Proact: Fiscal 4Q16 Financial Results

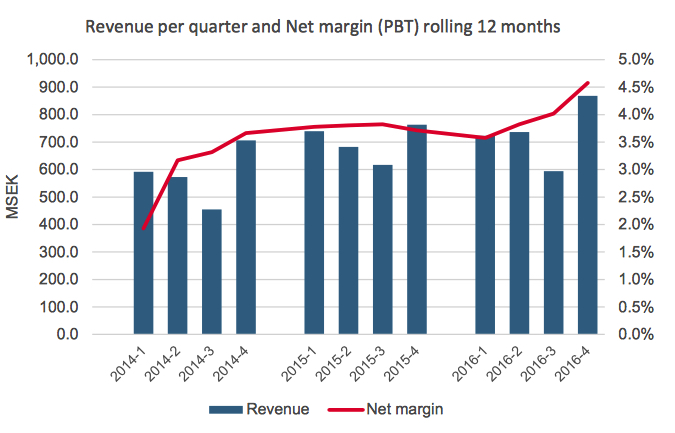

4% revenue growth for year

This is a Press Release edited by StorageNewsletter.com on February 10, 2017 at 2:48 pm| (in SEK million) | 4Q15 | 4Q16 | Growth | 2015 | 2016 | Growth |

| Revenue |

763 | 868 | 14% | 2,802 | 2,922 | 4% |

| Profit after tax |

25.5 | 33.8 | 33% | 78.4 | 96.7 | 23% |

Report by Jason Clark, CEO and president, Proact IT Group AB:

“I am delighted to announce a fourth consecutive record quarter for Proact and a very positive revenue and earnings trend. This excellent development means we are reporting a 5.7% profit before tax margin for the fourth quarter, which clearly exceeds the company target margin of 5%.

“Profit before tax for the quarter amounted to SEK 49.7 million, representing an increase of 70% compared with the corresponding period last year. Service revenues have continued to develop positively during the period and amounted to SEK 263 million, representing an increase of 12%. Service revenues relating to cloud services amounted to SEK 93 million, representing an increase of 25%. System revenues also developed positively and amounted to SEK 605 million, representing an increase of 15%. Total revenues increased by 14% to SEK 868 million in the fourth quarter.

“This positive trend has primarily been achieved by constantly working to the established strategy and defined focus areas. Among other things, this involves ensuring good cost control, regular improvement and streamlining in respect of the services operation, taking the necessary measures in countries failing to meet set financial targets, and increasing the emphasis on sales and marketing within the company. This excellent trend also shows that our specialist expertise and market-leading offering with regard to datacentres and cloud services are very much appreciated by both new and existing customers. We have successfully implemented a number of customer projects in the above fields during the quarter.

“Another part of the strategy involves growth through acquisitions where feasible. In early January this year, Proact acquired all of the shares of Teamix GmbH. Teamix is a well-established company in the German market and has outstanding expertise in various IT technology and service fields. The company has an in-depth knowledge of Proact’s focus areas such as datacentres and associated services. This acquisition will also augment Proact’s existing networking and security portfolio. Teamix also has a corporate culture that aligns well with Proact’s core values of integrity, commitment and excellence. The company has 85 employees and annual turnover of approximately €35 million. This acquisition will give Proact expertise and strength in one of the core European markets, which in turn means that we will further reinforce benefits for existing and new customers.

“Overall, it is clear to me that the initiatives implemented in various business areas are continuing to pay off, making us even more competitive. Our ability to help our customers to minimise risks and reduce costs, and also to supply flexible IT services and products, places us in a strong position on the European market, giving us good opportunities for continued positive development in terms of both revenues and profits.”

The fourth quarter in brief

• In local currencies revenues increased by 14%. Translated to SEK revenues increased by 14% to SEK 868 (763) million.

• EBITDA increased by 39% and amounted to SEK 65.7 (47.1) million.

• Profit before tax increased by 70% to SEK 49.7 (29.2) million.

• Profit after tax increased by 33% to SEK 33.8 (25.5) million.

• Profit per share amounted to SEK 3.69 (2.61).

2016 in brief

• In local currencies revenues increased by 7%. Translated to SEK revenues increased by 4% to SEK 2,922 (2,802) million.

• EBITDA increased by 13% to SEK 191.4 (169.2) million.

• Profit before tax increased by 28% to SEK 133.7 (104.1) million. Profit before tax amounted to SEK 139.5 (112.3) million adjusted for items affecting comparability, representing an increase by 24%.

• Profit after tax increased by 23% to SEK 96.7 (78.4) million.

• Profit per share amounted to SEK 10.32 (8.20).

• Items affecting comparability, expenses attributable to the change of Group president, have adversely affected the operating profit in the sum of SEK 5.8 (8.3) million.

• Return on equity over the last 12 months amounted to 29.8% (26.8%).

• The board of directors proposes that the annual general meeting should elect to pay a dividend of SEK 3.50 (2.70) per share.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter