Intevac: Fiscal 4Q16 Financial Results

Thin-film equipment revenue consisted of two 200 Lean HDD systems.

This is a Press Release edited by StorageNewsletter.com on February 2, 2017 at 2:40 pm| (in $ million) | 4Q15 | 4Q16 | FY15 | FY16 |

| Revenue | 16.4 | 29.0 | 75.2 | 80.1 |

| Growth | 77% | 7% | ||

| Net income (loss) | (2.5) | 2.8 | (9.2) | (7.4) |

Intevac, Inc. reported financial results for the fiscal fourth quarter and year ended December 31, 2016.

2016 Highlights

Significant improvements in performance compared to 2015:

- Revenues increased 7%, driven by our Thin-film Equipment growth initiatives and improved results in our core HDD business

- Gross margin improved 300bp; operating P&L improved by 13%

- Total orders up 25%, driven by a 76% increase in Thin-film Equipment orders

- Total backlog up 34%, with Thin-film Equipment backlog up 139%

- Orders for four new Intevac VERTEXsystems – from two customers

- Orders for eight 200 Lean systems

- Demonstrations of latest digital night-vision technology – expanding our Photonics revenue opportunity pipeline by 40%

- Positive cash flow from operations of $3.8 million

- Achieved objective to increase total balance of cash and investments year-over-year

“2016 marked an inflection point in the future revenue growth trajectory of Intevac,” commented Wendell Blonigan, president and CEO. “Most notably, we secured a multi-system production capacity order for our VERTEX system, and an additional VERTEX customer during the year. Our multiple 200 Lean orders demonstrated the ongoing need for technology investments in our core HDD business, which improved compared to 2015. We increased our revenue opportunity pipeline for Photonics through successful demonstrations with our ground force monocular and high-resolution digital goggles, and while we experienced a pause in contract R&D revenues during the year, we grew our Photonics product revenues over 2015. We also delivered continued improvement in our financial performance in 2016. We improved our gross margins, held SG&A flat, increased our strategic R&D investments by 16%, and improved our operating performance compared to 2015. We won significant new orders in our Thin-film Equipment business, and grew backlog to levels not seen since 2010; in each of our served equipment markets. Given the momentum we have built in our strategic growth initiatives, we are on the path to profitability for 2017.”

Fourth Quarter Fiscal 2016 Summary

- Net income for the quarter was $2.8 million, or $0.13 per diluted share. This compares to a net loss of $2.5 million, or $0.12 per diluted share, in the fourth quarter of 2015. Non-GAAP net income was $2.8 million, or $0.13 per diluted share, compared to a non-GAAP net loss $2.4 million, or $0.12 per diluted share, for the fourth quarter of 2015.

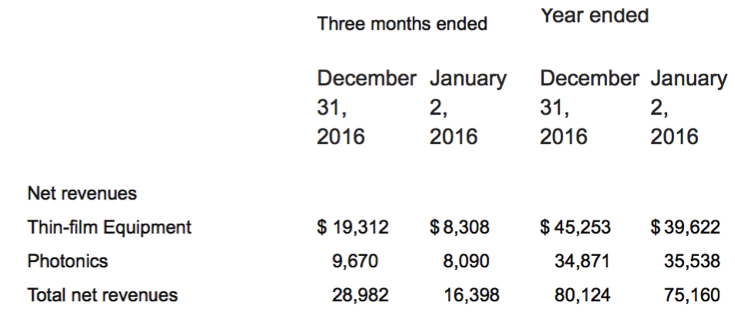

- Revenues were $29.0 million, including $19.3 million of Thin-film Equipment revenues and Photonics revenues of $9.7 million. Thin-film Equipment revenues consisted of two 200 Lean HDD systems, one MATRIX PVD solar system, upgrades, spares and service. Photonics revenues included $2.0 million of R&D contracts. In the fourth quarter of 2015, revenues were $16.4 million, including $8.3 million of Thin-film Equipment revenues and Photonics revenues of $8.1 million, which included $1.4 million of R&D contracts.

- Thin-film Equipment gross margin was 38.9% compared to 41.8 % in the fourth quarter of 2015 and 32.4% in the third quarter of 2016. The improvement from the third quarter of 2016 reflected higher revenues and improved factory absorption in the fourth quarter, and the lower-margin solar ion implant R&D tool included in revenues for the third quarter. The decline from the fourth quarter of 2015 reflected a higher mix of systems shipments versus higher-margin upgrades, offset in part by improved factory absorption.

- Photonics gross margin was 45.5% compared to 39.6% in the fourth quarter of 2015 and 46.9% in the third quarter of 2016. The decline from the third quarter of 2016 was due to lower margins on technology development contracts. The improvement from the fourth quarter of 2015 was primarily due to higher margins on technology development contracts and lower inventory provisions.

- Consolidated gross margin was 41.1%, compared to 40.7% in the fourth quarter of 2015 and 37.7% in the third quarter of 2016.

- Order backlog totaled $68.5 million on December 31, 2016, compared to $72.9 million on October 1, 2016 and $51.2 million on January 2, 2016. Backlog at December 31, 2016 included four 200 Lean HDD systems, four Intevac VERTEX display cover panel coating systems, one Intevac MATRIX solar system, and two ENERGi solar ion implant systems. Backlog at October 1, 2016 included four 200 Lean HDD systems, three Intevac VERTEX display cover panel coating systems, two Intevac MATRIX solar systems, and two ENERGi solar ion implant systems. Backlog at January 2, 2016 included three solar systems and one PVD display cover panel coating system.

- The company ended the year with $49.8 million of total cash, restricted cash and investments and $71.0 million in tangible book value.

Fiscal Year 2016 Summary

- The net loss was $7.4 million, or $0.36 per diluted share, compared to a net loss of $9.2 million, or $0.41 per diluted share. The non-GAAP net loss was $7.5 million or $0.36 per diluted share, compared to the non-GAAP net loss of $9.3 million or $0.42 per diluted share for fiscal 2015.

- Revenues were $80.1 million, including $45.3 million of Thin-film Equipment revenues and Photonics revenues of $34.9 million, of which $5.8 million was contract R&D revenues, compared to 2015 revenues of $75.2 million, including $39.6 million of Thin-film Equipment revenues and Photonics revenues of $35.5 million for 2015, of which $7.1 million was contract R&D revenues.

- Thin-film Equipment gross margin was 32.8%, compared to 32.4% in 2015. The improvement from 2015 reflected a higher level of revenue and improved factory absorption. Photonics gross margin was 44.6% compared to 37.9% in 2015, reflecting a higher mix of product sales versus lower-margin technology development contracts. Consolidated gross margin was 38.0% compared to 35.0% in 2015.

- Total R&D and SG&A expenses were $38.1 million compared to $35.3 million in 2015, with R&D investments up 16% and SG&A relatively unchanged from 2015 levels. The operating loss decreased by 13% from the prior year, to $7.6 million.

Comments

Abstracts of the earnings call transcript:

Wendell Blonigan, President and CEO:

"Fundamentals in the hard drive industry, once again, exceeded expectations in the third quarter with both PCs and hard drive units surprised into the upside, showing encouraging evidence of stabilization. We believe media shipments had their strongest second half growth in the last seven years and also grew year year-over-year.

"The second half of 2016 showed the most significant growth over the first half in all three categories; PCs, hard drive, media units that we have seen in at least seven years, all were up double-digits. Media units were unique and they actually showed year-over-year growth in both Q3 and Q4.

"The TIE ratio, or average number of media disks per drive, has also exceeded expectation, exiting the year over two by our estimation. In an HDD unit volume environment of 100 million to 120 million drives per quarter, the installed industry media capacity would be utilized once the overall HDD TIE ratio gets to the range of two and a half to three disks per drive. The growth segment in overall HDD unit shipments continues to be the high capacity near-line segment, which is positive for media units given that the number of disks in each drive is significant and is forecast to grow from four to over seven disks per drive by 2020.

"As we look into the near future, our HDD business is profitable, relatively stable, and is forecasted to drive $200 million to $300 million in total revenues over the next five years, depending on the timing of return to capacity system orders."

Jim Moniz, CFO:

"For Q1 specifically, we are projecting consolidated Q1 revenues to be between $28 million and $29 million."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter