SanDisk: Fiscal 3Q14 Financial Results

Expects enterprise SSD revenue to surpass $1 billion in 2015.

This is a Press Release edited by StorageNewsletter.com on October 20, 2014 at 3:16 pm| (in US$ million) | 3Q13 | 3Q14 | 9 mo. 13 | 9 mo. 14 |

| Revenues | 1,625 | 1,746 | 4,442 | 4,892 |

| Growth | 7% | 10% | ||

| Net income (loss) | 276.9 | 262.7 | 704.9 | 805.6 |

SanDisk Corporation announced results for the third quarter ended September 28, 2014.

Third quarter revenue of $1.75 billion increased 7% on a year-over-year basis and increased 7% sequentially.

On a GAAP basis, third quarter net income was $263 million, or $1.09 per share, compared to net income of $277 million, or $1.18 per share, in the third quarter of fiscal 2013 and $274 million, or $1.14 per share, in the second quarter of fiscal 2014.

On a non-GAAP basis, third quarter net income was $336 million, or $1.45 per share, compared to net income of $371 million, or $1.59 per share, in the third quarter of fiscal 2013 and net income of $329 million, or $1.41 per share, in the second quarter of fiscal 2014. For reconciliation of non-GAAP to GAAP results, see accompanying financial tables and footnotes.

“Third quarter results reflect the strength of our diversified product portfolio, broad customer engagements and solid execution,” said Sanjay Mehrotra, president and CEO. “Demand for NAND flash continues to be strong across mobile, client and enterprise, where SanDisk’s innovations are creating significant opportunities. As we focus on closing a record 2014, we also look forward to building upon our success in 2015.“

Other highlights

- Completed the acquisition of Fusion-io, a developer of flash-based PCIe hardware and software solutions, for approximately $1.1 billion, net of cash assumed.

- Commemorated the opening of Phase 2 of Fab 5 and began construction of the New Fab 2 in Yokkaichi, Japan.

- Announced design wins for its high-performance, low-latency ULLtraDIMM SSDs with Super Micro Computer and Huawei.

- In enterprise solutions, Dell launched SanDisk DAS Cache server-side caching software, allowing customers to benefit from SSDs, while maintaining data on direct-attached, disk-based storage.

- In client solutions, launched the Ultra II SSD, utilizing X3 technology to deliver a performance, cost-effective storage upgrade for PCs.

- Launched a SD card with the 512GB SanDisk Extreme PRO SDXC UHS-I card and a fast microSD UHS-I card with the 64GB SanDisk Extreme PRO microSDXC UHS-I card, both enabling 4K Ultra HD video capture.

SanDisk announced a fourth quarter 2014 dividend of $0.30 per share of common stock, payable on November 24, 2014 to shareholders of record as of the close of business on November 3, 2014.

Comments

Quarterly sales increased 7% Q/Q and Y/Y but net income is down 4% and 5% respectively.

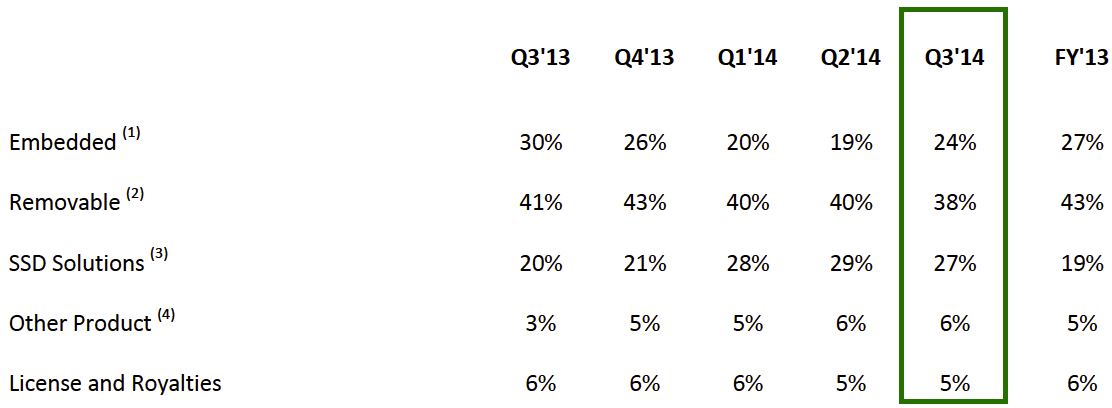

Revenue mix by form factor

(1) Embedded includes non-SSD products that attach to a host system board

(2) Removable includes products such as cards, USB flash drives and audio/video players

(3) SSD includes client, enterprise and embedded SSDs and associated software

(4) Other includes wafers, components and accessories

*Percentages may not add to 100% due to rounding

SSD

The company expects enterprise SSD revenue to surpass $1 billion in 2015, a year ahead of its previously stated timeline.

It also began shipment of 1Y nanometer X2 SSDs and qualification of 1Y nanometer X3 SSDs underway with several OEMs.

Combined sales from enterprise and client SSDs drove 27% of the quarter global revenue.

SSD revenue grew 48% Y/Y, with the strongest growth coming from enterprise units.

Sequentially, sales grew only 1% with growth in enterprise SSDs offset by a decline from client SSDs. This sequential decline reflected demand timing from certain customers as well as SanDisk's supply allocation decisions.

Embedded products

Embedded quarterly sales were down 16% Y/Y, and up 30% Q/Q. The sequential increase came from both custom embedded and iNAND solutions.

Removable products

Removable products revenue, including sales in both retail and commercial channels, was flat Y/Y and up 1% Q/Q.

Total petabytes sold

Total petabytes sold by SanDisk increased 9% Q/Q and 43% Y/Y. Captive bit sales grew faster than captive bit supply, resulting in further reduction to captive inventory levels. Overall inventory increased sequentially because of the non-captive inventory acquired in the Fusion-io transaction.

Average price per gigabyte declined 3% Q/Q and 26% Y/Y.

Fusion-io

The firm has decided to accelerate the combination of its legacy enterprise storage solutions group and the newly added Fusion-io team by forming one enterprise storage organization headed by John Scaramuzzo. The sales team has been integrated under Henri Richard.

Distribution

In retail, revenue increased slightly from the previous quarter but declined modestly on a year over year basis with growth in micro SD cards offset by decline in SD cards.

Commercial channel revenue grew 13% Y/Y, while retail revenue was down 2%.

The primary source of growth in the commercial channel was SSDs, both enterprise and client devices. Within the retail channel, sales of SD cards decreased due to the declining camera market, partially offset by growth in demand for micro SD cards.

Sequentially, commercial revenue grew 8%, driven by embedded growth, and retail revenue was up 5%, driven by back to school USB sales and mobile cards.

Sales in the retail channel comprised 32% of 3Q14 revenue mix, compared to 35% in the year ago quarter.

Fabs

1Y nanometer technology comprised approximately two-thirds of petabytes sold.

SanDisk completed the planned 5% wafer capacity expansion in Fab 5 phase one, bringing its annualized wafer capacity to approximately 2.8 wafers.

It said to be on track to begin product shipments of 15 nanometer this quarter, with meaningful production in 1Q15.

Mix of 1Y nanometer production is relatively consistent through the second half of 2014 at 60%, while the company maintain a long tail of 19 nanometer production for strategic customers and began 15 nanometer production ramp in 4Q14.

It is planning an approximate 5% capacity expansion in 2015.

3D NAND technology development continues to make progress and it is expect to be in pilot production in the second half of 2015, with target volume production in 2016.

Guidance

Revenue is forecasted between $1.8 billion to $1.85 billion next quarter.

In 2015, SanDisk plan to increase its supply bit growth from less than 25% this year to a range of 30% to 40%. Given the lean level of inventory at the end of 2014, 2015 revenue bit growth will likely need to be at the low end of that range.

Finally, SanDisk expects that 2014 will be another record year in both revenue and earnings.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter