India External Storage Market Growing 17.5% Q/Q in 4Q16

At $78 million, and Dell EMC continued to lead with 27% market share followed by HPE

This is a Press Release edited by StorageNewsletter.com on April 6, 2017 at 2:44 pmAccording to International Data Corporation‘s (IDC) AsiaPac Quarterly Enterprise Storage Tracker, India external storage market witnessed a growth of 17.5% Q/Q (in vendor revenue) and stood at $77.8 million in 4Q16.

Banking, professional services, manufacturing and government continued to be the key contributors in Q4 2016. Large banking refresh deals drove the storage market and expecting increased spending from banking on analytics and UPI platforms in the coming quarters. In addition to the major verticals, significant growth is witnessed in verticals such as securities, transportation, education and insurance which drove incremental storage revenues in 4Q16.

Mid-range external storage segment continued to lead the market with more than 50% market share in 4Q16. Increased market acceptance of new technologies such as hyperconverged infrastructure might cannibalize traditional mid-range storage business in the near future. High-end storage segment witnessed a significant Q/Q growth as compared to other segments in 4Q16 due to large refresh deals from banking and telecom verticals.

Witnessed significant Y/Y growth of all-flash arrays (AFA) due to uptake from banking, IT/ITeS and manufacturing verticals in 4Q16. Organizations are willing to pay a little extra to avail best in class performance, so opting flash storage technologies like never before.

With the increased acceptance of SMAC (social, mobile, analytics and cloud) technologies across organizations, storage demands from end customers are changing to accommodate these new age workloads. Increasing demand for cloud storage-as-a-service is clearly visible in the market. This trend would drive additional storage demand from third party datacenter players and cloud providers however these players started considering component manufactures or white-box players.

Dileep Nadimpalli, associate research manager, enterprise infrastructure, says: “Organizations are demanding for faster time to market but IT departments are loaded with growing infrastructure management complexities. Organizations started preferring hyperconverged solutions to address the management complexities and to have a competitive edge.”

Sharyathi Nagesh, senior research manager, enterprise infrastructure says: “Storage market will continue seeing significant pricing pressure in $/TB. Overall storage industry will continue to grow in capacity shipped. Both new and entrenched players are looking at price rationalization to drive growth and scale“.

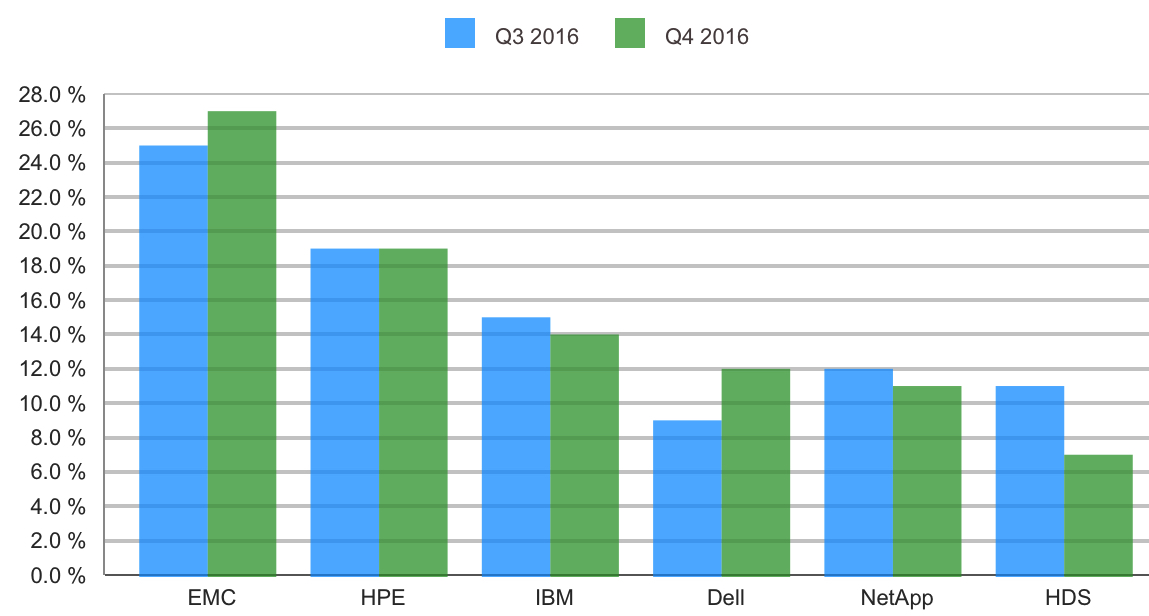

EMC continued to lead the market with market share of 27% followed by HPE in 4Q16. Dell witnessed a significant growth due to uptake from IT/ITeS and government segments in 4Q16. IBM, Netapp and HDS lost market share in 4Q16 as compared to last quarter.

India External Storage Market – Vendor Share (%)

Read also:

India External Storage Market Revenue Decreased 6% Y/Y at $64 Million in 2Q16 – IDC

Expected to pick up in 2H16

2016.10.26 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter