NetApp: Fiscal 3Q17 Financial Results

All-flash arrays save company: up 160% Y/Y in revenue, 300PB of flash shipped

This is a Press Release edited by StorageNewsletter.com on February 17, 2017 at 2:11 pm| (in $ million) | 3Q16 | 3Q17 | 9 mo. 16 | 9 mo. 17 |

| Revenues | 1,386 | 1,404 | 4,166 | 4,038 |

| Growth | 1% | -3% | ||

| Net income (loss) | 153 | 146 | 237 | 319 |

NetApp, Inc. reported financial results for the third quarter of fiscal year 2017, ended January 27, 2017.

- Net revenues of $1.40 billion, up 5% Q/Q and 1% Y/Y

- GAAP EPS of $0.52 and non-GAAP EPS of $0.82

- All-flash array annualized net revenue run rate almost $1.40 billion, up 160% Y/Y

- Nearly 300PB of flash shipped

- Clustered Data ONTAP managing 50% of installed base capacity

- $336 million returned to shareholders in share repurchases and a cash dividend

Third Quarter Financial Results

- Net revenues for the third quarter of fiscal year 2017 were $1.40 billion. GAAP net income for the third quarter of fiscal year 2017 was $146 million, or $0.52 per share, compared to GAAP net income of $153 million, or $0.52 per share, for the comparable period of the prior year. Non-GAAP net income for the third quarter of fiscal year 2017 was $231 million, or $0.82 per share,2 compared to non-GAAP net income of $206 million, or $0.70 per share, for the comparable period of the prior year.

- NetApp ended the third quarter of fiscal year 2017 with $4.6 billion in total cash, cash equivalents and investments. During the third quarter of fiscal year 2017, the company generated $235 million in cash from operations and returned $336 million to shareholders through share repurchases and a cash dividend.

- The company announced the next cash dividend of $0.19 per share. The quarterly dividend will be paid on April 26, 2017 to shareholders of record as of the close of business on April 7, 2017.

“Q3 marked another quarter of strong execution by NetApp,” said George Kurian, CEO. “The transformation of NetApp is yielding solid results and has changed the trajectory of our business. With our industry-leading portfolio of solutions and Data Fabric strategy, NetApp is well positioned to lead in the next era of IT.”

Q4 Fiscal Year 2017 Outlook

The company provided the following financial guidance for the fourth quarter of fiscal year 2017:

• Net revenues are expected to be in the range of $1.365 billion to $1.515 billion.

• GAAP earnings per share is expected to be in the range of $0.60 to $0.65 per share.

• Non-GAAP earnings per share is expected to be in the range of $0.79 to $0.84 per share.

Business Highlights

NetApp Expands Cloud Data Management and All-Flash Offerings:

- NetApp Improves Control, Simplifies Movement of Data in the Hybrid Cloud. New Data Fabric solutions and services speed data access and visibility, enhance data protection and security, and help customers extract value from their data from anywhere in the hybrid cloud.

- NetApp Expands All-Flash Portfolio with New Entry-Level Array. The All Flash FAS (AFF) A200 expands the market opportunity for the world’s fastest and most efficient cloud-connected enterprise storage portfolio. The entry-level system delivers enterprise-grade flash performance at an attractive price point and is for midsize businesses that are making the move to all flash.

Customers Team with NetApp to Accelerate Performance and Responsiveness

- Carrenza Limited Supports Rapidly Evolving Customer Application and Infrastructure Demands with NetApp SolidFire. Global cloud service company Carrenza leverages SolidFire all-flash storage to enable customers to scale and accelerate business performance, increase infrastructure agility and responsiveness, and reduce storage maintenance time and administration effort.

- Cologne Broadcasting Center GmbH (CBC) Upgrades TV Production and Delivery Services with NetApp. A new production storage and DR infrastructure has improved CBC broadcast service offerings throughout Germany with solutions delivered by NetApp and partner Pixit Media.

- Wirestorm Delivers DevOps in the Cloud with ONTAP Cloud for Amazon Web Services (AWS). To accelerate and automate its DevOps process, it deployed ONTAP Cloud. This Data Fabric solution delivers everything that the company needs for DevOps in the cloud-without a single physical array-enabling Wirestorm to use only laptops. The framework that it created with NetApp has enabled Wirestorm to automate so efficiently that it can implement an end-to-end solution all the way to AWS in less than a minute.

Comments

For the first time since 13 consecutive quarters in a row, revenue is finally growing Y/Y, by only 1% (and 5%Q/Q) at $1.4 billion, in the range of what was expected three months ago, thanks to all-flash systems just compensating the decrease of legacy storage products. Net income is at only $146 million.

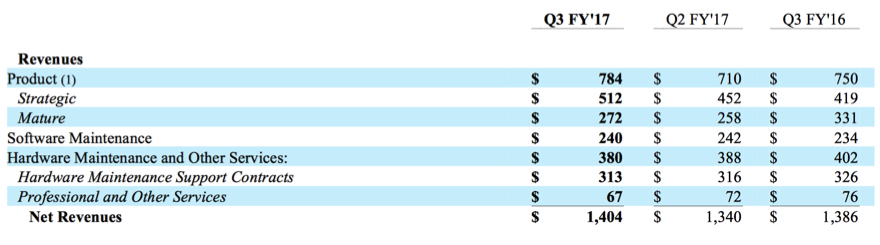

Revenue by business in $ million (1) Sales of certain products which should have been reported as strategic products were improperly reported as mature product revenues. All periods presented have been recast to reflect the appropriate classification.

(1) Sales of certain products which should have been reported as strategic products were improperly reported as mature product revenues. All periods presented have been recast to reflect the appropriate classification.

Global product revenue of $784 million was up 10% sequentially and 5% yearly.

The firm separates its activity into two businesses since the former quarter: strategic and mature solutions. In 3FQ17, strategic solutions constituted 65% of product revenue, up 22% yearly, and mature solutions declined 18% Y/Y.

NetApp's SSD subsystems are continuing to boom. The beginning of February marked the one-year anniversary of the excellent acquisition of SolidFire for $870 million in cash. Although NAND supply is tight, in the more recent quarter, all-flash array business grew 160% Y/Y to an annualized net revenue run rate of almost $1.4 billion, inclusive of all-flash FAS, EF, and SolidFire product and services.

Two examples of success:

- - A large North American-based retailer selected FAS to replace its legacy EMC SAN infrastructure solving its current application integration, replication and management challenges with a compelling path to hybrid cloud.

- - At a cloud-based talent management solution provider, NetApp displaced over 1PB of legacy EMC and HP storage for production and disaster recovery environments.

During the most recent three-month period, Clustered ONTAP was deployed on over 90% of FAS systems shipped. Unit shipments of Clustered ONTAP systems grew 24% Y/Y, and the install base of FAS systems continues to grow. Clustered ONTAP is now running on approximately 40% of systems in that large and growing install base and now manages over 50% of the FAS system capacity in company's install base.

| Period | Revenue | Y/Y Growth | Net income (loss) |

| 1FQ14 | 1,516 | 5% | 82 |

| 2FQ14 | 1,550 | 1% | 167 |

| 3FQ14 | 1,610 | -1% | 192 |

| 4FQ14 | 1,649 | -4% | 197 |

| FY14 | 6,325 | -0% | 638 |

| 1FQ15 | 1,489 | -2% | 88 |

| 2FQ15 | 1,542 | -0% | 160 |

| 3FQ15 | 1,551 | -4% | 177 |

| 4FQ15 | 1,540 | -2% | 135 |

| FY15 | 6,123 | -3% | 560 |

| 1FQ16 | 1,335 | -10% | (30) |

| 2FQ16 | 1,445 | -9% | 114 |

| 3FQ16 | 1,386 | -11% | 153 |

| 4FQ16 | 1,380 | -10% | (8) |

| FY16 | 5,546 | -9% | 229 |

| 1FQ17 | 1,294 | -3% | 64 |

| 2FQ17 | 1,340 | -7% | 109 |

| 3FQ17 | 1,404 | 1% | 146 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter