Micron: Fiscal 2Q17 Financial Results

Revenue up 21% for storage business unit driven by SSD shipments

This is a Press Release edited by StorageNewsletter.com on March 27, 2017 at 3:01 pm| (in $ million) | 2Q16 | 2Q17 | 6 mo. 16 | 6 mo. 17 |

| Revenue | 2,934 | 4,648 | 6,284 | 8,618 |

| Growth | 58% | 37% | ||

| Net income (loss) | (97) | 894 | 109 | 1,074 |

Micron Technology, Inc. announced results of operations for its 2FQ17, which ended March 2, 2017.

Revenues for 2FQ17 were $4.65 billion and were 17% higher compared to 1FQ17 and 58% higher compared to the 2FQ16.

“Strong demand and limited industry supply for NAND and DRAM solutions, combined with significant progress on our cost reduction plan, produced excellent results for our second quarter,” said Micron CEO Mark Durcan. “I’m proud of the team’s execution on critical technology and operational initiatives, which will allow us to continue to capitalize on market trends.”

GAAP Income and Per Share Data – On a GAAP basis, gross margin was 36.7% and net income attributable to shareholders was $894 million, or $0.77 per diluted share, for 2FQ17 compared to gross margin of 25.5% and net income of $180 million, or $0.16 per diluted share, for 1FQ17 and gross margin of 19.7% and a net loss of $97 million, or ($0.09) per diluted share, for the second quarter of fiscal 2016.

Non-GAAP Income and Per Share Data – On a non-GAAP basis, gross margin was 38.5% and net income attributable to shareholders was $1.03 billion, or $0.90 per diluted share, 2FQ17 compared to gross margin of 26.0% and net income of $335 million, or $0.32 per diluted share, for 1FQ17 and gross margin of 20.4% and net income of $12 million, or $0.01 per diluted share, for 2FQ16.

The increase in the company’s revenues of 17% for 2FQ17 compared to 1FQ17 was due primarily to a 21% increase in DRAM ASPs and an 18% increase in trade NAND sales volumes.

The company’s overall consolidated GAAP gross margin of 36.7% for 2FQ17 was 11.2 percentage points higher compared to 1FQ17 primarily due to increases in DRAM ASPs and manufacturing cost reductions for both NAND and DRAM.

Investments in capital expenditures, net of amounts funded by partners, were $1.17 billion for 2FQ17.

The company ended 2FQ17 with cash, marketable investments, and restricted cash of $4.58 billion.

Comments

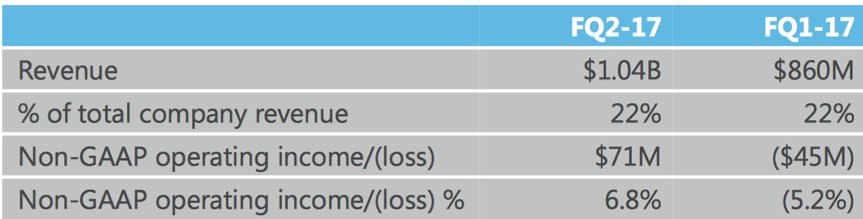

Revenue of SBU was up 21% Q/Q, driven by client and cloud SSD shipments. Operating income improvement Q/Q was enhanced by lower costs. 5100 drive was well-received and in process of additional qualifications. The company see increased traction for SSD portfolio across OEM, cloud and enterprise markets and record SSD shipments during the quarter, driven by OEM. Enterprise and cloud were fastest-growing segments of SSD portfolio.

Nonvolatile trade revenue, NAND revenue, increased 11% compared to the prior quarter, reflecting an 18% increase in bit shipments.

Nonvolatile trade represented 30% of total revenue:

- ♦ Consumer, which includes memory cards, USB and components, represented approximately 40%

- ♦ Mobile was 20% (eMCPs are primarily in the mobile segment)

- ♦ SSDs were in the mid-20s percentage range, up from mid-teens in 1FQ17

- ♦ Automotive and industrial multi-market segment and other embedded applications were in the high-teens percentage range

ASPs were down 6% from the prior quarter on a blended basis, primarily as a result of a higher density product mix.

CEO Mark Durcan said during conference call: "In NAND, we were able to capitalize on an increasing percentage of low-cost 3D TLC NAND by more fully participating in the SSD market. As a result, while blended ASPs were down slightly due to a higher density product mix, our NAND margins improved substantially over last quarter (...) Increased NAND shipments to industrial multi-market customers helped offset this quarter's anticipated decline in NOR shipments to Japanese gaming applications."

He added: "Our storage business performance this quarter was driven by continued shift to cost-effective 3D NAND TLC products and increased traction for our SSD portfolio across the OEM cloud and enterprise markets. Wins with OEM customers enabled a record number of SSD shipments during the quarter (...) We anticipate to grow our overall storage bit output as our Fab 10X expansion continues to ramp (...) As we look toward the end of our fiscal year, we're currently on track to have more than 75% of our NAND bits on 3D."

For CFO Ernie Maddock: "In our nonvolatile memory business, trade NAND represented 30% of our revenue with the following segmentation, consumer which includes memory cards, USB and components, represented approximately 40%; mobile represented 20%; and as a reminder, EMCPs are primarily in the mobile segment. SSDs were in the mid-20% range, up from the mid-teens% last quarter. And the automotive, industrial multi-market and other embedded applications were in the high teens percent range."

Technology transitions

Micron see 32-layer 3D NAND proliferating throughout product lines and is driving the deployment of 64-layer 3D NAND with meaningful output expected by end of FY17. It expects CMOS circuitry under the array to enable industry's smallest die size. Initial revenue will happen in 2017 for 3D XPoint technology.

Micron projects for next quarter higher revenue, between $5.20 and $5.60 billion or up between 12% and 20%.

To read the earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter