Nimble Storage: Fiscal 4Q15 Financial Results

660 new customers in Q4 and 2,300 in FY15, installed base of 4,979

This is a Press Release edited by StorageNewsletter.com on February 27, 2015 at 2:54 pm| (in $ million) | 4Q14 | 4Q15 | FY14 | FY15 |

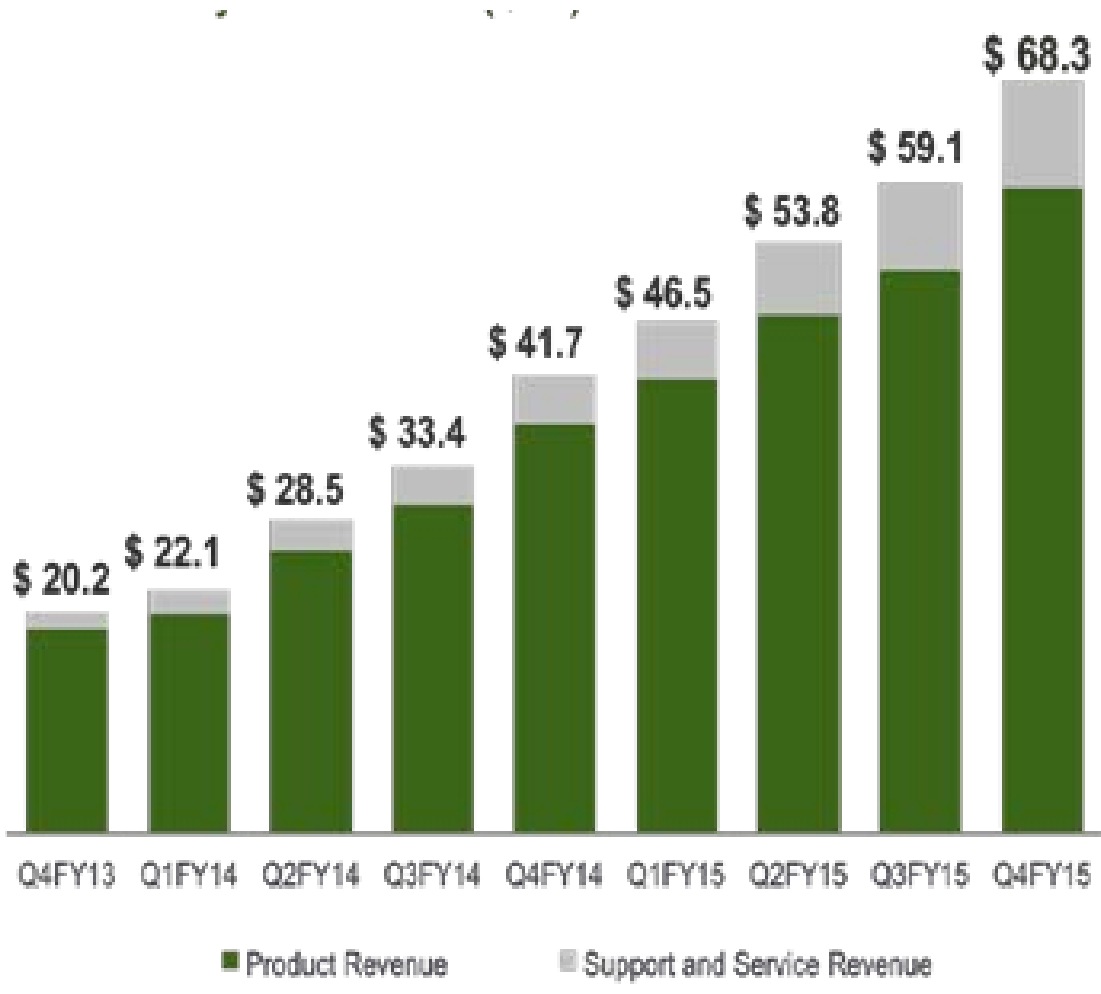

| Revenue | 41.7 | 68.3 | 125.7 | 227.8 |

| Growth | 64% | 81% | ||

| Net income (loss) | (13.2) | (24.7) | (43.1 | (98.8) |

Nimble Storage, Inc. reported financial results for the fiscal fourth quarter 2015 ending January 31, 2015.

“Our pace of innovation has further extended our technology leadership over established and emerging competitors, positioning us well as a leading contender in the minds of customers and channel partners that are looking for alternatives to legacy storage infrastructure,” said Suresh Vasudevan, CEO, Nimble. “As we look back on fiscal year 2015 and Q4 of 2015 in particular, we are convinced that we are now reaching an inflection point as enterprises of all sizes and service providers are concluding that the economic benefits of a modern architecture justify the risks of moving away from long-standing incumbent vendor relationships. We see this as the beginning of a secular share shift that presents a massive growth opportunity for us over the next several years.”

“FY15 was a year of very strong financial execution. We achieved revenue of $227.7 million, up 81% from FY14. We had our highest ever share of bookings from deals over $100K and deals over $250K in Q4FY15, which drove further increases in average deal sizes from already record levels in Q3FY15. We saw an improvement in gross and operating margins during FY15 as a result of economies of scale, the efficiencies of our Adaptive Flash platform, and increased operating leverage,” said Anup Singh, CFO. “Cash flow from operations increased by $12.1 million, from negative $6.7 million in FY14 to positive $5.4 million in FY15. During the fourth quarter, we generated positive free cash flow for the first time in our history and remain on track to achieve profitability on a non-GAAP basis by the end of FY16.”

Fiscal Fourth Quarter 2015 Financial Highlights:

- Revenues fwere $68.3 million, compared to $41.7 million in the fourth quarter of fiscal 2014, representing growth of 64% year-over-year.

- Non-GAAP gross margins of 67.2% , compared to 67.2% in the fourth quarter of fiscal 2014.

- Non-GAAP operating margins of negative 12.4%, compared to negative 20.9% in the fourth quarter of fiscal 2014.

- Adjusted EBITDA was negative $6.8 million or negative 10.0% of revenue compared to negative 17.1% in the fourth quarter of fiscal 2014.

- GAAP net loss was $24.7 million, or $0.33 per basic and diluted share, compared with a net loss of $13.2 million, or $0.29 per basic and diluted share in the fiscal fourth quarter of 2014.

- Non-GAAP net loss was $9.8 million, or $0.13 per basic and diluted share, compared with a net loss of $9.1 million, or $0.14 per basic and diluted share in the fiscal fourth quarter of 2014.

- Foreign exchange loss was $1.1 million, which had a $0.01 per share negative impact on basic and diluted loss per share.

Fiscal Year 2015 Financial Highlights:

- Revenues were $227.7 million, compared to $125.7 million in fiscal 2014, representing growth of 81% year-over-year.

- Non-GAAP gross margins of 67.0%, compared to 65.4% in fiscal 2014.

- Non-GAAP operating margins of negative 17.1% for fiscal 2015, compared to negative 26.6% in fiscal 2014.

- Adjusted EBITDA was negative $32.3 million or negative 14.2% of revenue compared to negative 23.4% in fiscal year 2014.

- GAAP net loss for fiscal 2015 was $98.8 million, or $1.37 per basic and diluted share, compared with a net loss of $43.1 million, or $1.61 per basic and diluted share in fiscal 2014.

- Non-GAAP net loss was $41.8 million, or $0.58 per basic and diluted share, compared with a net loss of $34.0 million, or $0.56 per basic and diluted share in fiscal 2014.

- Foreign exchange loss was $2.1 million, which had a $0.03 per share negative impact on basic and diluted loss per share.

Forward Outlook:

As a reminder, the first quarter is our seasonally slowest quarter; our guidance takes into account this seasonality. For the fiscal first quarter of 2016, Nimble Storage expects:

- Total revenue in the range of $68 to $70 million

- Non-GAAP operating loss in the range of $9 to $10 million

- Non-GAAP net loss per basic and diluted share in the range of $0.13 to $0.14 using approximately 76 million shares

Business Highlights

- Surpassed 5,000 Customer Mark. As the 5,000th customer, Uecomm, a telecommunications vendor in Australia, will deploy FC CS-Series arrays to replace their legacy SAN production environment and DR footprint.

- Issued an Adaptive Flash Challenge to Enterprises Evaluating Flash-Only Storage Solutions. Nimble invites IT organization evaluating all-flash storage to experience the performance of the Adaptive Flash platform. By including Nimble in side-by-side evaluations, enterprises will realize that the Adaptive Flash platform meets or exceeds performance requirements for enterprise-wide workloads, but also offers capacity that scales beyond the limitations of flash-only storage.

- Named Storage Vendor of the Year in 2014 By CRN. Nimble was recognized by CRN in the UK over traditional and start-up storage vendors, including tiered hybrid and all-flash vendors, to win the Storage Vendor of the Year category.

- Recognized as a Storage Product of the Year. Nimble was recognized by TechTarget as a 2014 Storage Product of the Year in the Storage Systems: disk and hybrid systems category.

- Cisco Relationship Gained Momentum with Expansion of the SmartStack Integrated Infrastructure Solution Portfolio. Nimble now offers eight SmartStack solutions based on Cisco UCS. The company also recently introduced integration with UCS Director.

- Voted Top Platinum Sponsor at JD Edwards Summit. Cisco and Nimble presented a UCS-mini based SmartStack solution at the JD Edwards EnterpriseOne conference where Cisco and Nimble were voted the top platinum sponsor.

- Tested CS-Series Arrays; Ready to Run on Oracle Linux and Oracle VM. Adaptive Flash CS-Series arrays achieved Oracle VM Ready and Oracle Linux Ready status through Oracle PartnerNetwork, demonstrating that Nimble has tested and supports Adaptive Flash CS-Series arrays on Oracle Linux and Oracle VM.

- Nimble Storage Named a Visionary in the Gartner Magic Quadrant for General-Purpose Disk Arrays, published on November 20, 2014, for the second consecutive year. The report analyzes providers of midrange, high-end and network-attached storage systems, and hybrid arrays and positions vendors into one of four quadrants: Leaders, Challengers, Visionaries and Niche Players. Nimble was recognized as a Visionary based on the company’s vision and ability to execute.

- Recognized in the Gartner Critical Capabilities Report. Nimble Storage was recognized among competitive products in the Gartner Critical Capabilities for General-Purpose, Midrange Storage Arrays distributed in November 2014.

- Opened New Campus in Research Triangle Park. Nimble signed a new lease for an 87,000 square feet. building in Research Triangle Park as the company continues to scale its presence in North Carolina.

Comments

Quarterly revenue in $ million

Abstracts of the earnings call transcript:

Suresh Vasudevan, CEO:

"During the very first full quarter of availability, our FC products did very well as FC accounted for over 10% of our bookings. We had 83 FCl customers at the end of FY '15. Over 70% of those are net new customers to Nimble."

Anup Singh, CFO:

"Moving to cash flow. We ended Q4 with cash of $208 million. During Q4, our cash actually has increased $3.4 million.

"We remain on track to achieve our goal of breakeven and operating income by the end of FY '16."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter