Imation: Fiscal 1Q15 Financial Results

Only storage and security solutions continue to deliver growth, as usual

This is a Press Release edited by StorageNewsletter.com on May 8, 2015 at 2:53 pm| (in $ million) | 1Q14 | 1Q15 | Growth |

| Revenue |

178.9 | 155.4 | -13% |

| Net income (loss) | (17.5) | (14.4) |

Imation Corp. released financial results for the first quarter ended March 31, 2015.

Q1 Overview

For the first quarter of 2015, Imation reported net revenue of $155.4 million, down 13.1% from Q1 2014, an operating loss from continuing operations of $13.0 million, including special charges of $1.2 million, diluted loss per share from continuing operations of $0.35 and a cash balance of $96.2 million. The decline in revenue is attributed to a decline of $23.5 million in the legacy Consumer Storage Media business and foreign currency exchange rates, which negatively impacted Q1 2015 revenues by 6.5%, or $11.7 million, compared to Q1 2014.

CEO Mark Lucas commented: “We are highly encouraged that our efforts to transform Imation into a global leader in storage and security are working as demonstrated by the greater than 20% revenue growth in our combined Nexsan and IronKey portfolios. The strategic investments we have made in our priority growth businesses have strengthened the pillars of our Tiered Storage and Security Solutions (TSS) segment, which serves as the foundation for profitable growth over the long term. Bolstering our sales and engineering teams has allowed us to introduce and market new, higher margin products that have been well received by a variety of customers, including Fortune 100 companies and large government agencies in the United States and abroad. As a result of these initiatives, during the first quarter, we saw continued positive sales momentum in our TSS portfolio with year-over-year growth. We anticipate our Consumer Storage & Accessories (CSA) segment will continue to produce strong cash flows to fund the continued growth of our TSS segment.”

Lucas continued: “While we execute on our strategic plan, we also continue to work with our financial adviser, Houlihan Lokey, in exploring all potential strategic alternatives to maximize shareholder value. We are very pleased with the progress to date and the alternatives that have surfaced through this fulsome process, and we look forward to sharing the results and our recommendations when the evaluation is complete in the coming weeks.”

Business Segment Overview

Lucas said: “Further penetrating higher growth markets where we can bring our enterprise commercial storage solutions to customers remains a top priority. Our IronKey mobile security products continue to benefit from the growing demand for BYOD solutions, with hundreds of new customer deployments of our Windows To Go solutions, and the introduction of the IronKey S1000, a secure USB 3.0 flash drive, during the quarter. Our PC on a Stick product line incorporates our patented technology, is Microsoft certified and supported, and allows enterprises to offer Windows technology on a secure flash drive. We have had successful results with large enterprises for use with Windows 8 and 8.1. We believe Microsoft’s expected release of Windows 10 later this year will be a catalyst for driving our PC on a Stick revenues.“

During the quarter, Imation continued to gain traction in its storage solutions business with the global rollout of its Assureon product family and the launch of the NST 4000. Furthermore, it saw increased demand for its storage solutions in a number of key industry verticals, including media and entertainment, healthcare and video surveillance. The company also strengthened its data security solutions portfolio by introducing Secure Data Movement Architecture, or SDMA. This product provides organizations a holistic approach to actively manage their high-value data files and protect them from tampering, destruction, loss or leakage through their entire lifecycle. SDMA empowers end users to manage their own policy for protecting their high-value data in addition to enabling organizational control and management policies.

Lucas continued: “The improved strength in our storage and security businesses drove an overall increase in our TSS segment sales and margins, underscoring that our strategic plan is yielding results. In our CSA segment, we continue to manage the secular decline in our legacy media business to generate meaningful cash flow. Additionally, we continue to introduce new consumer storage products, including the LINKPower Drive, our first mobile storage product that provides additional storage and power for iOS compatible devices. The new additions to our product portfolio have been well received since debuting earlier this year at the Consumer Electronics Show. For all these reasons, and as a result of the other steps we have taken to transform the company, we believe Imation is positioned to deliver substantial growth and shareholder value.”

Detailed Q1 2015 Analysis

The following financial results are for continuing operations for the current and prior periods unless otherwise indicated:

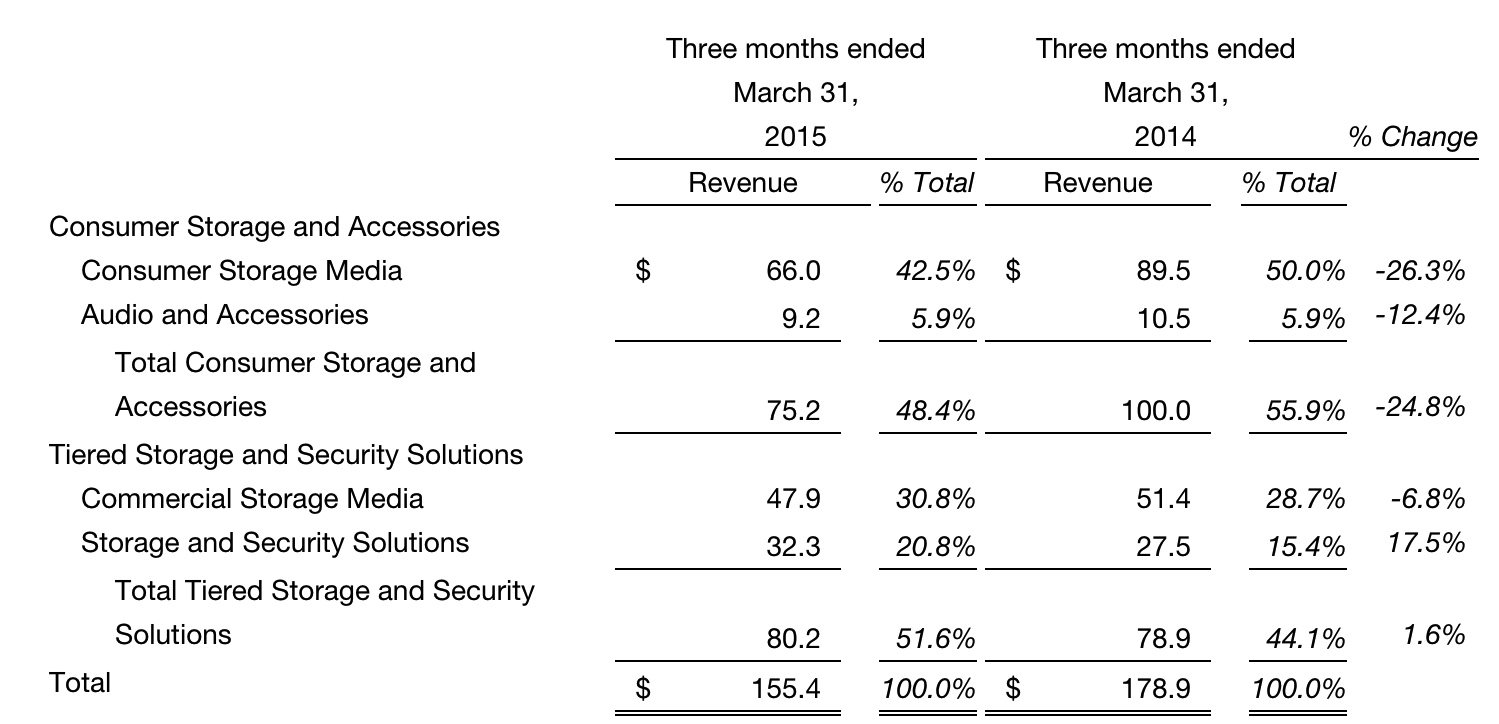

- Net revenue for Q1 2015 was $155.4 million, down 13.1% from Q1 2014. From a segment perspective, TSS grew 1.6% and CSA declined 24.8%. Within the TSS segment, Storage and Security Solutions grew year-over-year by 17.5%, partly offset by Commercial Storage Media declines of 6.8%. The growth in TSS was due to Nexsan hybrid storage and IronKey mobile security solutions portfolios. Commercial Storage Media only had single digit%age revenue declines compared to double digit declines in Q1 2014. CSA revenue decreased due to the ongoing declines in optical media products, which were in line with industry trends, along with negative foreign currency impacts. Foreign currency exchange rates negatively impacted total Q1 2015 revenues by 6.5% compared to Q1 2014.

- Gross margin for Q1 2015 was 21.9%, 3.1%age points better than Q1 2014. CSA gross margin was 23.7%, up from 19.3% in Q1 2014 primarily driven by the reversal of a $2.8 million accrual for copyright levies as a result of a favorable court ruling in Germany. TSS gross margin for Q1 2015 was 20.2%, up from 18.3% in Q1 2014 driven by higher margins in our Storage and Security Solutions business which reflects our focus on increasing gross margins as part of our strategic transformation.

- Selling, general and administrative expenses in Q1 2015 were $41.0 million, down $2.4 million compared with Q1 2014 expenses of $43.4 million due to lower spending and currency impacts. During 2013 and 2014 we have reduced legacy operating costs by $103.0 million.

- R&D expenses in Q1 2015 were $4.8 million, up from $4.3 million in Q1 2014, which reflects the company’s increased investment in higher margin projects in Storage and Security Solutions. The company continued to invest in new product development in its priority businesses and has aggressively reduced R&D expense associated with legacy media products.

- Special charges were $1.2 million in Q1 2015 compared to special charges of $2.1 million in Q1 2014. Special charges in Q1 2015 were primarily related to severance charges.

- Operating loss from continuing operations was $13.0 million in Q1 2015 compared with an operating loss of $16.1 million in Q1 2014. Excluding the impact of special charges described above, adjusted operating loss would have been $11.8 million in Q1 2015 compared with adjusted operating loss on the same basis of $14.0 million in Q1 2014.

Income tax expense was $0.1 million in Q1 2015 compared with no income tax expense in Q1 2014. The company maintains a valuation allowance related to its U.S. deferred tax assets and, therefore, no tax expense or benefit was recorded related to its U.S. results in either period. - Discontinued operations had no effect in Q1 2015 compared with a loss of $0.7 million (after-tax) in Q1 2014. Discontinued operations include both the results of the XtremeMac and Memorex consumer electronics businesses which were sold.

- Loss per diluted share from continuing operations was $0.35 in Q1 2015 compared with a loss per diluted share of $0.41 in Q1 2014. Excluding the impact of special items, adjusted loss per diluted share would have been $0.32 in Q1 2015 compared with a loss per diluted share of $0.36 in Q1 2014.

- Cash and cash equivalents balance was $96.2 million as of March 31, 2015, down $18.4 million during the quarter, in line with expectations. The anticipated decline in cash balance reflects the ongoing investment in Storage and Security Solutions growth initiatives and seasonal working capital changes and payments, as well as currency impacts. Imation repurchased approximately 157,000 shares of common stock for $0.7 million during the quarter.

Comments

It's the same scenario since several quarters. Nexsan and security businesses are growing but do not compensate huge decline in all other activities. Consequently, global revenue continues to decrease and loss never stopped.

Wait for big restructuration at Imation in the next future. An idea is to separate the company into two entities, storage subsystems and security on one side and renamed Nexsan, the rest of the company (storage media including LTO and RDX, audio accessories, flash products and external drives) under the name of Imation on another one and probably sold at cheap price to a company already specialized in computer media.

Abstracts of the earnings call transcript:

Mark Lucas, president and CEO:

"In the last 12 months, we have increased our Nexsan reseller base by approximately 20%, adding 250 new reseller partners worldwide. We have also added approximately 800 new end-user customers for our Nexsan portfolio, and 200 new customers for IronKey Windows To Go solutions. These customers include five U.S. and international government agencies, 13 Fortune 100 companies, several large media and entertainment organizations, hospitals and hundreds of mid-size organizations."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter