Nimble Storage: Fiscal 2Q17 Financial Results

Will be ever profitable?

This is a Press Release edited by StorageNewsletter.com on August 24, 2016 at 3:08 pm| (in $ million) | 2Q16 | 2Q17 | 6 mo. 16 | 6 mo. 17 |

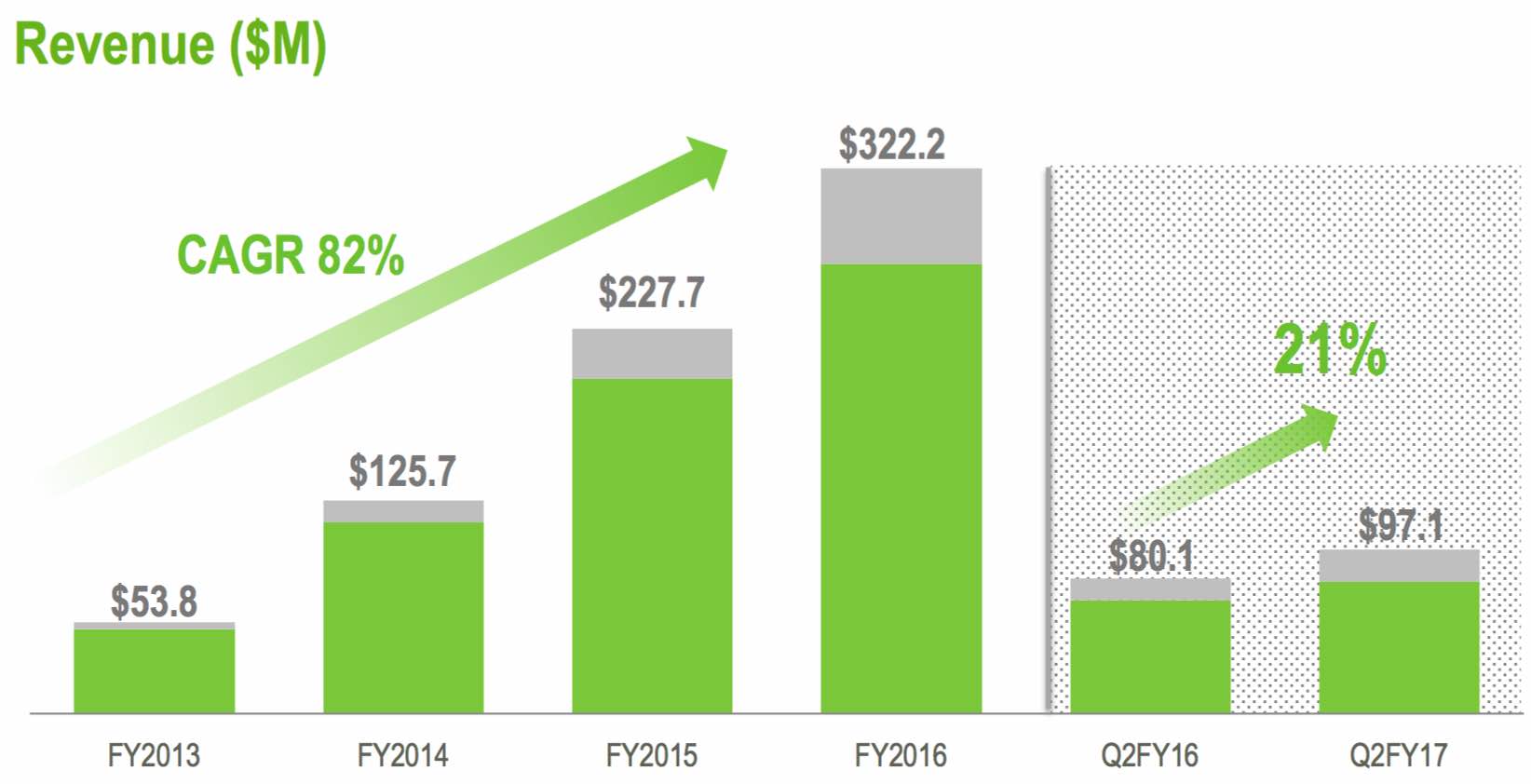

| Revenue | 80.1 | 97.1 | 151.4 | 183.5 |

| Growth | 21% | 21% | ||

| Net income (loss) | (30.1) | (40.0) | (59.1) | (82.6) |

Nimble Storage, Inc. reported financial results for the fiscal second quarter 2017.

“We saw strong momentum in customer and channel partner adoption of our all flash arrays. Our AFA bookings accounted for 17% of our total product bookings in Q2FY17, up from 9% in Q1FY17,” said Suresh Vasudevan, CEO. “During our first full quarter of having all flash arrays in our portfolio, we added 133 AFA customers, including 79 new to Nimble customers, with deal sizes substantially above our overall average.”

“During Q2FY17 we delivered another solid financial quarter as we executed against our financial and operational plan. We achieved revenue of $97.1 million and our non-GAAP gross margin was at its highest level in the last year,” said Anup Singh, CFO.

Second Quarter Fiscal 2017 Financial Highlights:

- Total revenue increased 21% to $97.1 million, up from $80.1 million in the second quarter of fiscal 2016.

- GAAP gross margin was 64.6% compared to 65.3% in the second quarter of fiscal 2016.

- Non-GAAP gross margin was 67.0% compared to 67.8% in the second quarter of fiscal 2016.

- GAAP operating loss was $39.3 million, compared to a loss of $29.5 million in the second quarter of fiscal 2016.

- Non-GAAP operating loss was $15.5 million, compared to a loss of $7.2 million in the second quarter of fiscal 2016.

- GAAP net loss was $40.0 million, or $0.47 per basic and diluted share, compared with a net loss in the second quarter of fiscal 2016 of $30.1 million, or $0.38 per basic and diluted share.

- Non-GAAP net loss was $16.1 million, or $0.19 per basic and diluted share, compared with a net loss of $7.8 million in the second quarter of fiscal 2016, or $0.10 per basic and diluted share.

Forward Outlook:

These metrics are provided on a non-GAAP basis, except for revenue and share count.

Nimble Storage provides guidance based on current market conditions and expectations. For the third quarter of fiscal 2017, Nimble Storage expects:

- Total revenue of $100.0 million to $103.0 million.

- Non-GAAP operating loss of $14.0 million to $16.0 million.

- Non-GAAP net loss of $0.17 to $0.19 per share, based on weighted average basic shares outstanding of approximately 86.0 million.

Business Highlights

- $1 Billion in Bookings Secured. Customers across the world have purchased over $1 billion in products and support since Nimble Storage started shipping its Predictive Flash platform in 2010.

- New Predictive Flash Array Offers Aggressive Entry Point to All-Flash Market. The AF1000 is a full-featured all-flash array that offers scalability, allowing customers to start small and scale non-disruptively up to 8PB at a substantially lower cost. The starting point for an AF1000 has up to 20TB effective capacity and is expandable up to 165TB effective capacity in 4U.

- New Generation of Adaptive Flash Arrays Expand Price-Performance Advantage. The new portfolio of CS-Series Adaptive Flash arrays deliver up to 2X performance improvement and 40% lower cost of capacity over the previous generation of Adaptive Flash arrays. CS-Series Adaptive Flash arrays deliver flexible performance and capacity for mixed mainstream workloads at one-third the TCO of legacy hybrid arrays.

- SmartStack Integrated Infrastructure Deployed by More Than 1,000 Customers. SmartStack customers can take advantage of 11 reference architectures and four Cisco Validated Designs, which now include the AF-Series All Flash arrays.

- Receives Flash Memory Summit Most Innovative Flash Memory Customer Implementation Award. The Predictive Flash platform with InfoSight Predictive Analytics was recognized based on Hutchinson Clinic’s implementation of the Nimble Unified Flash Fabric, enabling flash performance for all enterprise applications by unifying All Flash and Adaptive Flash arrays into a single consolidation architecture. The Hutchinson Clinic’s entire infrastructure will be deployed as a SmartStack reference architecture-based solution, comprised of Cisco UCS integrated infrastructure and the Nimble arrays.

- Network Product Guide Awards Received. The AF-Series All Flash array, CS-Series Adaptive Flash array and InfoSight Predictive Analytics were awarded 2016 IT World Awards.

- CRN 2016 Women of the Channel Awards Recognize Employees. Three employees were acknowledged by CRN, a top news source for solution providers and the IT channel, for their accomplishments and leadership in channel sales and marketing.

- Broadened Support to OpenStack Community with Mirantis Certification. The Mirantis Unlocked validation for the Nimble Cinder Driver provides easy-to-deploy, scalable and highly available storage options for customers using OpenStack infrastructure with the Predictive Flash platform.

- SAP HANA Certification Obtained for Predictive All Flash Arrays. The new certification adds to the SAP HANA certification previously obtained for Adaptive Flash CS-Series arrays as enterprise storage solutions for the SAP HANA platform.

- Predictive Flash Platform Certified for the Latest Versions of Citrix XenDesktop. AF-Series All Flash arrays and CS-Series Adaptive Flash arrays are now fully compatible with the newest version of Citrix XenDesktop 7.9. These storage platforms are validated for persistent and non-persistent XenDesktop VDI workloads.

Comments

The company never was profitable since its inception in 2007 and $168 million IPO in 2013. And this trend is going to continue in the future. Will Nimble be ever profitable?

$97.1 million revenue for the quarter exceeds the guidance range of $93 million to $96 million, increasing 21% Y/Y and 12% Q/Q.

During 2FQ17, the all-flash firm crossed $1 billion in cumulative purchases of products and services.

International sales grew 43% Y/Y.

The company expects lower sequential revenue growth next quarter, between 8% and 11%.

It ended its most recent three-month period with cash and cash equivalents of $194.2 million, a quarterly decrease of $8.8 million.

In 2FQ17, Nimble added 700 new customers to reach a total of 8,850, up 43% from one year ago.

Channel partners accounted for 48% of total bookings during the quarter, up from 45% in the previous quarter and 44% in 2FQ16.

For 2FQ17 average selling price rose 4% over 1FQ17 and 6% over 2FQ16.

Bookings from deals over $250,000 were higher by 60% Y/Y and bookings from large enterprise customers grew 37%. Cloud service provider bookings grew more rapidly at 69% and accounted for 19% of total bookings. Bookings growth from larger cloud service providers within our overall cloud service provider base was even higher. Repeat bookings from installed base contributed 50% of total bookings in the last quarter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter