Micron: Fiscal 1Q16 Financial Results

Hurt by lower prices of NAND and DRAM

This is a Press Release edited by StorageNewsletter.com on December 24, 2015 at 3:09 pm| (in $ million) | 1Q15 | 1Q16 | Growth |

| Revenue |

4,573 | 3,350 | -27% |

| Net income (loss) | 1,003 | 206 |

Micron Technology, Inc. announced results of operations for its first quarter of fiscal 2016, which ended December 3, 2015.

Revenues for the first quarter of fiscal 2016 were $3.35 billion and were 7% lower compared to the fourth quarter of fiscal 2015 and 27% lower compared to the first quarter of fiscal 2015.

Cash flows from operations were $1.12 billion for the first quarter of fiscal 2016.

GAAP Income and Per Share Data – On a GAAP basis, net income attributable to Micron shareholders for the first quarter of fiscal 2016 was $206 million, or $0.19 per diluted share, compared to net income of $471 million, or $0.42 per diluted share, for the fourth quarter of fiscal 2015.

Non-GAAP Income and Per Share Data – On a non-GAAP basis, net income attributable to Micron shareholders for the first quarter of fiscal 2016 was $249 million, or $0.24 per diluted share, compared to net income of $399 million, or $0.37 per diluted share, for the fourth quarter of fiscal 2015. For a reconciliation of GAAP to non-GAAP results, see the accompanying financial tables and footnotes.

Revenues for the first quarter of fiscal 2016 were lower compared to the fourth quarter of fiscal 2015 primarily due to a 13% decline in DRAM ASPs. Non-Volatile trade revenues for the first quarter of fiscal 2016 declined 2% compared to the fourth quarter primarily as a result of a 7% decline in ASPs partially offset by an increase in sales volume. The company’s overall consolidated gross margin of 25% for the first quarter of fiscal 2016 was 2% lower compared to the fourth quarter of fiscal 2015 primarily due to lower ASPs partially offset by manufacturing cost reductions for DRAM and non-volatile products.

“While conditions in some market segments are challenging, we believe long-term industry fundamentals are healthy, and we remain focused on the deployment of our advanced DRAM and 3D NAND technologies and products,” said CEO Mark Durcan.

Investments in capital expenditures for the first quarter of fiscal 2016 were $990 million.

The company ended the first quarter of fiscal 2016 with cash and marketable investments of $5.41 billion.

Comments

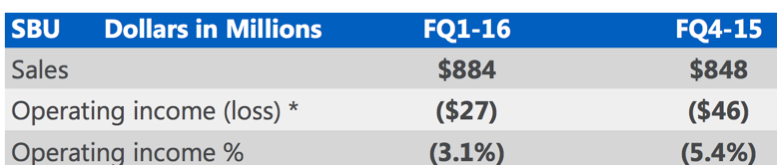

Storage Business Unit (SBU) Non-GAAP

* FQ1-16 operating income (loss) reflects GAAP operating loss of ($33) adjusted for restructure charges of $6.

- Maintained relatively stable average selling prices for the 4th consecutive quarter

- Continue to invest in development of next-generation flash storage

- 3D NAND-based solutions will be available to the market in the second half of fiscal 2016

- Continue to optimize mix of products to mitigate transactional market exposure while servinghigher value segments

Areas of Focus in FY16

- Ramping 20nm DRAM and enabling 1X DRAM in manufacturing

- Ramping 3D NAND and enabling Gen Two 3D NAND in manufacturing

- Accelerating the development of advanced controllers to enable growth in SSDs and other system solutions

Abstracts of the earnings call transcript:

Mark Durcan, CEO:

"(...) we've seen price competition in client SSDs and eMCPs during our first fiscal quarter. While we expect some of these trends to continue into fiscal Q2, we've also seen some positive signs in other segments and will continue to monitor market conditions carefully.

"Beyond 2016, we believe that the longer term NAND demand trend should lead to additional industry capacity, including our own Fab 10X expansion in Singapore. Construction for this facility is on-track and we currently expect to ramp into it starting in the second half of calendar 2016.

"For trade NAND, we expect our bit growth to be below the market in calendar 2016, as we proceed with 3D conversions which will limit output in the first half of the year. Our Fab 10X expansion and 3D conversions position us to significantly outgrow the NAND market in fiscal 2017."

Mark Adams, president:

"In our non-volatile memory business, trade revenue represents 34% of total revenue in fiscal Q1. Performance was consistent with our expectations making early progress on our 3D RAM and customer qualifications. As a percentage of trade, non-volatile memory revenue in fiscal Q1, consumer which includes our memory cards, USB and components was approximately 50% up from mid-40s in Q4. Mobile including MCPs was in the high-teens percent range from low-20s last quarter. SSDs were in the mid-teens percent range similar to last quarter and automotive and industrial multimarket segment and other embedded applications were in the mid-teens percent range similar to Q4.

"We are actively sampling and developing our own SSD product portfolio based upon through an 384Gb 3D TLC and 256Gb 3D MLC NAND, and expect to make products available for broad marketplace adoption in the second half of fiscal year 2016.

"In the components segment, we delivered our first 3D NAND dye to the market in Q1, shipping 256Gb MLC 3D NAND components to nearly 20 third-party USB and consumer SSD manufacturers. Shipments to additional customers are continuing this quarter.

"Client and consumer SSDs bit growth increased by double-digits sequentially as decreasing SSD prices continues to accelerate adoption in OEM ultrabook and ultrathin PCs, as well as consumer upgrades. Lower density consumer SSD will continue to narrow the cost gigabyte parity gap with hard drives, increasing their attractiveness.

"Our enterprise business saw quarter-over-quarter demand growth with strong OEM component sales growing 47% sequentially. Enterprise SSD revenue was up 13% sequentially driven by market pull for enterprise server, cloud storage and flash array solutions.

"We began sampling our new S600 Series of SaaS-based SSDs in fiscal Q1, having qualified these drives with OEM customers and engaging in qualifications with numerous end-users and channel integrators. This SSD series is the first product family developed as part of Micron's strategic agreement with Seagate combining flash innovation and SaaS expertise from both companies. These drives are scheduled to begin shipping commercially in the first half of the fiscal year."

Ernie Maddock, CFO:

"Moving now to our second fiscal quarter guidance on a non-GAAP basis we expect (...) consolidated revenue in the range of $2.9 billion to $3.2 billion."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter