Emulex: Fiscal 4Q14 Financial Results

Storage connectivity and other products decrease 32% Q/Q and 42% Y/Y

This is a Press Release edited by StorageNewsletter.com on August 8, 2014 at 2:52 pm| (in $ million) | 4Q13 | 4Q14 | FY13 | FY14 |

| Revenue | 120.4 | 99.8 | 478.6 | 447.3 |

| Growth | -17% | -7% | ||

| Net income (loss) | (4.6) | (14.7) | (5.2) | (29.5) |

Emulex Corporation announced preliminary earnings results for the fourth quarter and fiscal year ending June 29, 2014.

Fourth Quarter Financial Highlights

- Total revenue of $99.8 million was at the high end of the prior guidance range, aided by sequential growth in FC host products.

- Non-GAAP diluted earnings of $0.07 and a GAAP loss of $0.19 per share as compared to guidance of $0.00 – $0.05 and a loss of $0.16 – $0.21, respectively.

- Non-GAAP gross margins of 66%, unchanged sequentially and up 100 basis points year-over-year, with GAAP gross margins of 58%, unchanged over both periods.

- Cash, cash equivalents and investments at the end of the quarter of $158.4 million.

- Diluted share count of 77.8 million shares in the fourth quarter, down from 93.5 million at the end of the first quarter of fiscal 2014.

“I’m very pleased with the operational execution by the Emulex team during the fourth quarter. We achieved the high end of our revenue guidance, and with the completion of the closure of the Bolton engineering facility, we have accomplished the reduction in our operating expenses that we announced back in November. This, combined with strong gross margins helped us exceed the high end of our earnings per share guidance,” commented Jeff Benck, president and CEO, Emulex. “We experienced good recovery in our FC business in the quarter with sequential revenue growth. Based on reported results to date, we expect to demonstrate more than two points of FC market share gain in the quarter.”

“As we look forward, we believe that we should benefit from two major server upgrade cycles this year, IBM Power 8 and the Intel Grantley refresh. With this new Intel design cycle nearing completion, Emulex has broadened its design win footprint in Ethernet from a concentration among two OEMs to now include offerings from all of the top eight server OEMs as well as the leading open compute ODMs,” Benck concluded.

Business Outlook

Emulex is forecasting total net revenues in the range of $93-$99 million. The company expects first quarter non-GAAP earnings of $0.07-$0.11 and a GAAP loss of $0.07-$0.11 per share. GAAP estimates for the first quarter reflect approximately $0.18 per diluted share in expected charges arising primarily from amortization of intangibles, stock-based compensation, royalties, mitigation expenses and license fees associated with the Broadcom patent litigation, the accretion of debt discount on outstanding convertible senior notes, and the tax effects and the impact of our U.S. GAAP tax valuation allowance associated with these items.

Fourth Quarter Business Highlights

- Deepened Lenovo relationship with new 10GbE and 16Gb FC solutions for Lenovo ThinkServer rack and tower servers and was awarded the Lenovo Outstanding Quality supplier award for the second time in three years.

- Announced next generation 10GbE converged adapters as EMC E-Lab qualified for use with solutions including EMC VNX and the new VMAX3 storage arrays.

- Unveiled next generation 10GbE and 40GbE solutions featuring packet processing, enabling the telecommunications market to lower costs and scale flexibility by accelerating the deployment of Network Functions Virtualization (NFV) for the mobile, cloud-enabled world.

- Commenced a strategic partnership with Compuware to deliver integrated application-aware network performance management (AA-NPM) and network monitoring solutions using Compuware’s Data Center Real-User Monitoring (DC RUM) and EndaceProbe Intelligent Network Recorders (INRs).

Comments

Abstracts of the earnings call transcript:

Jeff Benck, president and CEO:

"We're early in this transition to 16Gb, but I think this will be a key technology in 2015, which we're heading into with greater than 50% market share.

"Beyond 16Gb, we are fully committed to extending our best-in-class FC offerings to 32Gb.

"We have FC target design wins within the SSD platforms at 3 of the top 4 storage OEMs on the planet and just recently won a major 40GbE target opportunity at the fourth.

"We're also seeing tremendous opportunity in China both for FC and Ethernet. In fiscal 2014, our revenue stemming from China-based OEMs sold directly into the China market grew almost 100%, exiting the year at a run rate of over 6% of NCP (Network Connectivity Products) sales."

Kyle Wescoat, CFO:

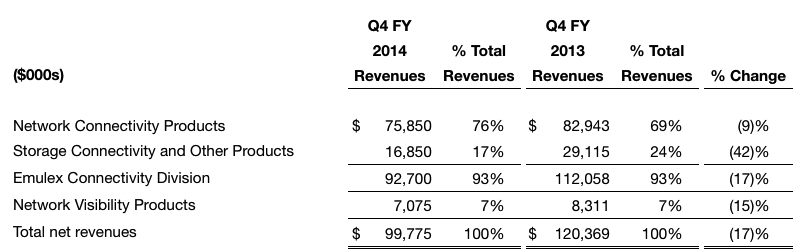

"Our fourth quarter results were in line with this expectation, with NCP revenues coming in at $76 million for the quarter, down 3% sequentially or 76% of total revenue.

"Our second product line, Network Visibility Products or NVP is our family of intelligent network recording products. NVP revenue was $7 million in the quarter or 7% of sales, which was in line with our previous guidance for the quarter.

"Our third product line, Storage Connectivity and Other Products or SCOP consists of our bridges and back-end connectivity products, baseboard management controllers and other miscellaneous products. Overall, SCOP revenues came in at $17 million or 17% of revenue. This represents a sequential decrease of 32% and a decline of 42% year-over-year. As we explained last quarter, a significant portion of our SCOP revenue is entering the end-of-life phase as customers move to next-generation platforms. As such, for modeling purposes, you should expect annual declines within SCOP of 30% or greater for fiscal 2015.

"Now that we've completed the closure of our Bolton Engineering facility at the end of June, we're delivering on our commitment to reduce the annual operating expenses for the ECD business by at least $30 million from 2013 levels going into fiscal 2015.

"( ...) our own transition from EMS providers in Thailand to a new partner in China as part of a strategy to optimize our supply chain affected near-term inventory levels. We expect the impact from both of these to correct during the first quarter."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter