Showa Denko Prepares for Production of Higher-Capacity Hard Disk Media

Based on shingled magnetic and thermally assisted magnetic recording

This is a Press Release edited by StorageNewsletter.com on December 16, 2013 at 3:05 pmShowa Denko K.K. (SDK) announces its business plan PEGASUS Phase II for the 2014-2015 period, the latter part of the five-year business plan launched in 2011.

1. Outline of PEGASUS Phase II

SDK’s current medium-term business plan is named after a ‘Winged Horse’ from Greek mythology. The HD media and graphite electrode businesses serve as ‘Wings’ to drive the Group’s growth.

In Phase II under PEGASUS, HD media and graphite electrodes will continue to serve as the group’s main businesses. In view of the drastic changes in business environment, however, SDK will consolidate the foundations of the two businesses in preparation for the Post-PEGASUS period.

This time, we have modified our business categories. Specifically, we have changed the three existing categories of Growth & New Growth, Base (Growth) and Base (Stable) into the four categories of New Growth, Growth, Base (Growth) and Base (Stable). Under Phase II, we will focus our efforts on improving overall profitability based on the new business portfolio.

2. Financial goals under PEGASUS Phase II

Business results in Phase I (2011-2013) fell short of initial goals due to the appreciation of the yen at historically high levels and the rise in energy costs following the Great East Japan Earthquake, as well as the decline in shipment volumes, reflecting the worsening supply-demand situation due to the stagnation in advanced countries and the slowdown of growth in emerging countries. Despite the initial plan of recording an operating income of JPY80 billion on consolidated net sales of JPY1 trillion in 2013, we had to announce, on July 29, 2013, a revised forecast of an operating income of JPY26 billion on consolidated net sales of JPY850 billion.In 2015, the last year under Phase II, we will aim to record an operating income of JPY50 billion (up JPY24 billion from the estimated results in 2013) on consolidated net sales of JPY950 billion (up JPY100 billion).

The planned JPY24 billion increase in operating income will be realized by such positive factors as cost reductions (JPY20 billion), an increase in shipment volumes (JPY9 billion) and a favorable exchange rate (JPY4 billion), which will be partially offset by such negative factors as a decrease in selling prices (JPY4 billion) and others (JPY5 billion). The exchange rate and naphtha price during Phase II are estimated at JPY100 to the $US and JPY65,000 per KL, respectively.

Capital investment under Phase II will total JPY105 billion (JPY60 billion in 2014, and JPY45 billion in 2015), and depreciation expenses for the period will amount to JPY80 billion. About 55% of the total capital investment budget will be allocated to Base (Growth) and Growth businesses.

Interest-bearing debt at the end of 2015 will be about JPY370 billion, up JPY10 billion from the end of 2013, as a result of capital investment for future growth and higher demand for funds related to M&A. D/E ratio will be 1.1 at the end of 2015. We will aim to create JPY30 billion of free cash flow in 2015.

3. Business strategy under PEGASUS Phase II

To achieve the planned increase of JPY24 billion in operating income versus 2013 results, we will strengthen our overseas operations, improve profitability of Base (Stable) businesses, reduce costs, and take measures for M&A and alliance. We are planning to increase operating income from overseas operations by JPY9 billion, and operating Financial goals and assumptions (JPY100 million) income from domestic operations by JPY15 billion. We will strengthen our overseas operations to realize the said JPY9 billion increase. A breakdown by business category of the planned JPY24 billion increase in operating income will be Base (Stable) JPY11 billion; Growth JPY7 billion; Base (Growth) JPY2 billion; and New Growth JPY4 billion. We will take measures to improve the profitability of Base (Stable) businesses to realize the said JPY11 billion increase.

As mentioned before, positive factors will be cost reductions (JPY20 billion), an increase in shipment volumes (JPY9 billion), and a favorable exchange rate (JPY4 billion), while there will be such negative factors as a decrease in selling prices (JPY4 billion) and others (JPY5 billion).

(1) Accelerate penetration into overseas markets

In Phase I, we acquired a graphite electrode plant in China, and established a new production site in China for the high-purity aluminum foil business. In Phase II, we will strengthen our presence in overseas markets for such businesses as semiconductor-processing high-purity gases and aluminum cans. Through such overseas activities, we will increase operating income by JPY9 billion from the 2013 level.

(2) Improve profitability of Base (Stable) businesses

In view of the fact that the profitability of Base (Stable) businesses has declined during Phase I, we will work hard to improve the profitability. Specifically, we will develop high-quality products and advanced technologies; develop new demand and market; consolidate operation sites; strengthen competitive power through renewal of production facilities; and fully utilize our electric power resources.

In particular, we will focus our efforts on developing dysprosium-free magnetic alloys and a new butadiene manufacturing process. Furthermore, we will reorganize small production sites within our Group. Through these measures, we will increase operating income from domestic operations in the category of Base (Stable) businesses by JPY7.5 billion, and operating income from overseas operations in the same category by JPY3.5 billion.

(3) Continue to reduce costs

The key element of the planned JPY24 billion increase in operating income versus 2013 results will be cost reductions totaling JPY20 billion. We will steadily promote the cost reductions. In addition to cost reductions of JPY7 billion on a regular basis, we will take strategic measures to further reduce costs by JPY13 billion. Major items will be improvement in productivity in the Electronics segment, including the HD media business (JPY4 billion), and restructuring of the alumina business (JPY3 billion).

(4) M&A and alliance

To catch opportunities for new businesses, we will continue to pursue M&A and alliance. In Phase I, we realized M&A and alliance in the fields of graphite electrodes, chemicals, petrochemicals, and ceramics. In Phase II, we will proceed with new M&A and alliance projects, covering other areas as well.

4. Strategies for major businesses under PEGASUS Phase II

(1) Base (Growth) businesses

Under Phase II, the HD media and graphite electrode businesses will be prepared for the next jump in the Post-PEGASUS period.

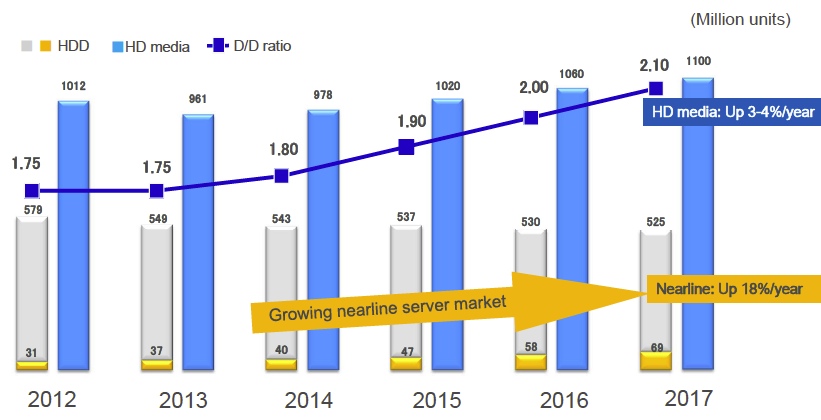

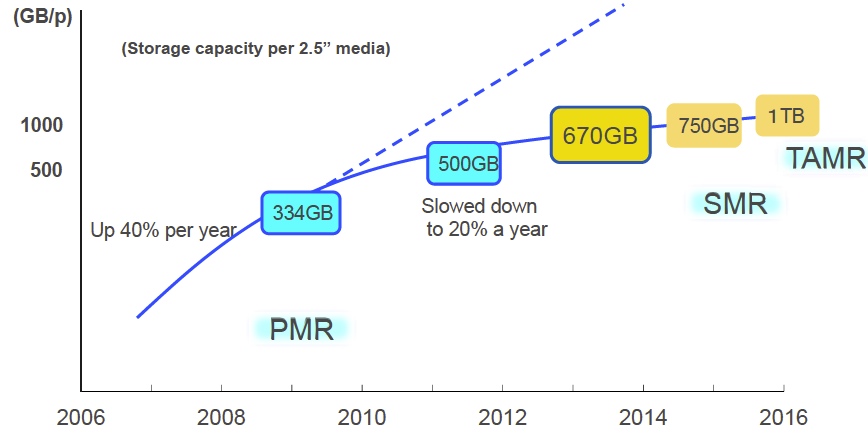

Demand for HDDs is decreasing due to the shift in applications from PCs to servers. In the short term, this trend has caused stagnation in demand for HD media. However, demand for HD media will increase in a medium term, reflecting the growth in server applications that require a larger number of HD media per HDD. To meet the growing demand for HD media for server applications, we will increase productivity by fully taking advantage of our strength as an integrated producer of aluminum substrates and media. Furthermore, we will promote technical development to prepare for the volume production of higher-capacity HD media based on shingled magnetic recording (SMR) and thermally assisted magnetic recording (TAMR) technologies.

HD: Growing for server applications; higher D/D ratio

(SDK estimates)

HD: Keep technical advantages,

world’s first 670GB/platter in production, developing new generation technology

In the graphite electrode business, we will complete the expansion work at SDKC by the second half of 2014 as scheduled, and start commercial shipments. Due mainly to the overproduction of steel in China, the unfavorable supply-demand situation will continue in the Chinese and ASEAN markets. However, steel demand is expected to recover gradually because the European economy is hitting the bottom and the U.S. economy remains steady. Thus, SDKC’s production volume will gradually increase, and its operating rate will improve. SDKC’s new facilities, scheduled for start-up next year, will contribute to the increase in production.

(2) Growth businesses

In the aluminum cans business, the domestic market is matured due to the declining birth rates and the aging population. However, demand will continue to grow in Asian countries, reflecting the increase in population and improvement in personal income. We will promote the business, targeting the growing new markets in Asia.

In the high-purity aluminum foil business, we started up a new production site in China this year to meet growing demand. We will step up marketing activities in China. In the areas of semiconductor-processing high-purity gases and functional chemicals, we are in the process of expanding capacities and establishing new sites.In Phase II, we will start up the new facilities as scheduled, and expand operations.

(3) Base (Stable) businesses

In the Petrochemicals segment, we will accelerate the development of innovative technologies, including the new butadiene manufacturing process. We will also promote the diversification of raw materials, increase the value of cracker by-products, and strengthen tie-up with refinery.

In the Chemicals segment, we will solidify the existing material chain of ammonia, acrylonitrile, etc., and improve the operating rate of the plant based on used plastic.

In the rare earths business, we will strengthen our competitive power by increasing the use of recycled materials produced at our site in Vietnam. Furthermore, we will do aggressive marketing to sell our magnetic alloys produced in China to magnet producers in China. In the Shotic business, we will start up our casting plant in Malaysia as scheduled, and develop new grades for automotive applications.

(4) New Growth businesses

In Phase I, we strengthened our production system for LIB packaging materials to meet growing demand for use in smartphones and tablet PCs. We will continue to expand production capacity step by step in response to demand growth.

Demand for SiC power devices is expected to grow for a medium- to long-term period as the key to energy conservation. SDK is producing and supplying top-quality SiC epitaxial wafers for use in SiC power devices. We will continue to improve the product quality, and strengthen our supply system through volume production of six-inch wafers (launched in October 2013) and expansion in production capacity, thereby contributing to full-scale commercialization of SiC power devices.

5. Summary

Phase II is a period for next jump in the Post-PEGASUS period as well. We will therefore take strong measures to improve the profitability of the HD media and graphite electrode businesses, which will continue to serve as main businesses in the Post-PEGASUS period. Meanwhile, we will work to develop and strengthen Growth businesses that will become the next main businesses. We will also carry out restructuring of Base (Stable) businesses whose profitability has deteriorated.

Through these measures, the Showa Denko Group aims to return to a growth track soon and contribute toward creating a society in which affluence and sustainability are harmonized.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter