Marvell: Fiscal 1Q18 Financial Results

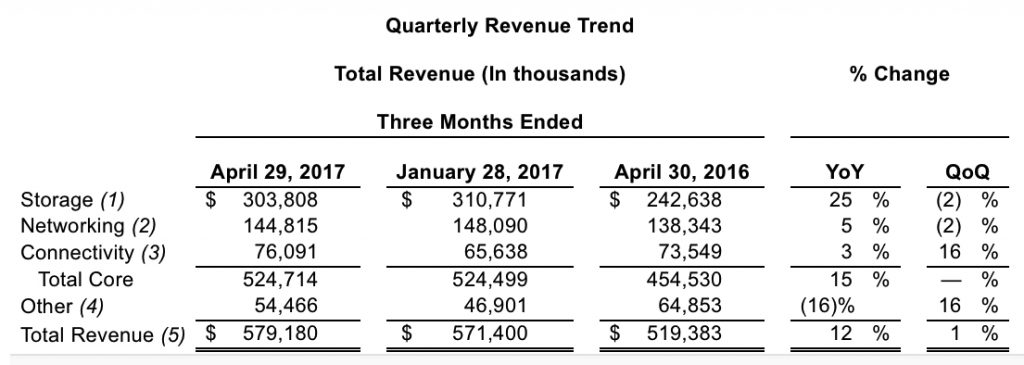

Storage represents 52% of revenue, up from 47% last year.

This is a Press Release edited by StorageNewsletter.com on May 29, 2017 at 2:53 pm| (in $ million) | 1Q17 | 1Q18 | Growth |

| Revenue |

519.4 | 579.2 | 12% |

| Net income (loss) | (22.7) | 106.6 |

Marvell Technology Group Ltd. reported financial results for the first fiscal quarter of fiscal year 2018 ended April 19, 2017.

Revenue for the first quarter of fiscal 2018 was $579 million, which exceeded the midpoint of the company’s guidance provided on March 2, 2017.

GAAP net income from continuing operations for the first quarter of fiscal 2018 was $97 million, or $0.19 per share. Non-GAAP net income from continuing operations for the first quarter of fiscal 2018 was $124 million, or $0.24 per diluted share. Cash flow from operations for the quarter was $135 million.

Subsequent to the close of 1FQ18, the company sold its LTE thin-modem business to ASR Microelectronics for a purchase price of $45 million. ASR is a provider of cellular platform SoCs and software for the cellular end market. This product line was classified as part of the company’s other product category. In the second quarter of fiscal 2018, this product line will be reclassified and added to discontinued operations. The company’s revenue guidance provided for the fiscal second quarter of 2018 excludes revenue associated with this sale, which has been approximately $5 million per quarter.

“Marvell executed well in the first quarter of fiscal year 2018 as a renewed focus on its core businesses of storage, networking and connectivity were able to generate revenue growth of 12% year-over-year, driven by the long-term secular growth trends in the amount of data being created, stored and transmitted both wired and wirelessly,” said Marvell’s president and CEO, Matt Murphy. “We are pleased to see that this growth was accompanied by a significant expansion in gross and operating margin, demonstrating the strength in our business model and the value Marvell’s solutions are bringing to our customers.”

Second Quarter of Fiscal 2018 Financial Outlook

• Revenue is expected to be $585 to $615 million. This range excludes approximately $5 million in revenue associated with sale of LTE thin-modem business.

• GAAP and non-GAAP gross margins are expected to be approximately 61%.

• GAAP operating expenses are expected to be $237 million to $247 million.

• Non-GAAP operating expenses are expected to be $215 million to $220 million.

• GAAP diluted EPS from continuing operations is expected to be in the range of $0.21 to $0.27.

• Non-GAAP diluted EPS from continuing operations is expected to be in the range of $0.26 to $0.30.

Discontinued Operations

The company’s financial results for prior periods presented herein have been recast to reflect certain businesses that were classified as discontinued operations during the fourth quarter of fiscal year 2017.

Comments

(1) Storage products are comprised primarily of HDD, SSD controllers and enterprise storage solutions.

(2) Networking products are comprised primarily of Ethernet switches, Ethernet transceivers, embedded ARM processors and automotive Ethernet, as well as a few legacy product lines in which the company no longer invest, but will generate a long tail of revenue for several years.

(3) Wireless connectivity products are comprised primarily of WiFi solutions including WiFi only, WiFi/Bluetooth combos and WiFi microcontroller combos.

(4) Other products are comprised primarily of printer solutions, application processors, communication processors, and others.

Abstracts of the earnings call transcript:

Matt Murphy, president and CEO:

"In Q1, our storage business performed much better than typical seasonality and grew 25% year-over-year. Our SSD revenue grew by double digits sequentially and by triple digit year-over-year.

"We are well positioned that this market continues to grow, and expect it to represent 25% of our total storage revenue in the second half of fiscal year 2018.

"In HDD, we experienced very strong growth in the enterprise and data center markets even as our client business declined sequentially."

Jean Hu, CFO:

"As a reminder, we did have a weak 1Q17 in storage revenue.

"At the midpoint of our guidance, we expect our storage revenue to be flat sequentially and to grow double digit year-over-year."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter