Western Digital: Fiscal 4Q16 Financial Results

Better than expected but HDD shipments continue to plunge

This is a Press Release edited by StorageNewsletter.com on August 1, 2016 at 3:15 pm| (in $ million) | 4Q15 | 4Q16 | FY15 | FY16 |

| Revenue | 3,191 | 3,495 | 14,572 | 12,994 |

| Growth | 10% | -11% | ||

| Net income (loss) | 220 | (351) | 1,465 | 257 |

Western Digital Corp. reported revenue of $3.5 billion and a net loss of $351 million, or $1.34 per share, for its fourth fiscal quarter ended July 1, 2016.

On a non-GAAP basis, fourth quarter net income was $208 million, or $0.79 per share. In the year-ago quarter, the company reported revenue of $3.2 billion and net income of $220 million, or $0.94 per share. Non-GAAP net income in the year-ago quarter was $356 million, or $1.51 per share.

The company generated $355 million in cash from operations during the fourth fiscal quarter of 2016, ending with total cash and cash equivalents of $8.2 billion.

On May 4, 2016, the company declared a cash dividend of $0.50 per share of its common stock, which was paid to shareholders on July 15, 2016.

For fiscal 2016, the company achieved revenue of $13.0 billion and net income of $257 million, or $1.06 per share, compared to fiscal 2015 revenue of $14.6 billion and net income of $1.5 billion, or $6.18 per share. On a non-GAAP basis, fiscal 2016 net income was $1.2 billion, or $5.09 per share, compared to fiscal 2015 net income of $1.8 billion, or $7.76 per share. The company generated $2.0 billion in cash from operations during the 2016 fiscal year and it returned $524 million in dividends and share repurchases combined.

“Fiscal 2016 was a transformative year for our company and we are pleased by our customers’ response to the new Western Digital,” said Steve Milligan, CEO. “With the combination of SanDisk and our WD and HGST subsidiaries, we are well-positioned to capture global opportunities through our full portfolio of products for data center, client device and client solution end markets. As we begin a new fiscal year, we remain focused on execution and realizing the benefits of our acquisitions while at the same time creating innovative solutions for the market.”

Comments

At the end of last quarter, WD expected revenue in the range of only $2.6 billion to $2.7 billion for the current one and then changes its expectations last July 6 to be between $3.35 and $3.45 billion following the close of the SanDisk acquisition on May 12. Finally with $3.5 billion, it's higher than expected and it included revenue from SanDisk for around half of the quarter. WD's global sales are up 10% Y/Y and 24% Q/Q. Profit is also higher than expectations.

The company gave details of its HDD business as usual, but few financial information for its flash activity.

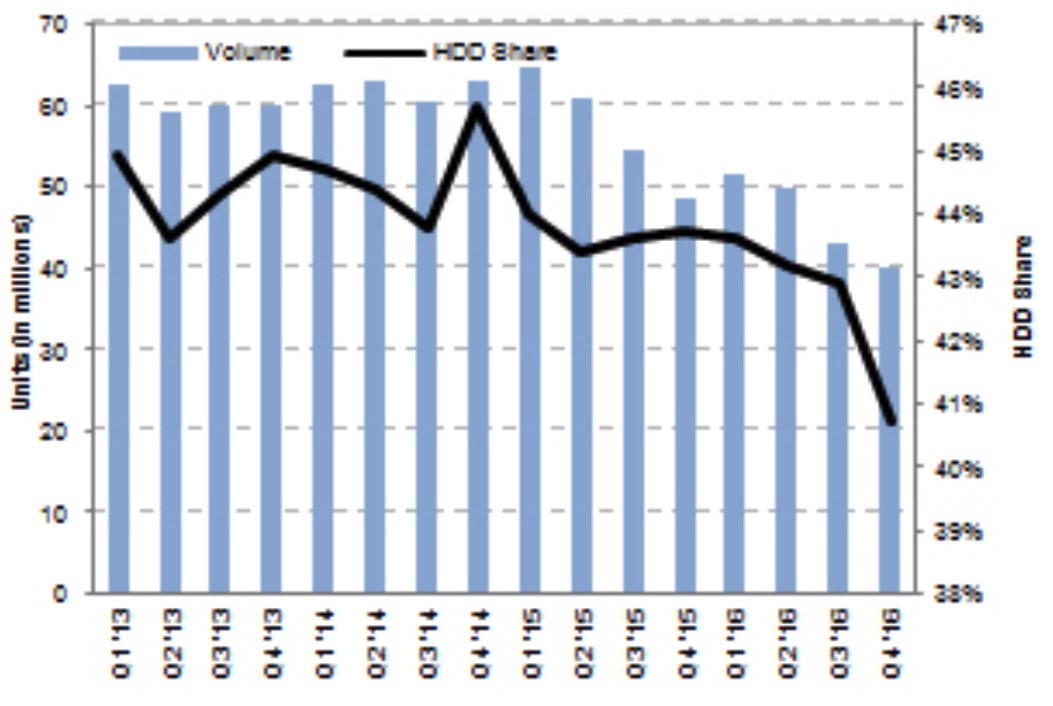

All the WD's HDD shipments decrease Q/Q but for CE products (+37%). Enterprise are down 6%, desktop 26%, notebook 16% and CE devices 10%. Globally disk drives sold diminished 7% Q/Q and 17% Y/Y as the TAM market continues to shrink, but exabytes shipped is up 4% and ASP increased from $60 to a record of $63 since at least four years.

WD has reduced overall facilities footprint by almost one fifth and headcount by almost one quarter over the last two fiscal years, now at 72,878 with SanDisk at the end of the more recent quarter.

Concerning flash, WD's CEO Steve Milligan commented:" From a wafer fab standpoint [with partner Toshiba], in the June quarter, we completed the planned 5% wafer capacity expansion for 2016, and this will provide us slightly more than 3 million wafers of captive output by the end of calendar 2016. Given the planned mix of 2D and 3D NAND technologies, for the rest of the year we expect our bit supply growth to be approximately 30% in calendar 2016, somewhat below our estimate for total industry bit supply growth, as we had previously indicated. However, as we look to 2017, the planned rate of conversion of our 2D NAND capacity to BiCS3 will enable a mix of our 3D NAND wafer capacity to approach 40% of the total capacity by the end of 2017."

If we look at the sales of WD and SanDisk separately for their last three months before the inclusion of the acquisition, it was $2.822 billion for the first one in 3FQ16 ended April 1, 2016, and $1.366 billion for the second one in 1FQ16 ended April 3, 2016, total being $4.188 billion together to be compared to $4.4 billion to $4.5 billion expected by WD for next quarter including a complete three month period for SanDisk.

For their respective revenue for their last fiscal year, it was $5.565 billion for SanDisk for FY16 ended January 3, 2016, and $14.572 billion for WD for FY15 ended July 2, 2015, then a total of $20.137 billion. It has to be proved than one plus one equals two and that WD will exceed $20 billion for its next fiscal year. But together it's pretty sure that they will be the top storage company in the world, largely in front of former EMC in storage, even with Dell storage, representing together $17.7 billion in 2015.

| WD's HDDs (units in million) |

Enterprise | Desktop | Notebook | CE | Branded | Total HDDs | HDD share | Exabyte Shipped |

Average GB/drive |

ASP |

| 4Q13 | 7.9 | 16.2 | 24.0 | 6.5 | 5.3 | 59.9 | 44.9% | 47.7 | 797 | $60 |

| 1Q14 | 7.8 | 17.3 | 22.9 | 8.5 | 6.1 | 62.6 | 44.7% | 50.8 | 811 | $58 |

| 2Q14 | 7.8 | 16.8 | 22.7 | 8.8 | 7.0 | 63.1 | 44.4% | 55.1 | 874 | $60 |

| 3Q14 | 7.1 | 16.6 | 21.8 | 8.6 | 6.3 | 60.4 | 43.8% | 53.6 | 888 | $58 |

| 4Q14 | 7.1 | 16.2 | 22.9 | 10.9 | 6.0 | 63.1 | 45.7% | 55.2 | 875 | $56 |

| 1Q15 | 7.8 | 16.3 | 23.4 | 10.5 | 6.8 | 64.7 | 44.0% | 64.9 | 1,002 | $58 |

| 2Q15 | 8.0 | 15.4 | 21.2 | 9.3 | 7.2 | 61.0 | 43.4% | 66.4 | 1,087 | $60 |

| 3Q15 | 7.5 | 13.5 | 18.8 | 8.6 | 6.1 | 54.5 | 43.6% | 61.3 | 1,123 | $61 |

| 4Q15 | 7.2 | 11.6 | 15.5 | 9.1 | 5.2 | 48.5 | 43.7% | 56.2 | 1,159 | $60 |

| 1Q16 | 7.2 | 11.7 | 15.8 | 11.5 | 5.6 | 51.7 | 43.6% | 63.5 | 1,228 | $60 |

| 2Q16 | 7.0 | 12.5 | 15.3 | 8.5 | 6.4 | 49.7 | 43.2% | 69.1 | 1,390 | $61 |

| 3Q16 | 6.4 | 10.7 | 13.6 | 7.3 | 5.2 | 43.1 | 43.2% | 63.7 | 1,443 | $60 |

| 4Q16 | 6.0 | 7.9 | 11.4 | 10.0 | 4.7 | 40.1 | 40.7% | 66.1 | NA | $63 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter