Pure Storage: Fiscal 4Q16 Financial Results

Best ever quarter, 1,650 customers, but far behind EMC

This is a Press Release edited by StorageNewsletter.com on March 3, 2016 at 2:48 pm| (in $ million) | 4Q15 | 4Q16 | FY15 | FY16 |

| Revenue | 65.9 | 150.2 | 174.5 | 440.3 |

| Growth | 128% | 152% | ||

| Net income (loss) | (47.6) | (44.3) | (183.2) | (213.8) |

Highlights:

- Record quarterly revenue of $150.2 million, up 128% Y/Y

- Record full year revenue of $440.3 million, up 152% Y/Y

- Record quarterly gross margin: 65.3% GAAP; up 10.1 ppts Y/Y; 66.0% non-GAAP, up 10.4% ppts Y/Y

- Record quarterly operating margin: -28.6% GAAP, up 41.3 ppts Y/Y; -13.9% non-GAAP, up 43.6 ppts Y/Y

Pure Storage, Inc. announced financial results for the fourth quarter and fiscal year ended January 31, 2016.

The company posted revenue of $150.2 million compared to revenue of $65.9 million in the year-ago quarter.

For the fourth quarter of fiscal 2016, GAAP gross margin was 65.3% and GAAP product gross margin was 68.2%, compared to 55.2% and 58.3%, respectively, in the year-ago quarter.

GAAP net loss was $44.3 million for the fourth quarter of fiscal 2016, compared to $47.6 million in the year-ago quarter.

Non-GAAP gross margin was 66.0% and non-GAAP product gross margin was 68.3%, compared to 55.6% and 58.3%, respectively, in the year-ago quarter.

Non-GAAP net loss was $22.3 million for the fourth quarter of fiscal 2016, compared to $39.5 million in the year-ago quarter.

“We delivered our best ever quarter in Q4, concluding another record setting year for Pure Storage. The business continues to run on all cylinders fueled by the rapid worldwide adoption of FlashArray combined with improved operating efficiency as we scale,” said Scott Dietzen, CEO. “We grew our customer base by more than 120 percent over the past year, capitalizing on the accelerating secular shift to flash and cloud-friendly storage. Pure is uniquely well positioned to succeed in the year ahead given our differentiation across the board in software, hardware, support automation and our business model.”

“We continue to achieve excellent performance in gross margin, operating margin and cash flow during Q4 and year over year,” said Tim Riitters, CFO. “We are confident in the strength of our business model and estimate an earlier timeframe to achieve sustained positive free cash flow, in the second half of calendar year 2017 versus our previous estimate of 2018. We will continue to make investments in sales, marketing and engineering, particularly in the first half of this year which is a seasonal investment period for Pure.”

Pure Storage grew its customer base to more than 1,650 organizations, adding more than 300 new customers in the quarter, including the Mercedes AMG Petronas Formula One Team and the three-time World Series Champion San Francisco Giants.

First Quarter Fiscal 2017 Guidance:

- Revenue in the range of $135 million to $139 million

- Non-GAAP gross margin in the range of 65% to 68%

- Non-GAAP operating margin in the range of (34%) to (30%)

Full Year Fiscal 2017 Guidance:

- Revenue in the range of $685 million to $725 million

- Non-GAAP gross margin in the range of 65% to 68%

- Non-GAAP operating margin in the range of (22%) to (18%)

Comments

Being public last October, Pure Storage recorded its best quarter ever with revenue more than doubling to $150.2 million - representing a 10% outperformance relative to the midpoint of 4FQ16 guidance - and loss diminishing 7% Y/Y. Sales increased 14% Q/Q.

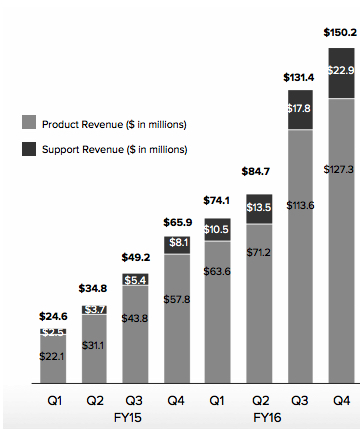

Product revenue is up 120% Y/Y and 12% Q/Q to $127.3 million. For fiscal year 2016, it grew 143% Y/Y to a record $375.7 million.

Support revenue grew 185% Y/Y and 29% Q/Q to $22.9 million in the quarter and accounted for 15% total revenue in 4FQ16 versus 12% in the year ago period. For the full fiscal year, support revenue grew 229% Y/Y to $64.6 million.

The company ended the quarter with 1,650 customers, an increase of 120% over the last 12 months. That group includes 66 of the Fortune 500, up from 59 one quarter ago.

CEO Scott Dietzen said: "For each initial $1 purchase, our top 25 cohort purchased greater than $12 more of Pure Storage within their first 18 months."

The firm added $32 million in positive free cash flow to its balance sheet, which now stands at $600 million.

It previously expected to reach sustained positive cash flow by calendar 2018, and pulls that date forward to the second half of 2017.

For fiscal year 2016, 79% of revenue came from the U.S. and 21% from international markets. This compares to a 77/23 split in the prior fiscal year.

In the market of all-flash array, EMC continues to be largely the dominant player. The storage giant stated that XtremIO ended the calendar year 2015 with over $1 billion in revenue, figure to be compared to $440 million for Pure Storage for its year ending one month later.

According to IDC's most recent Worldwide Quarterly Disk Storage Systems Tracker for 3CQ15 cited by EMC, the storage giant leader all-flash storage solutions with a 39% market share, more than the next three competitors combined. IDC added that the total all flash array market generated $626.2 million in revenue during 3CQ15, up 60.8% Y/Y.

Quarterly revenue in $ thousand

Revenue in $ thousand

(FY ended January 31)

| Period | Revenue | Y/Y growth | Loss |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter