EMEA Purpose-Built Backup Appliance Market Declines 9% Y/Y in 3Q16 – IDC

At $181 million, but capacity shipped up 23%

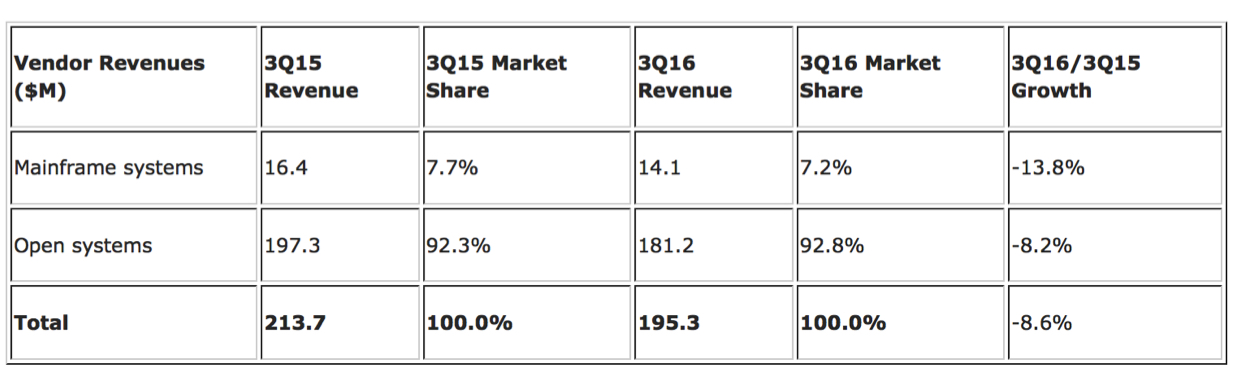

This is a Press Release edited by StorageNewsletter.com on January 18, 2017 at 3:09 pmEMEA purpose-built backup appliance (PBBA) vendor revenues declined 9% year over year to reach $195 million in the third quarter of 2016, according to International Data Corporation‘s Worldwide Quarterly Purpose-Built Backup Appliance Tracker.

Capacity shipped for 3Q16 totaled 237PB, an increase of 23% from 3Q15.

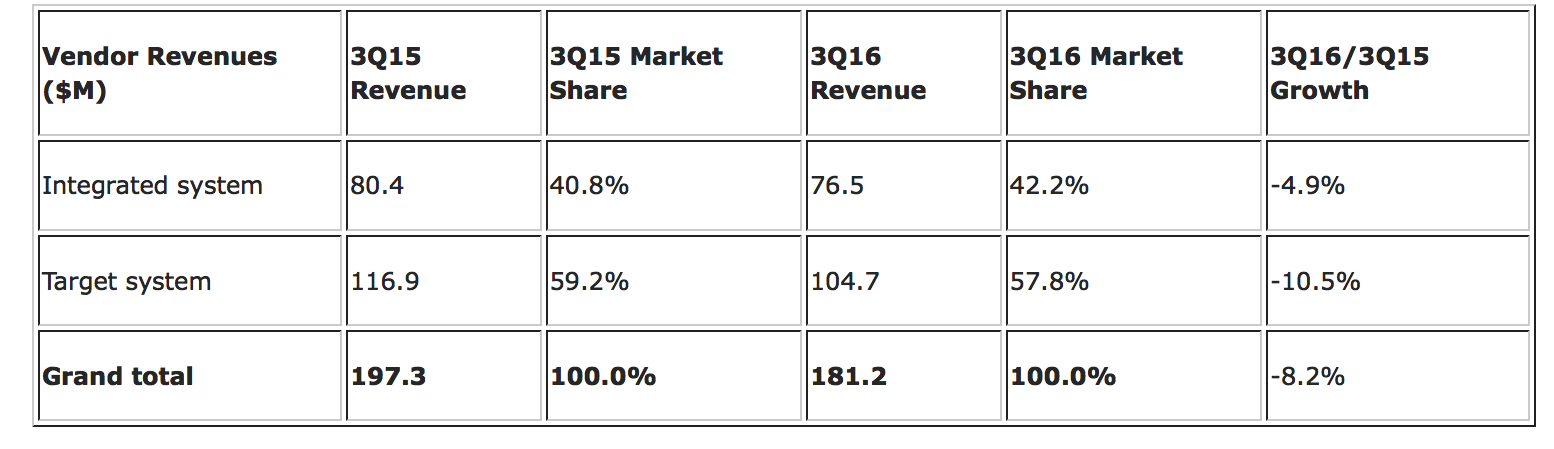

Total EMEA PBBA open systems vendor revenue decreased 8% year over year during the quarter, with revenues of $181 million. Mainframe system sales declined 14% year over year in 3Q16. Although most of the economies in Western Europe declined in 3Q16, emerging markets, mainly in Central Eastern Europe, saw healthy growth in the PBBA market, increasing 29% year on year in vendor revenue.

EMEA PBBA Vendor Revenue by Product, 3Q16

(revenues in $ million)

Regional Highlights

Western Europe

Vendor revenue in Western Europe was down 10% year on year in 3Q16 to $140 million, while capacity increased 35% year on year to 179PB.

“The economic and political turmoil has impacted consumer confidence, delaying modernization investment projects and negatively affecting the PBBA market in Western Europe,” said Jimena Sisa, senior analyst, European storage research. “Storage manufacturers have increased the prices of their products due to the devaluation of the pound and this has reduced demand for storage products in the U.K., and has triggered a move toward cloud services.”

The German PBBA market, meanwhile, saw 8% revenue growth year on year.

“Although cloud adoption appears as an alternative to moving to an opex model, the uncertainties around which data protection regulations will apply are making some European enterprises, especially in Germany, more wary and more inclined to evaluate cloud solutions against the benefit of being in control and have direct access that provides an onsite backup appliance,” said Sisa.

CEMA

PBBA market revenue figures in Central and Eastern Europe, the Middle East, and Africa (CEMA) show clear signs that the declining trend that began in 2015 is starting to slow. The region contracted 4% year over year, to $55.2 million, in 3Q16.

“This should be seen as a recovery in comparison to the 12.9% decline in 3Q15. Expectations for the eventual negative impact of Brexit in CEMA were not confirmed by the market,” said Kostadin Kostadinov, research analyst, IDC CEMA.

“Diverging trends were observed in CEE and MEA, with Central and Eastern Europe seeing double-digit year-on-year growth due to backup investments by the banking and government sectors and the slow transition to public cloud services. Conversely, the Middle East and Africa market declined due to the political instability and the worsening business climate in which only the most critical primary storage projects were financed,” said Marina Kostova, senior research analyst, IDC CEMA.

Taxonomy Notes

IDC defines a purpose-built backup appliance as a standalone disk-based solution that utilizes software, disk arrays, server engine, or nodes that are used for a target for backup data and specifically for data coming from a backup application (e.g., NetWorker, NetBackup, TSM, and Backup Exec) or can be tightly integrated with the backup software to catalog, index, schedule, and perform data movement. The PBBAs are deployed in standalone configurations or as gateways. PBBA solutions deployed in a gateway configuration connect to and store backup data on general-purpose storage. Here, the gateway device serves as the component that is purpose built solely for backup and not to support any other workload or application. Regardless of packaging (as an appliance or gateway), PBBAs can have multiple interfaces or protocols. PBBAs can also provide and receive replication to or from remote sites and a secondary PBBA for DR.

Major vendors covered in this tracker include EMC, Veritas, HPE, Dell, IBM, Quantum, Barracuda, Oracle, Fujitsu, Exagrid, HDS, Unitrends, and Falconstor Software.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter