5% Quartely Decline of HDD and SSD Market in Q17 – Trendfocus

But rise 19% Y/Y.

This is a Press Release edited by StorageNewsletter.com on May 18, 2017 at 2:59 pmAfter posting solid quarter-over-quarter growth through 2016, the number of exabytes shipped in HDDs and SSDs fell by 5% in the first quarter of the year, per analysis released by market research firm Trendfocus, Inc.

Several factors contributed to the decline, including weak PC sales, cyclicality in data center spending, and tight NAND supply affecting SSD buying patterns.

Combined revenue for HDDs and SSDs exceeded $11.5 billion.

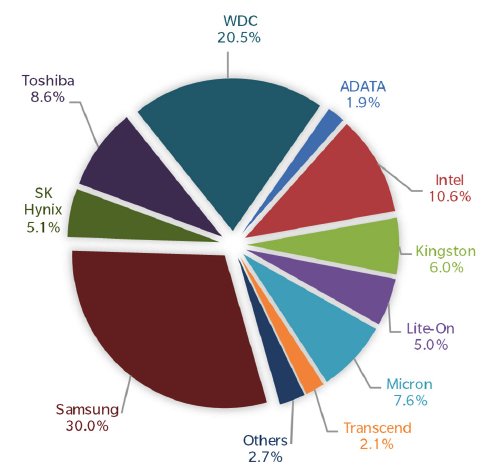

1CQ17 Total SSD Market: 39.783 Million Units

“Beyond the typical CQ1 seasonal declines, device shipments that have driven first quarter HDD exabyte reductions, the exabytes of NAND shipped in SSDs also declined sequentially for the first time in two years,” stated Mark Geenen, president, Trendfocus. “With tight NAND supply forcing SSD pricing increases, the penetration of SSDs into PCs and enterprise applications has slowed somewhat, exposing the SSD market to the kind of seasonality long seen in the HDD market.”

According to data released in Trendfocus’ HDD and NAND/SSD Information Services CQ1 ’17 Quarterly Updates, a variety of factors contributed to the shortfall:

• Seasonally weak PC shipments: While year-over-year PC shipment declines are moderating from high single-digit%age drops to a projected 2017 reduction of around 3%, the CQ1 ’17 PC units are down more than 13% from the prior quarter. Despite this typical seasonal drop, on a year-over-year basis, PC shipments held essentially flat, a trend not seen since 2013.

• Tight NAND/SSD supply that impacted corporate buying behaviors: NAND manufacturers are transitioning to new technology that is temporarily limiting bit output. This has led to higher prices for SSDs used in PCs, enterprise storage, and data centers. These higher prices and the threat of insufficient supply forced significant changes in buying behavior, including SSD ‘buy-aheads’ in the second half of 2016 that resulted in higher-than-normal inventories entering 2017.

• Elevated SSD pricing has also slowed the penetration of solid-state storage into lower priced PCs and servers.

• Delays in storage spending in data centers: Some large hyperscale/data center companies purchased fewer HDDs and SSDs in the quarter, temporarily slowing exabyte growth in the segment responsible for driving the highest long-term rate of capacity demand.

“With delays in data center rollouts of high-capacity nearline HDDs and continued tightness in NAND supply expected through most of 2017, the total HDD and SSD exabyte growth will moderate in 2017,” added Geenen. “We expect exabyte growth to be below historical norms this year.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter