Broadcom: Fiscal 3Q16 Financial Results

Enterprise storage revenue at $527 million (-10%), 14% of total sales

This is a Press Release edited by StorageNewsletter.com on September 5, 2016 at 3:02 pm| (in $ million) | 3Q15 | 3Q16 | 9 mo. 16 | 9 mo. 16 |

| Revenues | 1,735 | 3,792 | 4,984 | 9,104 |

| Growth | 119% | 83% | ||

| Net income (loss) | 240 | (315) | 935 | (1,193) |

Broadcom Limited reported financial results for the third quarter of its fiscal year 2016, ended July 31, 2016, and provided guidance for the fourth quarter of its fiscal year 2016.

Recent Developments

Broadcom is the successor to Avago Technologies Limited. Following Avago’s acquisition of Broadcom Corporation on February 1, 2016, Broadcom became the ultimate parent company of Avago and BRCM. Financial results for the fiscal periods prior to the acquisition relate solely to the company’s predecessor, Avago. The financial results from businesses that have been classified as discontinued operations in the company’s financial statements are not included in the results presented below, unless otherwise stated.

Third Quarter Fiscal Year 2016 GAAP Results

- Net revenue was $3,792 million, an increase of 7% from $3,541 million in the previous quarter and an increase of 119% from $1,735 million in the same quarter last year.

- Gross margin was $1,782 million, or 47.0% of net revenue. This compares with gross margin of $1,046 million, or 29.5% of net revenue, in the prior quarter, and gross margin of $884 million, or 51.0% of net revenue, in the same quarter last year.

- Operating expenses were $2,046 million. This compares with $2,047 million in the prior quarter and $585 million for the same quarter last year.

- Operating loss was $264 million, or 7% of net revenue. This compares with operating loss of $1,001 million, or 28% of net revenue, in the prior quarter, and operating income of $299 million, or 17% of net revenue, in the same quarter last year.

- Net loss, which includes the impact of discontinued operations, was $315 million, or $0.75 per diluted share. This compares with net loss of $1,255 million, or $3.02 per diluted share, for the prior quarter, and net income of $240 million, or $0.84 per diluted share, in the same quarter last year.

- Net loss attributable to ordinary shares was $298 million. Net loss attributable to the noncontrolling interest (restricted exchangeable limited partnership units – REUs) in the company’s subsidiary, Broadcom Cayman L.P., was $17 million

The company’s cash balance at the end of the third fiscal quarter was $1,961 million, compared to $2,041 million at the end of the prior quarter.

During the third quarter, the company generated $963 million in cash from operations and received $630 million in net cash proceeds from the completion of previously announced divestitures. In the third quarter, the company repaid $1,306 million of its outstanding term loans and spent $232 million on capital expenditures.

On June 30, 2016, the company paid a cash dividend of $0.50 per ordinary share, totaling $199 million. On the same date, the Partnership, of which the company is the General Partner, paid holders of REUs a corresponding distribution of $0.50 per REU, totaling $12 million.

3FQ 2016 Non-GAAP Results From Continuing Operations

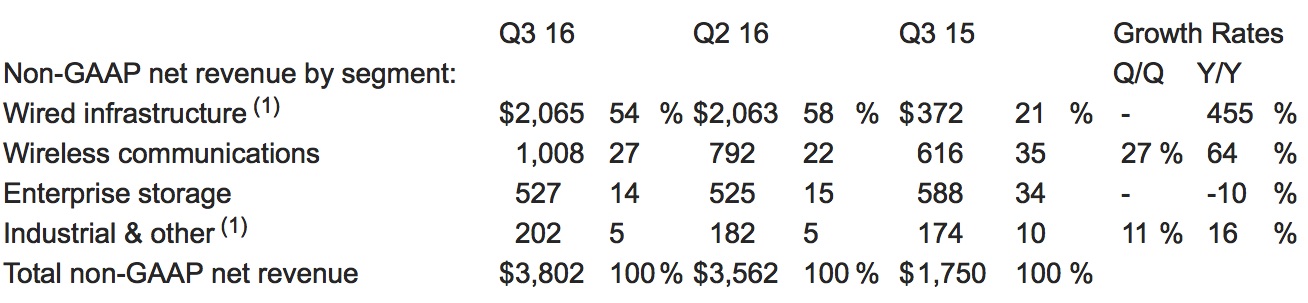

- Net revenue from continuing operations was $3,802 million, an increase of 7% from $3,562 million in the previous quarter, and an increase of 117% from $1,750 million in the same quarter last year.

- Gross margin from continuing operations was $2,297 million, or 60.4% of net revenue. This compares with gross margin of $2,138 million, or 60.0% of net revenue, in the prior quarter, and gross margin of $1,063 million, or 60.7% of net revenue, in the same quarter last year.

- Operating income from continuing operations was $1,489 million, or 39% of net revenue. This compares with operating income from continuing operations of $1,329 million, or 37% of net revenue, in the prior quarter, and $733 million, or 42% of net revenue, in the same quarter last year.

- Net income from continuing operations was $1,293 million, or $2.89 per diluted share. This compares with net income of $1,120 million, or $2.53 per diluted share last quarter, and net income of $660 million, or $2.24 per diluted share, in the same quarter last year.

“We delivered strong third quarter financial results with 7% sequential growth in revenue and 14% sequential growth in EPS, a clear demonstration of the leverage inherent in our operating model,” said Hock Tan, president and CEO, Broadcom. “We are expecting an even stronger performance in the fourth quarter, driven by robust growth in our wireless segment.“

Fourth Quarter Fiscal Year 2016 Business Outlook

Based on current business trends and conditions, the outlook for continuing operations for the fourth quarter of fiscal year 2016, ending October 30, 2016, is expected to be as follows:

- Net revenue of $4,090 million +/- $75 million

- Capital expenditures are expected to be approximately $325 million.

- Depreciation is expected to be $114 million and amortization is expected to be approximately $580 million.

The company’s board of directors has approved a quarterly, interim cash dividend of $0.51 per ordinary share. A corresponding distribution will also be paid by the Partnership, of which the company is the General Partner, to holders of REUs, in the amount of $0.51 per REU.

Comments

(1) Non-GAAP data include the effect of acquisition-related purchase accounting revenue adjustments relating to licensing revenue.

Abstracts of the earnings call transcript:

Hock Tan, president and CEO:

"In the third quarter, enterprise storage revenue came in at $527 million, and this segment represented 14% of total revenue. Segment revenue came in flat sequentially compared to the large seasonal decline in the prior quarter. We had expected revenue in this segment to decline sequentially, but instead we delivered better results as some stability returned to both the hard disk drive and server storage SaaS connectivity businesses in the third quarter. Looking into the fourth quarter, we expect positive end market seasonality to drive enterprise storage revenue growth in the low single-digits sequentially."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter