SanDisk: Fiscal 1Q15 Financial Results

Revenue declining 12% Y/Y and 23% Q/Q: why?

This is a Press Release edited by StorageNewsletter.com on April 16, 2015 at 3:04 pm| (in $ million) | 1Q14 | 1Q15 | Growth |

| Revenue |

1,512 | 1,332 | -12% |

| Net income (loss) | 268.9 | 39.0 |

SanDisk Corporation announced results for the first quarter ended March 29, 2015.

First quarter revenue of $1.33 billion declined 12% on a year-over-year basis and decreased 23% sequentially.

On a GAAP basis, first quarter net income was $39 million, or $0.17 per share, compared to net income of $269 million, or $1.14 per share, in the first quarter of fiscal 2014 and $202 million, or $0.86 per share, in the fourth quarter of fiscal 2014. First quarter GAAP results include a $61 million impairment charge for an in-process R&D project from the Fusion-io acquisition and $41 million of restructuring and other charges.

On a non-GAAP basis, first quarter net income was $134 million, or $0.62 per share, compared to net income of $330 million, or $1.44 per share, in the first quarter of fiscal 2014 and net income of $294 million, or $1.30 per share, in the fourth quarter of fiscal 2014. First quarter non-GAAP results include $41 million of restructuring and other charges. For a reconciliation of non-GAAP to GAAP results, see accompanying financial tables and footnotes.

“We are disappointed with our financial and operational performance and are quickly taking aggressive measures to regain the excellence in execution that we have delivered in the past,” said Sanjay Mehrotra, president and CEO. “Our top priorities for 2015 are to strengthen our product roadmap and rebuild our momentum across the business. We are excited about the long-term opportunities available to us and believe we are uniquely positioned in the industry to deliver innovative solutions to our growing customer base.“

News highights

- Launched a new category of ‘Big Data Flash’ with the launch of the InfiniFlash System, a next generation storage platform offering flash at massive scale and at a breakthrough cost metric for the customer.

- Announced its 48-layer, second-generation 3D NAND planned for use in a range of solutions from removable products to enterprise SSDs.

- Introduced iNAND 7132, a 1Y-nanometer 3-bit-per-cell (X3) embedded storage solution for flagship mobile devices. The iNAND 7132 storage solution uses SmartSLC to drive near SLC performance for high-performance, data-intensive applications.

- Introduced the 200GB SanDisk Ultra microSDXC UHS-I card, the world’s highest capacity microSDcard for use in mobile devices.

- Introduced a suite of robust, automotive grade NAND flash solutions designed for next-generation ‘connected cars’ and automotive infotainment systems.

- Announced a second quarter 2015 dividend of $0.30 per share of common stock, payable on May 26, 2015 to stockholders of record as of the close of business on May 4, 2015.

Comments

Commenting the disappointing quarterly financial results, Sanjay Mehrotra, SanDisk's president and CEO, said: "Our Q1 results and 2015 outlook have been adversely impacted by the unusual confluence of four main factors: first, product issues, including qualification delays impacting embedded and enterprise sales; second, our reduced 2015 opportunity in the enterprise market due to rapid market shifts; third, weaker than anticipated pricing; and fourth, supply challenges."

1/ Product issues

SanDisk has been working with a customer - name not revealed - to qualify an embedded component for client SSD application. Qualification work for this new embedded component was going well early in the first quarter. However, during this period, the company encountered an issue related to a material used in its product assembly at the very last stage of the customer's qualification process. The delay in sales of this embedded component was the single largest contributor to 1Q15 revenue shortfall and will also impact 2Q15 and 2015 results.

What we know is that HP is a big OEM of SanDisk for 1.92TB SAS SSDs for 3par hybrid and all-flash arrays, delivering products especially for the computer manufacturer, and with a new 4TB model supposed to be available next June, according to an internal HP source

2/ Reduced 2015 opportunity in enterprise market due to rapid market shifts in PCIe and SATA

1Q15 results as well as 2015 revenue estimates for Fusion-io PCIe solutions are significantly below original plan. SanDisk plans to launch its new Fusion-io based PCIe solutions with captive 1Y technology-based NAND later this month and expect revenue contribution from the new PCIe solutions later in the year after customer qualifications are completed.

The biggest contributor to the reduced 2015 enterprise PCIe outlook is that a substantial portion of the PCIe TAM moving to lower cost solutions using enterprise SATA SSDs.

But SanDisk believes that the broadening deployment of NVMe infrastructure and availability of NVMe PCIe solutions, along with lower cost PCIe solutions built on captive NAND, will contribute to the PCIe market expanding again, likely beginning in 2016.

In enterprise SATA SSDs, there was a demand shift to the 2TB point in the hyper-scale portion of the market, starting as early as the second quarter. The company expects its 2TB enterprise SATA product to be ready for production later this year. The current lack of this offering will also impact enterprise SATA sales this year. The longer term impact of the hyper-scale market moving to these high capacity SATA SSDs is that it will expand the TAM.

In enterprise SATA, SanDisk is working to improve its market position and broaden portfolio with multiple new 15nm product offerings launching later in the year.

Following this, the flash maker expects Y/Y enterprise revenue growth in 2015, but not to reach its target of $1 billion of sales in enterprise this year.

3/ Weaker than anticipated pricing

SanDisk experienced softer than expected pricing conditions in some parts of its business in 1Q15, including in global retail sales and in client SSDs. It also made the choice to pull back on sales of private label products late in the quarter because of the accelerated price decline in this channel. The company sees some industry oversupply in the first half of 2015.

4/ Supply challenges

Due to supply constraints, SanDisk were unable to meet the timing of delivery required to fulfill all of the demand for a large hyper-scale customer in enterprise SATA. Separately, its overall petabyte supply for the year has been reduced as the firm is now planning for a higher mix of 1Y technology relative to 15nm in 2H15 to support the mix of business requirements.

In light of the near-term revenue outlook, the company is lowering expenses with a reduction in force during 2Q15 of approximately 5% of its non-factory headcount.

15nm X3 embedded product qualifications are underway and expected to ramp volume shipments in 2Q15.

In client SSDs, SanDisk is shipping X3 based solutions to the channel and OEMs. It also released a 15nm client SSD to retail and expect to begin OEM qualifications in 3Q15.

Key driver of sequential decline in commercial revenue was the phasing out of a client SSD program with a large customer not cited by SanDisk. But once more, according to our SanDisk's source, its Apple that decided not to OEM anymore the SSDs from SanDisk for its MacBooks and probably moved to its own products resulting of the acquisition in December 2011 of Anobit, an Israeli start-up specialized in NAND controllers, for $390 million.

Outlook

In 2Q15 the company expects a sequential decline in revenue, influenced by three primary drivers. First, 2Q15 client SSD revenue will be down sequentially. Second, enterprise revenue will decline in SATA and SAS. Finally, the lower price points in the latter part of 1Q15 will also impact several parts of its business in 2Q15. Consequently, SanDisk expects 2Q15 sales to be in the range of $1.150 billion to $1.225 billion or a quarterly decrease between 14% and 8%.

In 2H15, sequential revenue growth is expected in 3Q15 and 4Q15, but the firm no longer sees Y/Y revenue growth in the second half of fiscal year.

FY15 revenue is forecasted in the range of $5.4 billion to $5.7 billion, or down between 18% and 14% compared to FY14.

From a petabyte perspective, expected revenue bit growth is now well below 30%.

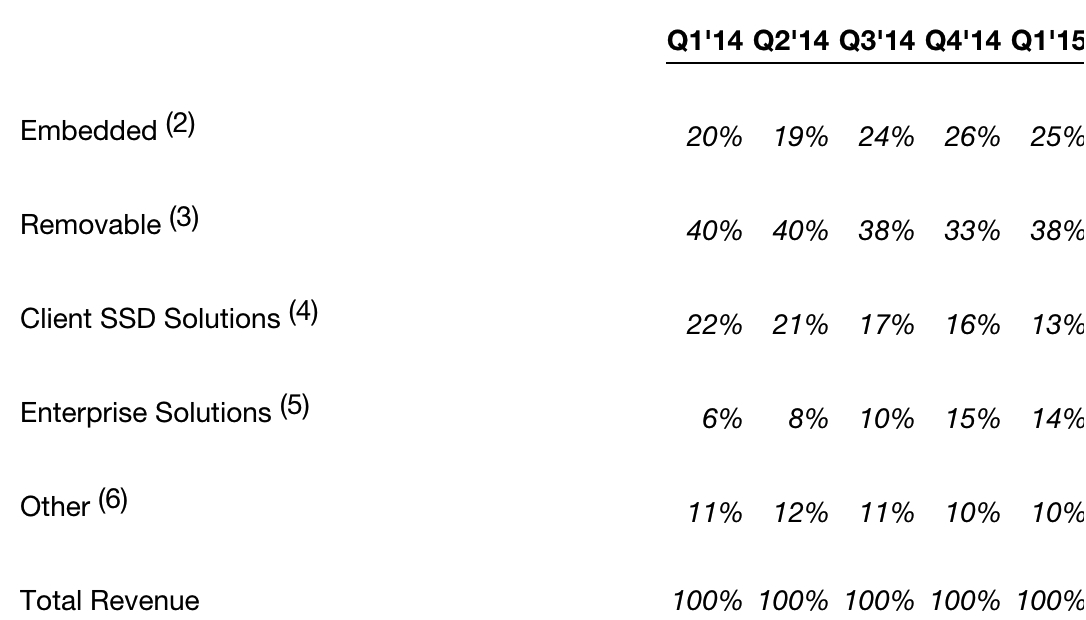

Revenue Mix by Category (1)

% of revenue (unaudited)

Percentages may not add to 100% due to rounding

(1)Revenue by category is estimated based on analysis of the information the company collects in its sales reporting processes.

(2)Embedded includes products that attach to a host system board.

(3)Removable includes products such as cards, USB flash drives and audio/video players.

(4)Client SSD Solutions includes SSDs used in client devices and associated software.

(5)Enterprise Solutions includes SSDs, system solutions and software used in datacenter applications.

(6)Other includes wafers, components, accessories and license and royalty.

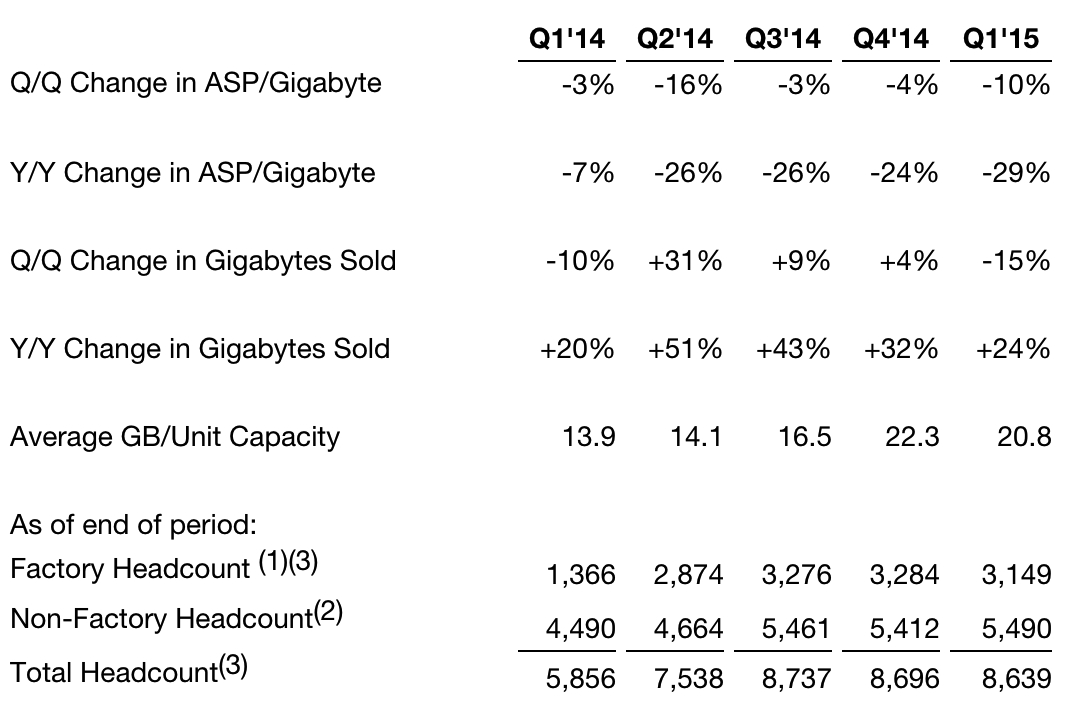

Preliminary Quarterly Metrics

(1)Reflects China and Malaysia factory employees, excluding temporary and contract workers.

(2)Reflects non-factory employees, excluding temporary and contract workers.

(3)During FY14, 1,505 employees were converted from contractor to employee status in assembly and test facility in China.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter