Broadcom: Fiscal 1Q17 Financial Results

Enterprise storage revenue up 26% Q/Q at $707 million

This is a Press Release edited by StorageNewsletter.com on March 3, 2017 at 2:51 pm| (in $ million) | 1Q16 | 1Q17 | Growth |

| Revenue |

1,771 | 4,139 | 134% |

| Net income (loss) | 377 | 252 |

Broadcom Limited reported financial results for its first quarter of fiscal year 2017, ended January 29, 2017, provided guidance for the second quarter of its fiscal year 2017 and announced a quarterly interim dividend.

Broadcom Limited is the successor to Avago Technologies Limited. Following Avago’s acquisition on February 1, 2016, it became the ultimate parent company of Avago and BRCM.

Financial results for the fiscal periods prior to the acquisition relate solely to the company’s predecessor, Avago. The financial results from businesses that have been classified as discontinued operations in the company’s financial statements are not included in the results presented below, unless otherwise stated.

First Quarter Fiscal Year 2017 GAAP Results

- Net revenue was $4,139 million, slightly higher than the $4,136 million in the previous quarter and an increase of 134% from $1,771 million in the same quarter last year.

- Gross margin was $2,001 million, or 48.3% of net revenue. This compares with gross margin of $2,171 million, or 52.5% of net revenue, in the prior quarter, and gross margin of $941 million, or 53.1% of net revenue, in the same quarter last year.

- Operating expenses were $1,495 million. This compares with $1,790 million in the prior quarter and $466 million in the same quarter last year.

- Operating income was $506 million, or 12.2% of net revenue. This compares with operating income of $381 million, or 9.2% of net revenue, in the prior quarter, and operating income of $475 million, or 26.8% of net revenue, in the same quarter last year.

- Net income, which includes the impact of discontinued operations, was $252 million, or $0.57 per diluted share. This compares with net loss of $668 million, or $1.59 per diluted share, in the prior quarter, and net income of $377 million, or $1.30 per diluted share, in the same quarter last year.

Net income attributable to ordinary shares was $239 million. Net income attributable to the noncontrolling interest (restricted exchangeable limited partnership units – REUS) in the company’s subsidiary, Broadcom Cayman L.P. was $13 million.

The company’s cash balance at the end of the first fiscal quarter was $3,536 million, compared to $3,097 million at the end of the prior quarter.

During the first quarter, the company generated $1,353 million in cash from operations and spent $325 million on capital expenditures.

On December 30, 2016, the company paid a cash dividend of $1.02 per ordinary share, totaling $408 million. On the same date, the partnership, of which the company is the general partner, paid holders of REUs a corresponding distribution of $1.02 per REU, totaling $23 million.

1FQ17 Non-GAAP Results From Continuing Operations

- Net revenue from continuing operations was $4,149 million, slightly higher than the $4,146 million in the previous quarter, and an increase of 133% from $1,782 million in the same quarter last year.

- Gross margin from continuing operations was $2,590 million, or 62.4% of net revenue. This compares with gross margin of $2,522 million, or 60.8% of net revenue, in the prior quarter, and gross margin of $1,089 million, or 61.1% of net revenue, in the same quarter last year.

- Operating income from continuing operations was $1,806 million, or 43.5% of net revenue. This compares with operating income from continuing operations of $1,719 million, or 41.5% of net revenue, in the prior quarter, and $783 million, or 43.9% of net revenue, in the same quarter last year.

- Net income from continuing operations was $1,627 million, or $3.63 per diluted share. This compares with net income of $1,549 million, or $3.47 per diluted share last quarter, and net income of $710 million, or $2.41 per diluted share, in the same quarter last year.

“We had a very good start to our fiscal year 2017 delivering first quarter revenue and gross margin at the top end of guidance,” said Hock Tan, president and CEO. “We expect healthy demand for our products to continue and we are guiding second fiscal quarter revenue to grow organically by 15% on a year over year basis.“

Comments

Enterprise storage revenue

| (in $ million) | 1FQ16 | 4FQ16 | 1FQ17 |

| Revenue | 678 | 561 | 707 |

| Growth | -13% | 26% |

Abstracts of the earnings call transcript:

Hock Tan, president and CEO:

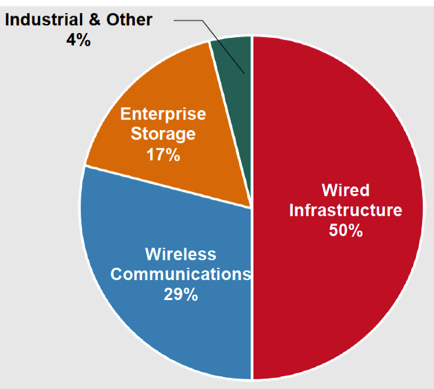

"Let me now turn to enterprise storage, which continues to be strong. In the first quarter, enterprise storage revenue came in at $707 million and this segment represented 17% of our total revenue.

"Segment revenue grew 26% sequentially, gaining better than expected driven by stronger shipments of SAS, RAID, and FC products. As we foresaw, our HDD and custom SSDs controllers also had a very strong quarter.

"And looking into the second quarter, however, we believe this resurgence of enterprise storage has to taper off and hence flatten out. Having said that, backlog for enterprise storage products continues up to today to be very strong.

But we foresaw what we foresee seasonality to start slowing demand in the third quarter if not in this - late in the second quarter."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter