NetApp: Fiscal 1Q16 Financial Results

Difficult to do worse but good guidance for next quarter

This is a Press Release edited by StorageNewsletter.com on August 20, 2015 at 2:44 pm| (in $ million) | 1Q15 | 1Q16 | Growth |

| Revenue |

1,489 | 1,335 | -10% |

| Net income (loss) | 88 | (30) |

Highlights

- NetApp clustered Data ONTAP node shipments increased 114% year-over-year; 13th consecutive quarter of triple-digit growth.

- All flash FAS units grew 137% year-over-year; 5th consecutive quarter of triple-digit growth.

- $484 million returned to shareholders in share repurchases and cash dividends.

NetApp, Inc.ww.netapp.com reported financial results for the first quarter of fiscal year 2016, ended July 31, 2015.

First Quarter Financial Results

Net revenues for the first quarter of fiscal year 2016 were $1.34 billion. GAAP net loss for the first quarter of fiscal year 2016 was $30 million, or $0.10 per share, compared to GAAP net income of $88 million, or $0.27 per share, for the comparable period of the prior year. Non-GAAP net income for the first quarter of fiscal year 2016 was $89 million, or $0.29 per share, 3 compared to non-GAAP net income of $198 million, or $0.60 per share, for the comparable period of the prior year.

Cash, Cash Equivalents and Investments

NetApp ended the first quarter of fiscal year 2016 with $5.0 billion in total cash, cash equivalents and investments and generated $129 million in cash from operations. During the first quarter of fiscal year 2016, the company returned $484 million to shareholders through share repurchases and a cash dividend.

The next dividend in the amount of $0.18 per share will be paid on October 21, 2015, to shareholders of record as of the close of business on October 9, 2015.

“The IT industry as a whole is going through fundamental change as enterprises transform themselves with digital capabilities. Data is at the heart of these transformations and where NetApp has a profoundly important role to play with our differentiated vision for data management,” said George Kurian, CEO. “Our first fiscal quarter marks the beginning of a new chapter for NetApp. In the next phase of our journey, we are pivoting to better address the changing industry, to improving our own execution and to enhancing value for our shareholders.”

Q2 Fiscal Year 2016 Outlook

- Net revenues are expected to be in the range of $1.40 billion to $1.50 billion.

- GAAP earnings per share is expected to be in the range of $0.35 to $0.40 per share.

- Non-GAAP earnings per share is expected to be in the range of $0.55 to $0.60 per share.

Business Highlights:

NetApp Expands All Flash FAS Solutions

to Support Seamless Data Movement from Flash to Disk to Cloud:

- Delivers Complete All Flash Offering for the Enterprise. With the All Flash FAS8000 series, customers benefit from built-in data protection, multiprotocol support, scale-out performance, and seamless data movement from flash to disk to cloud. Other features include QoS, multi-tenancy and NetApp’s application integration for simplified configuration and management of SQL and Oracle databases, virtualized servers and VDI workloads.

- Flash Essentials Innovations. The All Flash FAS products incorporate software optimizations derived from the NetApp technology development lab. These innovations include a flash-optimized read data path, inline compression, and zero-based inline deduplication. Flash Essentials innovations are included in clustered Data ONTAP.

- NetApp OnCommand Performance Manager 2.0. The new software release gives users a dashboard to evaluate All Flash FAS performance automatically and troubleshoot issues to maintain optimal system operation.

NetApp Expands Solutions and Services in Support of Hybrid cloud Strategy:

- The New AltaVault Solutions and Services Help Customers Unlock Cloud Economics. NetApp AltaVault, cloud-integrated storage solutions and services, provides customers with the ability to backup data quickly to any cloud at up to 90% less cost than on-premises solutions. AltaVault supports NetApp’s vision for hybrid cloud data management, which gives customers the confidence that, no matter where their data lives, they can control, integrate, move, secure and consistently manage it.

Comments

After three flat fiscal years in revenue, new chairman and CEO George Kurian recognizes that "(...) we're clear that we have a lot more work to do."

More bad news ...

NetApp registered lowest quarterly sales ($1.3 billion) with a record in percentage of revenue decreasing Y/Y (-10%) and Q/Q (-13%) since a long time, as well as a net loss for the first time since years.

Customers are reducing their spend on traditional storage, which has put pressure on ONTAP 7-mode business. The 7-mode storage OS was shipped in only 35% of FAS units in the quarter, down from roughly 75% a year ago.

NetApp's customers are also slowing investment in the capacity expansion of their traditional storage environments. Both of these dynamics lowered new unit shipments off and lower incremental capacity in ONTAP 7-mode systems put downward pressure on product revenue, despite growth in other parts of the business.

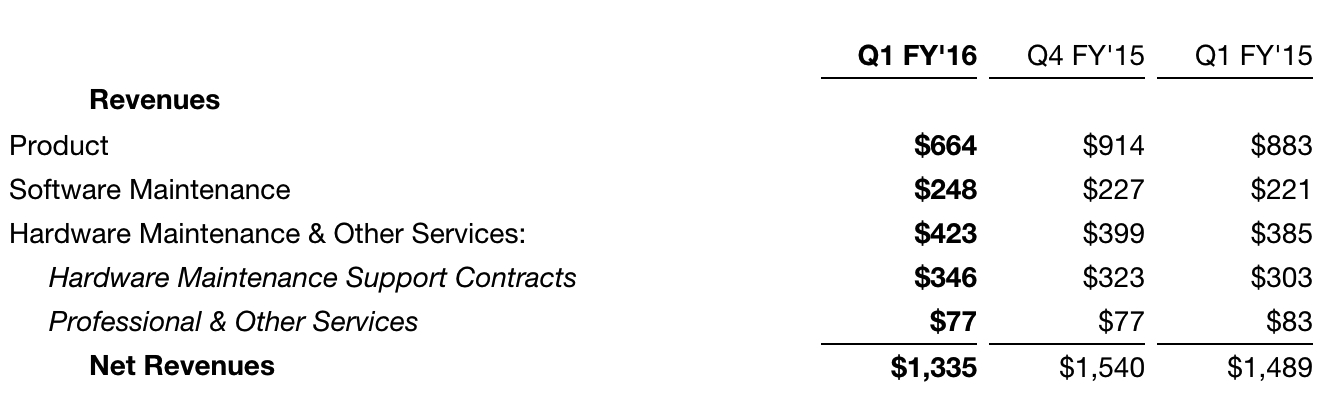

Product revenue was $664 million in the first quarter, down 27% sequentially and 25% year-over-year. FX headwinds had an unfavorable impact on the yearly product revenue comparison by about five points.

Headcount reduction is approximately 3% and the company records GAAP restructuring charge of $27 million in the quarter.

FY16 revenue is expected to be down 5% with impact from FX headwinds and limited top line predictability in the first half of the year easing in the second half.

.. than good news

Combination of software maintenance and hardware maintenance and other services revenues primarily comprised of existing, new and renewed service contracts was $671 million in the first quarter up 7% sequentially and up 11% year-over-year.

Clustered ONTAP was deployed on 65% of the FAS systems shipped in 1Q16 up from 25% a year ago. Unit shipments of Clustered ONTAP systems grew by 115%, the 13th consecutive quarter of triple digit growth.

The number of customers migrating to Clustered ONTAP grew by more than 130% in 1Q16 from 1Q15. The fastest growth was in new to NetApp customers, which grew 225%.

Unit shipments of all flash FAS solution grew 140% Y/Y, the fifth consecutive quarter of triple-digit growth.

E series platforms continue to grow with unit shipments up 50% from 1Q15.

The storage firm expects net revenues for Q2 to range between $1.4 billion and $1.5 billion, which at the midpoint implies 6% decrease year-over-year (and sequential increase of approximately 9%).

Revenue by Business in $ Million

Revenue and Net Income (Loss) From 1FQ14 to 1FQ16

(in $ million)

| )Period | Revenue | Y/Y Growth | Net income (loss) |

| 1FQ14 | 1,516 | 5% | 82 |

| 2FQ14 | 1,550 | 1% | 167 |

| 3FQ14 | 1,610 | -1% | 192 |

| 4FQ14 | 1,649 | -4% | 197 |

| FY14 | 6,325 | -0% | 638 |

| 1FQ15 | 1,489 | -2% | 88 |

| 2FQ15 | 1,542 | -0% | 160 |

| 3FQ15 | 1,551 | -4% | 177 |

| 4FQ15 | 1,540 | -2% | 135 |

| FY15 | 6,123 | -3% | 560 |

| 1FQ16 | 1,335 | -10% | (30) |

To read the earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter