SanDisk: Fiscal 4Q14 Financial Results

Why quarterly revenue down 1%?

This is a Press Release edited by StorageNewsletter.com on January 23, 2015 at 3:02 pm| (in $ million) | 4Q13 | 4Q14 | FY13 | FY14 |

| Revenue | 1,728 | 1,735 | 6,170 | 6,628 |

| Growth | 0% | 7% | ||

| Net income (loss) | 337.8 | 201.9 | 1,043 | 1,007 |

SanDisk Corporation announced results for the fourth quarter and fiscal year ended December 28, 2014.

Fourth quarter revenue of $1.74 billion was slightly higher on a year-over-year basis and decreased 1% sequentially.

Total revenue for fiscal 2014 was a record $6.63 billion, a 7% increase from $6.17 billion in fiscal 2013.

On a GAAP basis, fourth quarter net income was $202 million, or $0.86 per share, compared to net income of $338 million, or $1.45 per share, in the fourth quarter of fiscal 2013 and $263 million, or $1.09 per share, in the third quarter of fiscal 2014. Net income for fiscal 2014 was $1.01 billion, or $4.23 per share, compared to $1.04 billion, or $4.34 per share, in fiscal 2013.

On a non-GAAP basis, fourth quarter net income was $294 million, or $1.30 per share, compared to net income of $390 million, or $1.71 per share, in the fourth quarter of fiscal 2013 and net income of $336 million, or $1.45 per share, in the third quarter of fiscal 2014. Net income for fiscal 2014 was $1.29 billion, or $5.60 per share, compared to $1.27 billion, or $5.31 per share, in fiscal 2013.

“We delivered record revenue in 2014 with continued progress in shifting our portfolio towards high value solutions,” said Sanjay Mehrotra, president and CEO, SanDisk. “Our SSD solutions reached 29% of revenue in 2014, with strong growth from both client and enterprise SSDs. We are disappointed with our fourth quarter results, which were impacted primarily by supply constraints. We believe that NAND flash industry fundamentals are healthy, and we expect our financial results to improve as we move through 2015.“

Other highlights

- Announced that its board of directors has authorized a $2.5 billion increase in the company’s existing share repurchase program. With the additional authorization, the company has approximately $3.0 billion remaining available for stock repurchases under the program.

- Announced a first quarter 2015 dividend of $0.30 per share of common stock, payable on March 23, 2015 to shareholders of record as of the close of business on March 2, 2015.

- Celebrated the receipt of its 5,000th patent and was named a Thomson Reuters 2014 Top 100 Global Innovator for the fourth consecutive year.

- Introduced the iXpand flash drive, the company’s first USB key designed for iPhone and iPad, allowing quick photo and video transfers from an iPhone or iPad to a Mac or PC.

Comments

2014 is a good year for SanDisk with revenue up 7% but 4Q14 was flat compared to one year ago and to the former quarter, and profit diminishing, a lot for the quarter and slightly the year. Furthermore next two quarters are not going to be impressive.

Commenting on the fiscal results, president and CEO Sanjay Mehrotra confirmed: "We are disappointed with our fourth quarter execution."

The main problem concerned inventory levels extremely lean exiting the third quarter and anticipated to become even leaner throughout the fourth quarter, creating supply shortfalls in certain products. Additionally, within 4Q14, unplanned maintenance activities in Yokkaichi fab operations, as well as lower yield on certain memory die, led to unexpected reductions in production output.

These factors impacted most notably:

- - in the retail, resulting in lost sales opportunities, with revenue down 2% sequentially and 18% Y/Y in this field, and

- - iNAND product lines with demand falling more rapidly than forecasted by SanDisk's

customers.

Top operational priorities for the company in 2015 is to rebuild its inventory levels, expected to be restored to normal levels by mid-year 2015.

In manufacturing, the output from company's wafer fabs was below expectations for the fourth quarter, with 2014 bit supply growth increasing by 20% from 2013, at the low end of the 20% to 30% range estimate.

From a NAND industry standpoint, SanDisk estimates for 2015 supply bit growth in the range of 35% to 40% and continues to expect a healthy industry supply-demand environment. It will be implementing a 5% expansion to wafer capacity in 1H15 and this will increase captive wafer capacity to approximately 3 million wafers in this period.

Globally gigabytes sold increased only 4% Q/Q and 32% Y/Y. ASP/GB decreased 4% Q/Q and 24% Y/Y, usual percentages. Average capacity per unit was 22GB for the quarter vs. 16GB the former one.

Furthermore, the flash maker remains confident that its 3D NAND memory products will be in production in 2016.

Note also that for the first time since at least 1Q10, headcount diminished during the quarter, at 8,696.

On the other side, there are good news concerning client and enterprise SSDs.

Client SSDs completed a strong year in 2014 with 36% growth and strong penetration in OEM and retail markets, but a major customer whose name was not revealed has decided to move away from the company's client SSD solution starting in Q1.

Enterprise SSDs sales grew on a sequential and Y/Y basis during the fourth quarter, with 2014 revenue nearly doubling. 4Q14 revenue was driven by continuing strength in SAS SSDs and a significant increase from sales of CloudSpeed enterprise SATA products to hyperscale customers. SanDisk expects that enterprise solutions revenue will achieve $1 billion in 2015.

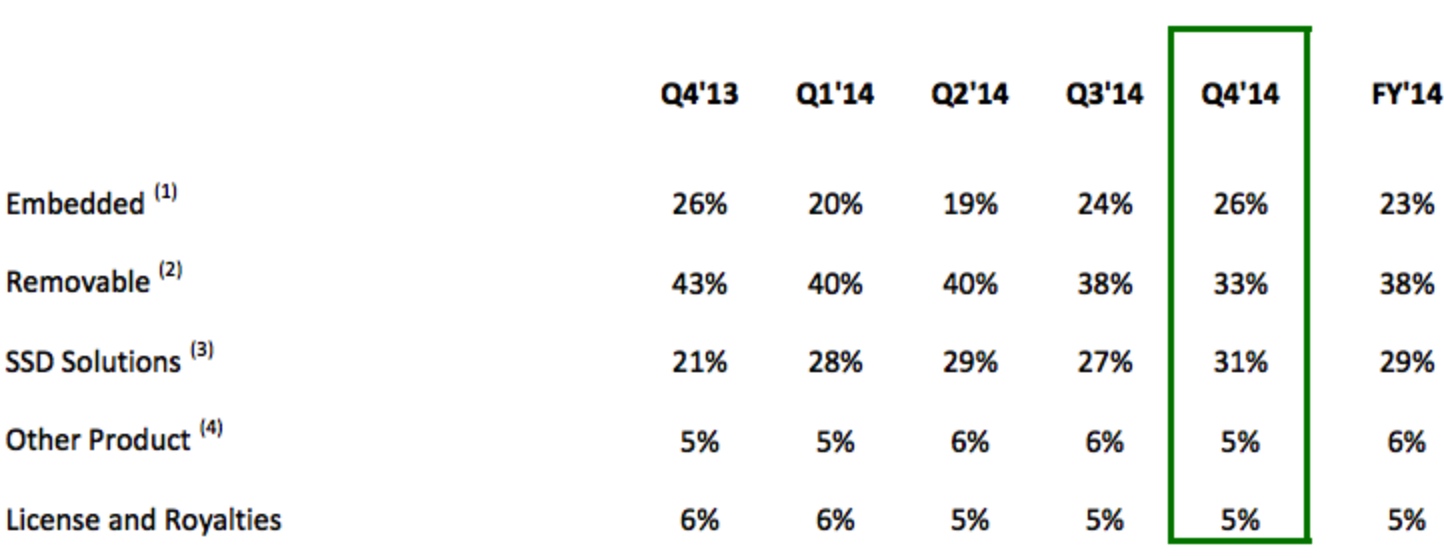

Combined SSD revenue increased to 31% of total revenue in the fourth quarter, up from 27% in the third one. 2015 sales are supposed to remain similar to the 29% sales mix in 2014, driven by higher sales in enterprise, partially offset by a decline in client SSDs. But it is anticipated that client SSD business will grow again starting in 2016.

Embedded sales grew sequentially by 10%, with a decline from iNAND solutions and strong growth in custom embedded.

CFO Judy Bruner expects revenue to experience a Y/Y decline in both the first and second quarters, and return to yearly growth in 2H15. First quarter revenue forecasted is $1.40 billion to $1,45 billion or down 19% to 16% sequentially for 1Q15, and $6.5 billion (-2%) to $6.8 billion (+3%) for 2015

Revenue mix by form factor

(1) Embedded includes non SSD products that attach to host system board

(2) Removable includes products such as cards, USB flash drives and audio/video players

(3) SSD includes client, enterprise and embedded SSDs and associated software

(4) Other includes wafers, components and accessories

*Percentages may not add to 100% due to rounding

Yearly revenue and net income for SanDisk

| FY | Revenue* | Y/Y growth | Net income* |

| 2009 | 3,567 | 6% | 416.3 |

| 2010 | 4,807 | 35% | 1,300 |

| 2011 | 5,662 | 17% | 986.9 |

| 2012 | 5,053 | -11% | 417.4 |

| 2013 | 6,170 | 22% | 1,043 |

| 2014 | 6,628 | 7% | 1,007 |

* in $ million

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter