Some Lessons From Recent IPOs

Bit of realism in world of dream and utopia

By Philippe Nicolas | April 13, 2017 at 3:02 pmThe IPO season has restarted during 1Q17 and some ISVs have made introductions recently like MuleSoft, Alteryx or Okta.

Special comment for AppDynamics who was acquired by Cisco for $3.7 billion just before their introduction, Cisco having anticipating a potential even higher value after the introduction.

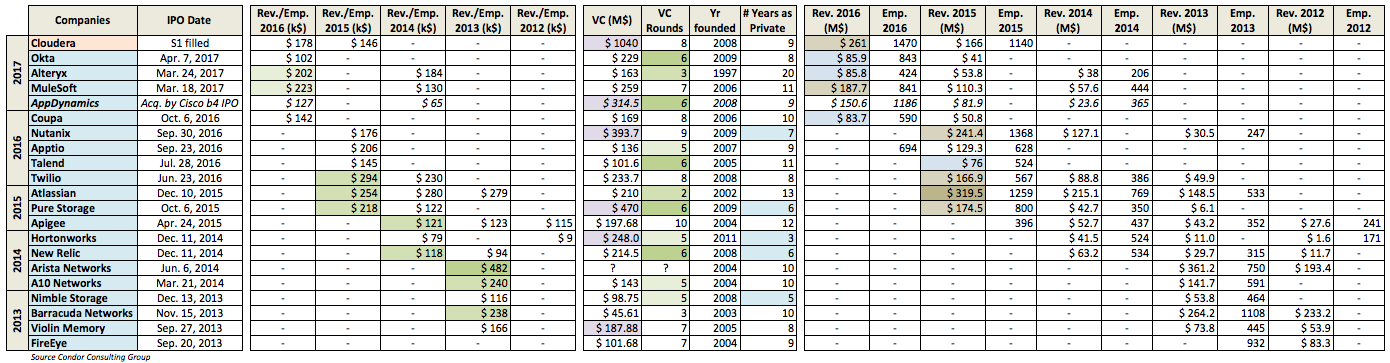

We have collected and selected around 20 companies – AppDynamics included – since 2013 to illustrate some information regarding their IPOs or plans to. Of course the table below doesn’t illustrate all possible ratios but is enough interesting to learn a few things:

- Number of years before IPO: There is no rule as hot companies take 10 years and others less like Nimble Storage (5 years), New Relic (6 years), Hortonworks (3 years), Pure Storage (6 years) or Nutanix (7 years). If we remove the two extreme values, the average number of years in this group is 9 years minimum.

- Number of rounds: Except Atlassian or Barracuda Networks and Alteryx, a bit exceptional as the company exists for years, all companies listed received at least 5, 6, 7 or even more rounds. Without the to extreme values, the average number of rounds is 6.

- Total money raised: The amount received by some companies is just high and illustrate the role in the IT industry leading a particular segment. Violin memory was a pioneer, replaced by Pure Storage, leading the flash storage business, Hortonworks was synonymous of Hadoop, Nutanix the reference in hyperconverged infrastructure, AppDynamics top in application performance management or of course Cloudera as the enterprise Hadoop player. Same approach, if we don’t consider the two extreme values, the average total money raised is $215 million. Two exceptions with Barracuda Networks and Nimble who received less then $100 million and did their IPO in 2013.

- Revenue at intro: this is an important criteria and in 2014 it was lower. Hortonworks was introduced with a pretty low level of revenue, around $40 million. In 2015 it climbed at $76 million and finally $83 million in 2016 for Coupa Software or even higher at $85 million for Okta and Alteryx with IPOs a few weeks ago.

- Revenue per employee at intro: It’s pretty variable and depends of the business model, product and segment but clearly above $120,000 except for Okta. But we can estimate that the company has recruited recently lots of people to start 2017 by the introduction momentum.

So if some companies have pushed and promoted some IPO desires, look at the table below which just represents a snapshot of some recent activities with indicators above.

Click to enlarge

Read also:

Storage Start-Ups in 2016

Worst year since 2003

by Jean-Jacques Maleval | 2017.01.10 | News

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter