration of 16Gb at the expense of 8Gb and 4Gb, especially with 32Gb still two years out.“

“Most of the 16Gb market is inter-switch, or switch-to-storage array, and not server connections,” adds Grossner.

Market highlights

- Globally, the SAN market (FC switches and HBAs) totaled $592 million in 1Q14, down 9% from 4Q13, and down 3% from a year ago

- Brocade continues to dominate the SAN switch and adapter market, gaining 3 market share points in 1Q14

- Worldwide converged data center network adapter revenue (Ethernet switch ports-in-use for storage and converged network adapters, or CNAs), declined 4% sequentially in 1Q14, to $549 million

- CNAs continue to account for the majority of revenue, followed by iSCSI adapters and universal adapters

- Thanks to its recent acquisitions, QLogic is expected to move into the #2 spot in the converged data center network adapter market in 2Q14

- In an effort to grab market share, converged data center network adapter vendors are reaching for the cloud, software-defined networking (SDN), and network functions virtualization (NVF)

- The shift to cloud-architected data centers with automated deployment of virtual workloads is driving a long-term trend toward a converged network with storage and application traffic on Ethernet in the data center

Vendors tracked: Alcatel-Lucent, Arista, ATTO, Brocade, Broadcom, Cisco, Dell, Emulex, HP, IBM (BNT), Intel, Juniper, QLogic, others.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter