Seagate: Fiscal 2Q14 Financial Results

Revenue down 4% and net 13%, next quarter expected to be worst

This is a Press Release edited by StorageNewsletter.com on January 29, 2014 at 3:29 pm| (in US$ million) | 2Q13 | 2Q14 | 6 mo. 13 | 6 mo. 14 |

| Revenues | 3,668 | 3,528 | 7,400 | 7,017 |

| Growth | -4% | -5% | ||

| Net income (loss) | 492 | 428 | 1,074 | 855 |

Seagate Technology plc reported financial results for the second quarter of fiscal year 2014 ended December 27, 2013.

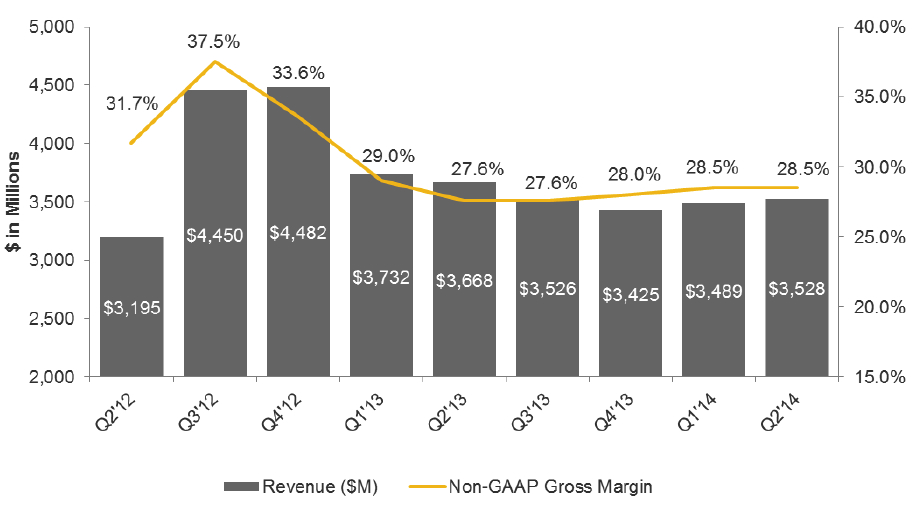

During the second quarter, the company reported revenue of $3.53 billion, gross margin of 28.0%, net income of $428 million and diluted earnings per share of $1.24. On a non-GAAP basis, which excludes the net impact of certain items, Seagate reported gross margin of 28.5%, net income of $455 million and diluted earnings per share of $1.32.

During the second quarter, the company generated approximately $856 million in operating cash flow, paid cash dividends of $142 million and repurchased 33 million ordinary shares for approximately $1.5 billion. There were 328 million ordinary shares issued and outstanding as of the end of the quarter. Cash, cash equivalents, restricted cash, and short-term investments totaled approximately $2.3 billion at the end of the quarter.

“Seagate’s results in the December quarter reflect discipline in managing the profitability of our business and strong operational execution. We continue to strategically invest in our product portfolio and enhance our vertically integrated manufacturing capabilities to effectively capitalize on the cloud, mobile and open source storage trends that are being fueled by data growth,” said Steve Luczo, Seagate’s chairman and CEO. “Our cash flow was very strong this quarter, and combined with the execution of our capital allocation strategy, we are on track to meet our goal of returning 70% of our operating cash flow to shareholders this fiscal year.”

Comments

It's not a great quarter for Seagate as Y/Y revenue decreased 4%, net income 13%, and number of units shipped 3% with unchanged ASP ($62).

It was a little better for leader WD (with HGST) for the same period ended December 2013 with sales up 4%, net increasing 28%, devices shipped up 7% and ASP down from $61 to $60.

Since mid-2012, we entered into a flat curve for the HDD worldwide industry - including prices per unit -, and there is no sign of change in 2014. On its side, the SSD market is growing much faster and these silicon-based devices are a real challenge for the mechanical ones, mainly today in the low-end capacities, as well in the high end with the booming sector of all-flash storage subsystems. It confirms more and more that the remaining market of HDDs will be high capacity units for data protection rather than primary storage. Products like 6TB helium devices from HGST followed by 6TB Seagate's disk drives next quarter will help.

Abstracts the earnings call transcript:

Steve Luczo, chairman and CEO:

"We are continuing to expand our offering of high capacity drives with our 6-disk, 6TB drive shipping early next quarter.

"We are shipping in-volume drives that utilize single magnetic recording or SMR and we will continue to deploy this technology advancement across our portfolio in the coming months. We also continue to invest in advancing our HAMR technology development and our hybrid and flash technology initiatives.

"Turning to our March quarter outlook, we expect to achieve at least $3.4 billion in revenues and to maintain non-GAAP margins approximately flat sequentially.

"I think last quarter we did something like 1.7 or 1.5 million hybrid drives.

"I would expect that the average capacity per drive crosses over terabyte sometime this year."

Seagate's revenue and gross margin

Seagate vs. WD for most recent quarter

| in million | Seagate | WD |

| Revenue | $3,528 (-4% Y/Y) |

$3,972 (-1% Y/Y) |

| Net income | $428 | $430 |

| HDD shipped | 56.6 |

63.1 |

Seagate's HDDs From 2FQ12 to 2FQ14

(units in million)

| Enterprise | Desktop | Notebook | CE | Branded | Total HDDs |

ASP | Exabyte Shipped* |

Average GB/Drive |

|

| 2Q12 | 6.4 | 17.1 | 15.6 | 4.8 | 3.0 | 46.9 | $67 | 30.6 | 653 |

| 3Q12 | 7.4 | 23.8 | 20.1 | 6.9 | 2.7 | 60.7 | $73 | 40.9 | 673 |

| 4Q12 | 8.5 | 23.9 | 22.4 | 7.4 | 3.9 | 65.9 | $67 | 45.5 | 690 |

| 1Q13 | 6.3 | 20.4 | 20.3 | 5.8 | 5.2 | 58.0 | $63 | 42.5 | 731 |

| 2Q13 | 7.3 | 21.9 | 17.3 | 5.6 | 6.0 | 58.2 | $62 | 47.9 | 823 |

| 3Q13 | 7.5 | 19.6 | 17.0 | 5.8 | 5.7 | 55.7 | $63 | 47.2 | 848 |

| 4Q13 | 8.2 | 18.6 | 16.1 | 6.1 | 4.8 | 53.9 | $63 | 45.9 | 852 |

| 1Q14 | 8.1 | 19.1 | 17.2 | 6.2 | 5.1 | 55.7 | $62 | 48.9 | 878 |

| 2Q14 | 7.8 | 19.2 | 16.9 | 6.7 | 6.2 | 56.6 | $62 | 52.2 | 922 |

* HDD only

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter