Broadcom: Fiscal 2Q17 Financial Results

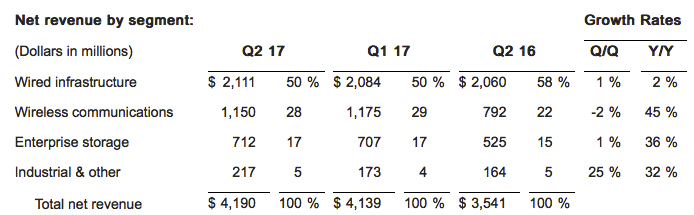

Enterprise storage at $712 million, up 1% Q/Q and 36%Y/Y

This is a Press Release edited by StorageNewsletter.com on June 5, 2017 at 2:21 pm| (in $ million) | 2Q16 | 2Q17 | 6 mo. 16 | 6 mo. 17 |

| Revenue | 3,541 | 4,190 | 5,312 | 8,329 |

| Growth | 18% | 57% | ||

| Net income (loss) | (1,255) | 464 | (878) | 716 |

Broadcom Limited reported financial results for its second quarter of fiscal year 2017, ended April 30, 2017, provided guidance for the third quarter of its fiscal year 2017 and announced a quarterly interim dividend.

2FQ17 GAAP Results

- Net revenue was $4,190 million, slightly higher than the $4,139 million in the previous quarter and an increase of 18% from $3,541 million in the same quarter last year.

- Gross margin was $1,976 million, or 47.2% of net revenue. This compares with gross margin of $2,001 million, or 48.3% of net revenue, in the prior quarter, and gross margin of $1,046 million, or 29.5% of net revenue, in the same quarter last year.

- Operating expenses were $1,502 million. This compares with $1,495 million in the prior quarter and $2,047 million in the same quarter last year.

- Operating income was $474 million, or 11.3% of net revenue. This compares with operating income of $506 million, or 12.2% of net revenue, in the prior quarter, and operating loss of $1,001 million, or 28.3% of net revenue, in the same quarter last year.

- Net income, which includes the impact of discontinued operations, was $464 million, or $1.05 per diluted share. This compares with net income of $252 million, or $0.57 per diluted share, in the prior quarter, and net loss of $1,255 million, or $3.02 per diluted share, in the same quarter last year.

- Net income attributable to ordinary shares was $440 million. Net income attributable to the noncontrolling interest (restricted exchangeable limited partnership units, or ‘REUs’) in the company’s subsidiary, Broadcom Cayman L.P., was $24 million.

- The company’s cash balance at the end of the second fiscal quarter was $4,254 million, compared to $3,536 million at the end of the prior quarter.

- During the second fiscal quarter, the company generated $1,583 million in cash from operations and spent $256 million on capital expenditures.

- On March 31, 2017, the company paid a cash dividend of $1.02 per ordinary share, totaling $414 million. On the same date, the Partnership, of which the company is the General Partner, paid holders of REUs a corresponding distribution of $1.02 per REU, totaling $23 million.

2FQ17 Non-GAAP Results From Continuing Operations

- Net revenue from continuing operations was $4,201 million, slightly higher than the $4,149 million in the previous quarter, and an increase of 18% from $3,562 million in the same quarter last year.

- Gross margin from continuing operations was $2,652 million, or 63.1% of net revenue. This compares with gross margin from continuing operations of $2,590 million, or 62.4% of net revenue, in the prior quarter, and $2,138 million, or 60.0% of net revenue, in the same quarter last year.

- Operating income from continuing operations was $1,853 million, or 44.1% of net revenue. This compares with operating income from continuing operations of $1,806 million, or 43.5% of net revenue, in the prior quarter, and $1,329 million, or 37.3% of net revenue, in the same quarter last year.

- Net income from continuing operations was $1,666 million, or $3.69 per diluted share. This compares with net income of $1,627 million, or $3.63 per diluted share, in the prior quarter, and net income of $1,120 million, or $2.53 per diluted share, in the same quarter last year.

“We delivered strong financial results for our second fiscal quarter with revenue, gross margin and EPS all above the top end of guidance,” said Hock Tan, president and CEO. “Anticipating that end markets will remain healthy, we expect third fiscal quarter revenue growth of approximately 6% sequentially, driven by solid growth from our wired segment and a seasonal second half ramp in our wireless segment.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter