SanDisk: Fiscal 1Q16 Financial Results

Revenue up 3% Y/Y, down 11% Q/Q

This is a Press Release edited by StorageNewsletter.com on April 28, 2016 at 2:54 pm| (in $ million) | 1Q15 | 1Q16 | Growth |

| Revenue |

1,332 | 1,366 | 3% |

| Net income (loss) | 39.0 | 78.4 |

SanDisk Corporation announced results for the first quarter ended April 3, 2016.

First quarter revenue of $1.37 billion increased 3% on a year-over-year basis and decreased 11%t sequentially.

On a GAAP basis, first quarter net income was $78 million, or $0.37 per share, compared to net income of $39 million, or $0.17 per share, in the first quarter of 2015 and net income of $135 million, or $0.65 per share, in the fourth quarter of 2015.

On a non-GAAP basis, first quarter net income was $167 million, or $0.82 per share, compared to net income of $134 million, or $0.62 per share, in the first quarter of 2015 and net income of $257 million, or $1.26 per share, in the fourth quarter of 2015.

“Our first quarter results mark a solid start to 2016,” said Sanjay Mehrotra, president and CEO. “We delivered year-over-year growth in revenue, earnings and cash flow, and are pleased with the strength of our Q1 revenue in enterprise solutions, client SSDs and removable products. We are excited about the opportunities ahead as the combination of SanDisk and Western Digital will provide our customers with a tremendous breadth of solutions and deep expertise in storage across a range of applications.”

News highlights

- SanDisk and IBM announced a collaboration to bring out a new class of next-generation, software-defined, all-flash storage solutions for the data center utilizing SanDisk’s InfiniFlash System and software-defined storage featuring IBM Spectrum Scale filesystem from IBM. The joint solution addresses the escalating datacenter challenges of scale, performance, agility and break-through economics.

- SanDisk expanded its automotive solutions with an automotive grade SD card featuring a new suite of features including enhanced power failure protection, and a memory health status monitor. SanDisk also extended these new smart features to its SanDisk Industrial and SanDisk Industrial XT SD cards.

- SanDisk introduced new retail removable products, including introducing the world’s fastest microSD card, featuring transfer speeds of up to 275MB/s, and the SanDisk Ultra USB Type-C flash drive designed specifically for next-generation devices with USB Type-C connectors.

In light of the pending acquisition of SanDisk by Western Digital Corporation, SanDisk will not hold a conference call to discuss its financial results.

Comments

Enterprise Solutions

- - Revenue grew 9% Q/Q and 15% Y/Y

- - Strength in enterprise SATA SSDs and PCIe solutions and growth from hyperscale customers

- - Growing contribution from InfiniFlash all-flash storage platform

- - Sampled second generation 12Gb SAS SSD based on 15nm technology

- - On track to launch 15nm 12Gb SAS SSD and NVMe PCIe SSD later in 2016

Client SSDs

- - Revenue declined 6% Q/Q and grew 6% Y/Y

- - Excluding the 1Q15 client SSD revenue from Apple which ended its client SSD program, sales grew 55% Y/Y

- - Strong Y/Y revenue growth in commercial and retail channels

- - Finished qualification of 15nm X3 client SSD at a major OEM, with production ramp expected in 2Q16

- - Expecting to complete additional qualifications of 15nm X3 client SSDs in 2Q16

Embedded Solutions

- - Revenue declined 33%, both Q/Q and Y/Y, due to weak demand from smartphone customers

- - Focus on X3 eMMC embedded solutions, which are in the early stages of market adoption

- - X3-based iNAND 7232 achieved additional design wins, including in the HTC 10, with production ramp of the iNAND 7232 continuing throughout 2016 as these designs come to market

Removable

- - Revenue declined 15% Q/Q due to retail seasonality

- - Gained global retail market share from 4Q15 to 1Q16 in cards and USBs

- - Revenue grew 6% Y/Y, benefiting from new retail solutions such as iXpand and Ultra Dual USB drives, growing usage of cards in new commercial applications in the connected home and industrial sectors

Other

- - Other category increased 12% Q/Q and 54% Y/Y, with growth driven by sales of components and wafers

Technology and operations

- - Now receiving initial 3D NAND production output at New Fab 2 facility; began OEM qualification work on 3D NAND

- - On track for development of the next generation 3D NAND, expected to be in volume production in 1H17

- - Began 5% wafer capacity expansion which will include both 2D and 3D NAND, with completion expected in 2Q16

- - Back-end supply operations executed well in 1Q16, responding to demand upsides

- - Captive assembly and test facilities in Shanghai and Penang, along with network of contract manufacturing partners, continue to provide the scale and agility to meet customer requirements

Supply

- - 2016 Y/Y industry bit supply growth expected to be in the low 30% range

- - 2016 Y/Y SanDisk bit supply growth expected to be somewhat lower than industry average, close to 30%

- - 3D NAND is estimated to represent 15% to 20% of the industry's total NAND wafer capacity exiting 2016

- - SanDisk's 3D NAND wafer capacity estimated to be 15% of our company's total wafer capacity exiting 2016

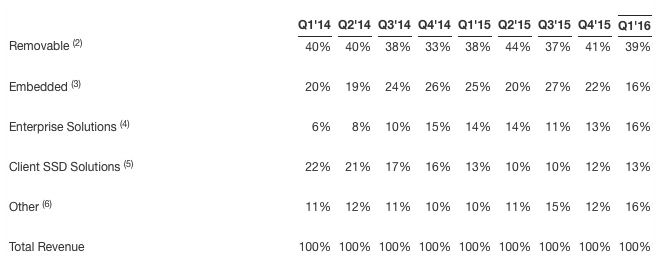

Revenue Mix by Category

(percentages may not add to 100% due to rounding)

(1) Revenue is estimated based on analysis of the information the company collects in its sales reporting processes.

(2) Removable includes products such as cards, USB flash drives and audio/video players.

(3) Embedded includes products that attach to a host system board.

(4) Enterprise Solutions includes SSDs, system solutions and software used in data center applications.

(5) Client SSD Solutions includes SSDs used in client devices and associated software.

(6) Other includes wafers, components, accessories, and license and royalties.

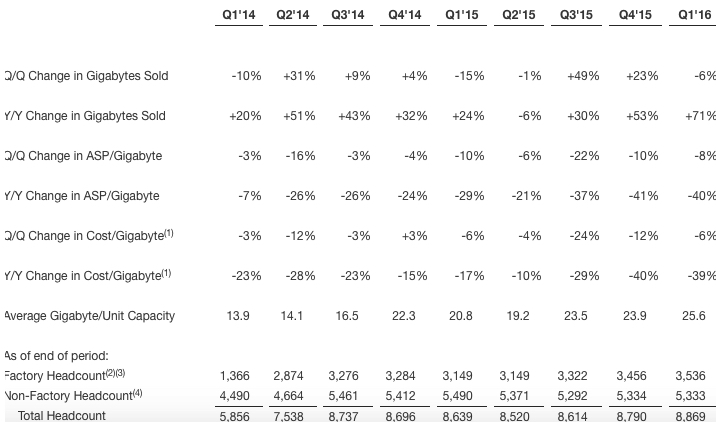

Preliminary Quarterly and Annual Metrics

(1) Cost per gigabyte and cost reduction are non-GAAP and are computed from non-GAAP cost of revenue.

(2) Reflects SanDisk China and Malaysia factory employees, excluding temporary and contract workers.

(3) During 2014, 1,505 employees were converted from contractor to employee status in SanDisk's assembly and test facility in China.

(4) Reflects SanDisk non-factory employees, excluding temporary and contract workers.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter