Marvell: Fiscal 2Q17 Financial Results

Storage revenue up 13% Q/Q, reflecting higher HDD and SSD demand

This is a Press Release edited by StorageNewsletter.com on September 7, 2016 at 3:09 pm| (in $ million) | 2Q16 | 2Q17 | 6 mo. 16 | 6 mo. 17 |

| Revenue | 710.5 | 626.4 | 1,435 | 1,167 |

| Growth | -12% | -19% | ||

| Net income (loss) | (771.9) | 51.3 | (757.9) | 286 |

Marvell Technology Group Ltd. reported financial results for the second quarter of fiscal year 2017, ended July 30, 2016.

Revenues for the second quarter of fiscal 2017 were $626 million, up approximately 16% from $541 million in the prior quarter and down approximately 12% from the same quarter of last year.

“We experienced a seasonally strong second quarter, driven by solid demand from customers across storage, networking, and wireless end markets,” said Matt Murphy, president and CEO. “We are also beginning to see the benefits of improved focus on product cost as well as a more disciplined approach to spending, which resulted in better than expected earnings per share.”

In the second quarter of fiscal 2017, storage revenue increased 13% sequentially, reflecting higher HDD and SSD demand.

Networking revenue in the second quarter of fiscal 2017 grew 12% sequentially due to continued strength in enterprise networking demand.

Mobile and wireless revenue grew 21% sequentially, mainly driven by seasonal game console production ramps. Mobile handset-related revenues in the second quarter of fiscal 2017 were $9 million, down from $22 million in the first quarter, reflecting the anticipated declines due to the restructuring actions announced on September 24, 2015.

Net income on a GAAP basis for the second quarter of fiscal 2017 was $51 million, or $0.10 per diluted share. On a non-GAAP basis, net income for the second fiscal quarter of 2017 was $92 million, or $0.18 per diluted share.

Third Quarter of Fiscal 2017 Financial Outlook

- Revenue is expected to be flat to down 4% from the second quarter.

- GAAP and Non-GAAP Gross Margins are expected to be in the range of 52% to 54%.

- GAAP and Non-GAAP Operating Expenses are expected to be approximately flat from the second quarter.

- GAAP Diluted EPS are expected to be in the range of $0.03 to $0.08.

- Non-GAAP Diluted EPS are expected to be in the range of $0.08 to $0.13.

Comments

Founded in 1995 and now with 5,300 employees, semiconductor company Marvell has HQs in Bermuda and international design centers located in Santa Clara, CA, China, Europe, Israel, with offices in several US states and many Asian and European countries.

Last June, Matt Murphy replaced Sehat Sutardja as president and CEO.

Since 2015, the firm received several Nasdaq notifications for certain accounting and internal control matters.

At the beginning of the year, there was a rumor of Broadcom (Avago) buying Marvell and another one in 2013 for the firm to go private.

It acquired in 2005 some assets of QLogic in disk and tape drive controller for $225 million.

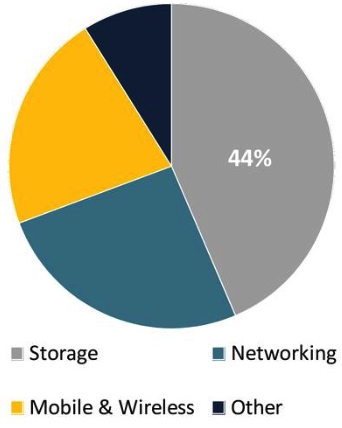

The company is mainly involved in ICs with three kinds of products covering networking, mobile and wireless, and storage.

Concerning storage, it offers:

- - host SAS and SATA controllers,

- - read channel, processors, transceivers, cryptographic engines, preamplifiers and motor controllers for HDDs

- - solutions that include (SoC), board design and firmware for SSDs (SATA controllers, DRAM-less SATA/PCIe NVMe SSD controllers, PCIe 3x4 NVMe SSD controllers)

Storage represented 44% of overall revenue, growing 13% Q/Q and decreasing 10% Y/Y.

HDD grew on improved demand and inventory replenishment, as well as SSD on strong SATA and PCIe demand.

Storage revenue is expected to be up next quarter on continued HDD - despite shrinking market - and SSD strength.

Storage revenue in $ million

| Period | Revenue | Q/Q growth | Y/Y growth | % of global revenue |

| 1FQ16 | 347.7 | -20% | NA |

48% |

| 2FQ16 | 305.5 | - 12% | NA | 43% |

| 3FQ16 | 256.5 | -16% | NA | 38% |

| 4FQ16 | 289.6 | 12% | 33% | 47% |

| FY16 | 11,993 | NA | 31% | 44% |

| 1FQ17 | 243.4 | -16% | -30% | 44% |

| 2FQ17 | 275.6 | 13% | 10% | 44% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter