Brocade: Fiscal 3Q15 Financial Results

SAN product revenue down 5% Y/Y at $309 million

This is a Press Release edited by StorageNewsletter.com on August 21, 2015 at 2:45 pm| (in $ million) | 3Q14 | 3Q15 | 9 mo. 14 | 9 mo. 15 |

| Revenues | 545.5 | 551.8 | 1,647 | 1,675 |

| Growth | 1% | 2% | ||

| Net income (loss) | 87.4 | 91.7 | 154.6 | 256.0 |

Brocade Communication Systems, Inc. reported financial results for its third fiscal quarter ended August 1, 2015.

Brocade reported third quarter revenue of $552 million, up 1% year over year and up 1% sequentially.

The company reported GAAP diluted earnings per share (EPS) of $0.21, up from $0.20 in Q3 2014 and up from $0.18 in Q2 2015. Non-GAAP diluted EPS was $0.27 for Q3 2015, up from $0.23 in Q3 2014 and up from $0.22 in Q2 2015. Tax benefits recognized in Q3 2015 increased both GAAP and non-GAAP diluted EPS by approximately $0.02 in the quarter.

“I am pleased with our Q3 2015 financial results as we delivered improved profitability and higher revenue year over year,” said Lloyd Carney, CEO. “Our IP Networking revenue growth of 16% continues to outpace the market with strong performance from both service provider and U.S. federal customers. As the storage market evolves, our SAN business continues to demonstrate the vital role of FC as customers connect both traditional disk storage and next-generation flash arrays. Brocade is well positioned with our customers, partners, and products heading into the final quarter of our fiscal year.”

Highlights:

- SAN product revenue was $309 million, down 5% year over year. The decline was primarily the result of softer demand for embedded and fixed-configuration FC switches, partially offset by growth in director revenue. The sequential revenue decline of 1% was consistent with normal fiscal Q3 seasonality.

- IP Networking product revenue was $154 million, up 16% year over year. The growth was across each product category with router sales up 35%, switch sales up 6%, and higher software networking revenue. The increased revenue year over year was primarily from service providers, up 43%, and U.S. federal, up 32%, partially offset by a decline in enterprise revenue of 3%. Sequentially, IP Networking revenue increased 6% due to higher switch revenue, which was up 26%, as well as higher software networking revenue, partially offset by lower routing revenue, which was down 23% primarily due to the timing of large service provider orders. Q3 2015 included a full quarter of revenue from the virtual application delivery software acquired in Q2 2015.

On June 17, 2015, Brocade hosted the fourth annual Federal Forum in Washington, D.C. The multi-vendor sponsored event has become the showcase for New IP technologies that can help transform government networks to lower cost, improve service agility, and increase security. The event has continued to grow in size and influence, with approximately 1,000 attendees this year across a variety of federal agencies, and has become an important component in building brand preference to support Brocade’s revenue growth strategy.

The Brocade board of directors has declared a quarterly cash dividend of $0.045 per share of the company’s common stock. The dividend payment will be made on October 2, 2015 to stockholders of record at the close of market on September 10, 2015.

Comments

Financial Highlights

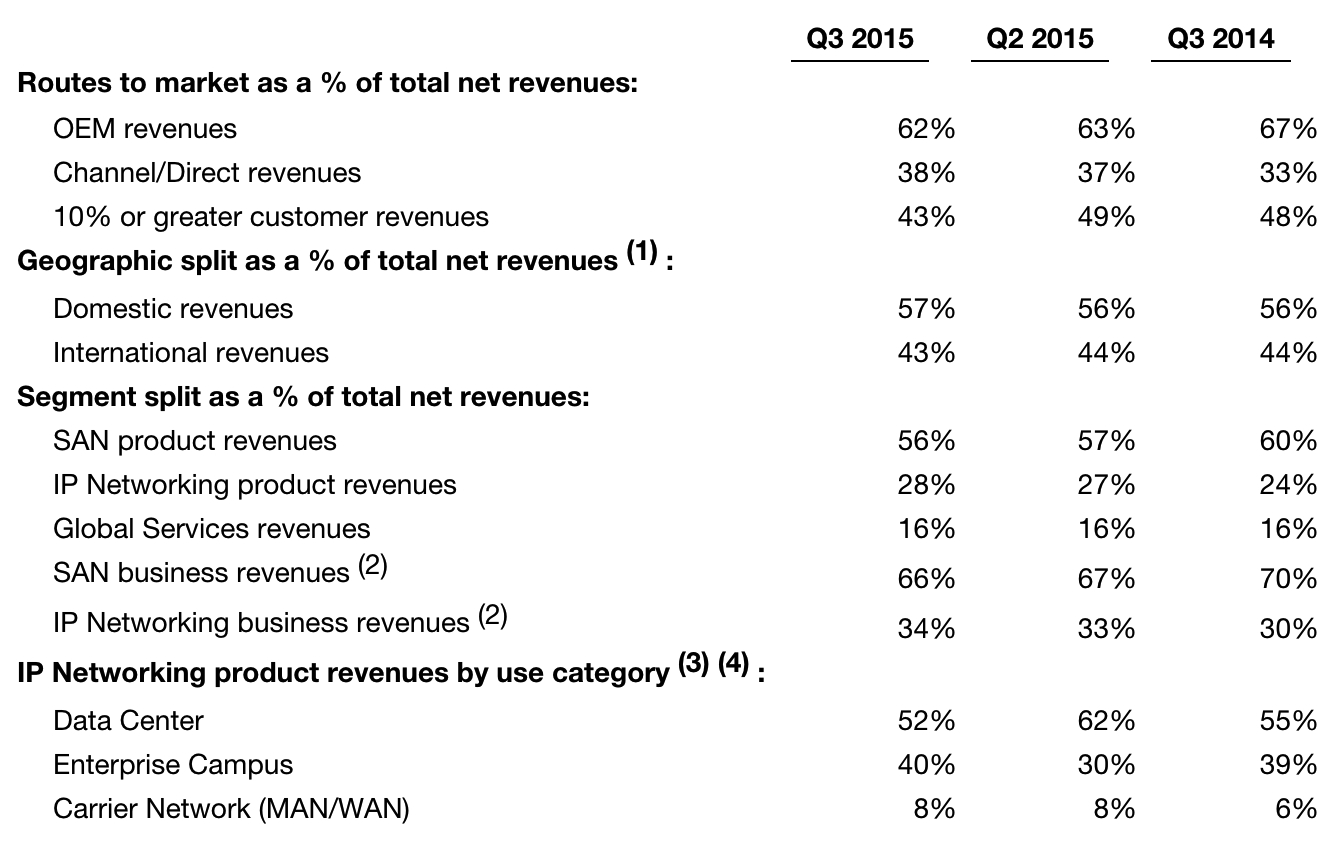

(1) Revenues are attributed to geographic areas based on product delivery location. Since some OEM partners take delivery of Brocade products domestically and then ship internationally to their end users, the percentage of international revenues based on end-user location would likely be higher.

(2) SAN and IP Networking business revenues include

hardware and software product, support, and services revenues.

(3) Product revenue by use category is estimated based on analysis of the information the company collects in its sales management system. The estimated percentage of revenue by use category may fluctuate

quarter-to-quarter due to seasonality and the timing of large customer orders.

(4) Each use category includes enterprise, service provider, and government revenues.

Abstracts of the earnings call transcript:

Dan Fairfax, CFO:

"Looking forward to Q4 2015, we considered a number of factors including the following in setting our outlook. For Q4 2015, we expect SAN product revenues to be up 1% to up 5% quarter-over-quarter as we enter a seasonally stronger SAN quarter. Although some of the market and partner challenges we encountered in Q2 and Q3 may linger for another quarter or two, storage conditions in general appear to be stable."

Jack Rondoni VP, storage networking:

"We're expecting the products will be out in the market first-half calendar 2016 for the Gen 6 or 32Gb products with revenue ramping in the second-half of calendar year 2016."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter